China's ban on ICOs : Not all Doom and Gloom?

Yesterday the Dragon took a huge bite out of the cryptocurrency world, but what are the implications?

All over of the world, the continuing hype around ICO’s is skyrocketing, even celebrities are getting involved with the Paris Hilton the latest in endorsing new digital currencies. Major news outlets such as CNBC are offering advice to viewers on how to create their own “cryptocurrency portfolio”. In China though, it is a completely different outlook.

On Monday China cracked down on individuals and firms that raise funds through ICO’s. In this article Crowdholding will look into the sanction and the implications of this swift banning.

Yesterday’s’ ruling came from China’s central bank, which released a statement criticizing ICO’s for “disrupting” the country’s financial order. The statement describes ICO’s (Initial coin offerings) as a source of “unapproved illegal public financing” and raises suspicions. They also went on to state that it could be used for “fraud and criminal activity.”

ICO’s by nature are a relatively new concept and they have become popular not just in China but worldwide. According to the Chinese state news agency Xinhua, close to $395 million has been raised from investors in China alone. China makes up over 25% of the worldwide investments in ICO’s (This year Coindesk suggested that more than $1.5 billion has been raised through ICO’s, a $256 million increase from the previous year.

Implications?

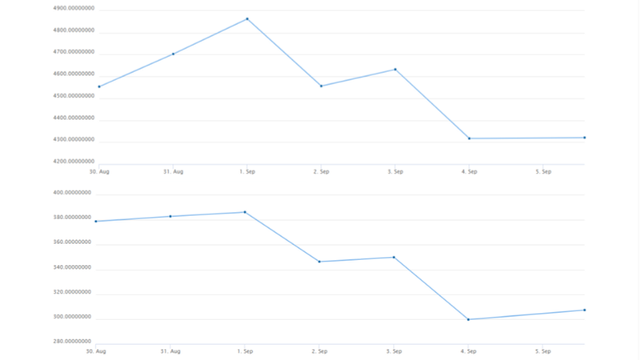

The first major implication of the ban was a global one, all major cryptocurrencies took a hit. Bitcoin tumbled as much as 11%, the most since July and Ethereum decreased by 16% according to Coindesk. Since then both of them have slowly started to increase again. Below is a graph of the price of Bitcoin (the top graph) and Ethereum (bottom on) over the last 7 days.

On a national level,Chinese startups planning to start an ICO or are in the process of their ICO are expected to halt their plans. As part of the ban, Chinese authorities have called on individuals and organisations to refund investors for any amount raised through ICOs. It is worth taking note that the policy only affects raising capital through ICO’s and is not a ban on cryptocurrencies.

It is no surprise that risk averse China has decided to ban this new type of capital raising before it “disrupts their social order” as stated by the Chinese Central Bank. But there are other countries who are looking into sanctioning ICO’s, The United States and Singapore have also stated their desire to regulate them.

But it is not all doom and gloom. ICO’s are very much still alive. The fact that after what could be considered the “biggest hit” against cryptocurrencies since their inception, they are still increasing in price the day after the hit. Also with increasing publicity around cryptocurrencies (Thanks Paris) more and more people are discovering them and are able to invest due to the drop in price, just like in the stock market where the concept of “buying the dips”. This concept is based on the price dropping, more people investing and the price increasing back up once again. There are also countries who are going the completely opposite direction to China and embracing cryptocurrencies. Estonia is looking into the possibility of having it’s own national cryptocurrency and in Moscow you can trade cryptocurrencies on their stock exchange.

Regulations are not something that should be feared in the crypto world. In the long run more competitive and sustainable coins / tokens will survive. an analogy to explain this would be the nature sieving by a river, the stronger larger rocks will be left behind, while the the small ones will be washed away. Regulations will force startups to do more than create a website and a white paper and protect investors from flimsy companies, poor business concepts or con artists.

The dragon may have taken a bite out of the cryptocurrency, but it is still standing strong and will come back stronger. We would like to leave you with some words from Fred Wilson who is a VC investor who has had his hand in Twitter, Tumblr, Foursqaure, Zenga and now Coinbase.

If you would like to learn more about Crowdholding, our vision or our website at https://ico.crowdholding.com