How to start a company in China ?

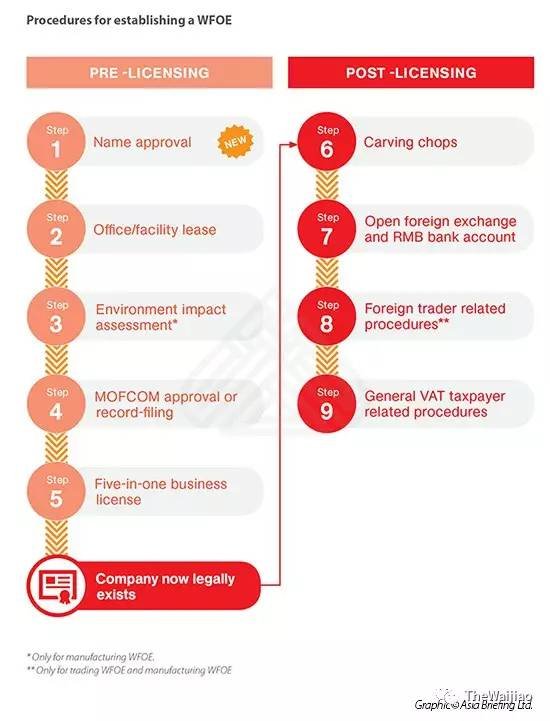

Over the last few years, there have been a number of changes to the wholly foreign owned enterprise (WFOE) establishment process in China. Primarily, the latest update to the Catalogue for the Guidance of Foreign Investment Industries, which lifts regulatory thresholds for certain industries such as the energy and finance sectors, affects the record filing process with MOFCOM. In addition, obtaining a business license has become easier with the introduction of the new five-in-one license: previously, five different certificates had to be acquired from different authorities. These new considerations for investors looking to set up a WFOE in China are advantageous, widening the scope of investment and speeding up the application process.

The establishment process of a WFOE can vary somewhat depending on the chosen structure, namely a service WFOE, manufacturing WFOE, or trading WFOE, and its associated business scope. For instance, a trading WFOE also needs to register with authorities such as Customs after obtaining a business license, while a manufacturing WFOE must complete an environmental impact evaluation report. Other country-specific issues, such as bank accounts with different currencies and official company seals, may also affect investors’ business operations in China. Therefore, it is advisable for potential investors to enlist professional assistance when navigating the establishment procedures in order to ensure the venture’s success and to guard against any future issues. The following steps offer a rough guideline of the establishment process.

Step 1: Name approval

One of the first steps for foreign companies is to

decide on an appropriate name for the Chinese market. The key pieces of legislation governing this are the Regulations on Registration and Management of Enterprises Name and the Implementation Measures on Registration and Administration of Enterprise Names, which detail how a Chinese company name should be structured. It includes:

**1. Administrative region name of incorporation;

- Brand name;

- Industry or business;

- ‘Company Limited’.**

Additional guidelines restrict the content of names, forbidding the use of content that either misleads consumers or hinders fair competition, or damages or contradicts national unity, policies, social ethics, culture, or religion. Special characters, such as Arabic numerals, foreign symbols or alphabets, are not permitted, and certain words such as ‘China’, ‘Chinese’, ‘National’, ‘State’ or ‘International’ can only be used under limited circumstances. An English translation or transliteration of the company name is not required to be registered with the AIC, but may have equal legal validity as a Chinese company name providing there is enough evidence to associate the English name of a company with its Chinese name, such as a bilingual company chop bearing the two names.

Companies should conduct market research on the naming strategy of industry competitors, thereby understanding the types of names that are typically successful. The name should be consistent with preexisting brand strategy, clearly reflecting the brand’s key attributes and appealing to its target demographic. Careful attention should be paid to the nuances of the Chinese language, with subtleties in character meaning or pronunciation potentially leading to a negative connotation and interpretation.

The availability of names can be checked by searching trademark and business registration databases, such as the Trademark Office of the Administration for Industry and Commerce (AIC) (http://www.saic.gov.cn/sbjEnglish) or the China Trademark Office (http://www.chinatrademarkoffice.com), as reference. Applications can then be made to the local AIC, which will reserve the name and process the approval.

Step 2: Office/facility space lease

As the company name contains the city of registration, careful consideration should be made before engaging an estate agent or landlord. In some cases, the city name can affect operations, as certain city names carry prestige and credibility that may impact sales, business development, and governmental relations. Relocation, especially cross-district, is a taxing and expensive process, as it may implicate registration with a new AIC and tax authorities, in addition to the MOFCOM filing record procedures, business license, bank information, and other company certificates that must be revised.

If the intended facility space is not owned by the investor, it needs to be leased for legal operation in China. The lease should be made before submitting the application for incorporation, and a rental period of at least 12 months starting from the application submission date to the AIC is also required. Leases should be made with correct formatting, and registered with the local real estate authority. A land rights certificate and personal documentation should also be obtained from the landlord to ensure the legitimacy of the property. It is recommended that a clause be included in the contract stating that, in case of WFOE application rejection, the lease can be voided. A copy of a Certificate of Premise Ownership (CPO) issued by the real estate authority needs to be submitted to the local AIC, with the owner making the application.

Step 3: Environment impact assessment (for manufacturing WFOE)

The environmental impact assessment is set up to control the impact that a manufacturing enterprise may have on the environment. According to the Catalogue for Classified Administration of Environmental Impact Assessment, manufacturing projects can be classified as having either a “significant”, “moderate”, or “small” impact on the environment, which determines whether they need to provide an environmental impact evaluation “statement”, “report”, or “registration form”, respectively. The evaluation should be carried out by qualified institutions with a certificate issued by the environmental protection department of the State Council. In addition, the local environmental protection authorities will require information on the raw materials to be used, the equipment and machinery, measures for environmental protection, and the consumption and disposal of hazardous materials.

Step 4: MOFCOM approval or record-filing

As long as a company’s business scope is not restricted by the Negative list for Foreign Investment (in free trade zones), or is not subject to the special administration measures for foreign investment access, the application can go through a simplified record-filing process, recently promulgated in the Provisional Measures for the New Filing System issued by MOFCOM. This process requires:

An application form;

Commitment letter by all investors or their representatives;

Business license or pre-approval documents for the name of the WFOE;

Power of attorney appointing the representatives and the identity paper of the representatives; and

Certificate or identity document of investors and legal representative for the application.

These documents must be uploaded through the online integrated management system. The commerce authorities – normally provincial-level – should verify the integrity and accuracy of the information and complete the filing within three working days. Interestingly, the filing process is not actually a necessity for obtaining a business license, but for restricted or encouraged industries with equity portion requirements, the setup of a WFOE requires the approval of commerce authorities.

The new filing system is being implemented within the scope of the 2015 Catalogue, but the draft of the forthcoming updated Catalogue has now been made public by the NDRC and MOFCOM for comment. The State Council has also issued an announcement for further opening-up of industries for foreign investment, with a notable emphasis on easing restrictions on the financial and energy sectors.

Step 5: Five-in-one business license

After receiving an Approval Certificate from MOFCOM, registration and application for a business license can be made to the local AIC within 30 days of receipt. As with the record-filing process, the application for a business license has recently been significantly simplified with the introduction of the five-in-one business license, which has replaced the previous three-in-one license. The standardized national credit number simultaneously covers:

Accompanying the new business license scheme is an online business registration system, which facilitates information sharing between all departments involved in the registration procedure, thereby simplifying the overall establishment process. One application form and one set of application materials can be submitted to an application terminal at the local AIC, reducing the process from one month to around 15 to 25 days.

Step 6: Carving chops

Unlike practices in the West, a company’s official seal in China has legal authority over the signature of a legal representative and has the power to validate documents and contracts, regardless of who uses it. Its possession and whereabouts are therefore of utmost importance.

All companies operating in China are required to have an official seal, which is round in shape and bears the official company name in Chinese, and where applicable, in English. A company seal can be obtained from the local Public Security Bureau (PSB) after successful registration with the AIC. When signing a contract, it is always the opposite party’s responsibility to ensure that the signing party’s seal is authentic – if not, the contract is not legally binding. The PSB therefore keeps a duplicated copy of the official company seal in the event of fraud or disputes.

Other than the official company seal, a company must also have a legal representative seal, a financial seal, a seal for use on fapiao, and in the case of trading WFOEs, a customs seal. A legal representative seal is used for specific license and certificate applications and banking documents, while the legal representative seal is square in shape and bears the name of the company’s legal representative. The financial seal is used to validate financial transactions such as cash withdrawals, wire transfers, and bank checks. The company’s financial officer should keep possession of this seal separately from others, with a duplicate stored with the company’s registered bank for verification and anti-fraud purposes. With authority in a Chinese company residing primarily in the hands of the person who currently holds its seals, it is advisable to put in place a mechanism to track, record, and monitor their use.

Step 7: Open foreign exchange and RMB bank account

A WFOE in China needs to have a minimum of two banks accounts: an RMB basic account, and a foreign currency capital contribution account. An RMB basic account is a must for a WFOE’s daily business operations in China. This account is the only account from which the company can withdraw RMB cash, and often acts as a designated account for making tax payments. The foreign currency capital contribution account is necessary to receive capital injections from overseas. Approval to open this account can be obtained from SAFE.

A WFOE can establish bank accounts with both Chinese and international banks. Although many foreign investors prefer to establish an account with an international bank due to an existing business relationship, creating accounts with a Chinese bank has some advantages regarding efficiency, convenience, and security. A WFOE’s financial and legal chops are usually required in order to verify the ‘signature’ of the company when opening a bank account in China.

Step 8: Import and export registration procedures (only for trading WFOE)

In order for a trading WFOE to conduct import/export trading & distribution activities, it must first obtain a customs registration certificate and an import-export license, which essentially allows it to exchange foreign currencies to RMB, and refund sales or VAT on imported or exported products. In addition to this, a trading WFOE must complete foreign trader operator filing with MOFCOM, make quality inspection registration with the Entry-Exit Inspection and Quarantine Bureau, and obtain an E-port IC card, software, and card reader with the China Electronic Port.

Step 9: General VAT taxpayer related procedures

Taxpayers in China are split into two categories when it comes VAT: general taxpayers and small-scale taxpayers. The latter are entities involved with wholesale and retail with sales of less than RMB 800,000 per year, manufacturers (including those providing processing, repair, and replacement services) with sales not exceeding RMB 500,000 per year, and taxpayers offering VAT-taxable services with maximum annual sales of RMB 5 million. All other taxpayers come under the general classification.

Despite lower VAT rates for small-scale taxpayers, general taxpayers can deduct input VAT from output VAT, reducing the overall tax burden of the company. General taxpayer status also permits the company to issue special VAT fapiao to its clients and customers. Fapiao are important in business transactions and can be used as legal receipts and for tax deduction purposes, where appropriate. Provided a sound accounting system can be demonstrated, entities who fall into the small-scale taxpayer category can also apply for general taxpayer status, the application process for which has recently been simplified.

To gain general taxpayer status, an application form and tax registration certificate must be submitted to the local tax bureau. The registration will then be checked and confirmed by the bureau. Previously, extra steps, such as an interview and on-site inspection, were required; the removal of these steps has shortened the time required from 30 working days to around five. It is important to note that once this status is acquired, it is not possible to convert back to small-scale status.

Conclusion

Steps towards the simplification of the WFOE set up process are continually being made. Most noticeable are the developments with the business license. The five-in-one business license departs from the need for multiple sets of application materials to multiple authorities, and with it, the streamlining of administration, which is becoming more tightly knit and effective. Sharing of information via the means of integrated and digitalized management systems facilitates not only quicker application times, but also more uniform ratification and assessment means. However, components such as the Catalogue and other requirements and regulations are always in the process of being updated. Therefore it is important to keep on top of these changes in order for the establishment process to run smoothly, particularly as the different business intents of WFOEs will affect the nature and steps of the set up process.