The Petroyuan Was Born This Week. Here's What It Means.

by James Corbett

corbettreport.com

March 31, 2018

It has been promised for 25 years. Its coming has been heralded as a world-changing event. It has launched a thousand headlines in the last few months. And it happened this week. But if you blinked you would have missed it.

What am I talking about? Why, the launch of a Chinese yuan-denominated oil futures contracts on the Shanghai International Energy Exchange, of course! Or, in more headline-appropriate terms: The Birth of the Petroyuan!

Considering this event has been in the works for literally a quarter of a century (since the Chinese tried and failed to launch such a contract in 1993), the event came and went with remarkably little fanfare, even from the ChiCom mouthpiece press. Take Xinhua's decidedly low-key announcement: "China launches crude oil futures trading." No celebration of the glorious arrival of the dawn of a new monetary order. No bold proclamations about the impending dominance of the Chinese benchmark in global oil sales. Not even a screed about how the fearless leader, President For Life Xi, is bravely steering the country toward a petroyuan utopia. Just:

China on Monday launched trading of the yuan-denominated crude oil futures contracts at the Shanghai International Energy Exchange, which is the first futures listed on China's mainland to overseas investors.

The listed futures for trading are contracts to be delivered from September this year to March 2019. The benchmark prices of 15 contracts were set at 416 yuan (65.8 U.S. dollars), 388 yuan and 375 yuan per barrel, varied by delivery dates.

Li Qiang, Shanghai's Party chief, and Liu Shiyu, chairman of China Securities Regulatory Commission, together rang the gong to open the trading session.

Oh, and the name of this earth-shaking, world-changing futures contract? "SC1809." It's like they're going out of their way to make this as unremarkable as possible.

But still, here it is. The event that everyone's been waiting for. A first, tentative step toward the petroyuan and one potential way for the international community to step away from the petrodollar. So what does it mean?

Well, that really depends whether you're talking short-term or long-term.

I've discussed the long-term ramifications of this move before, most notably in "China’s New World Order: Gold-backed oil benchmark on the way." Quick recap: The Shanghai Energy Exchange's yuan-denominated oil contracts, combined with the Shanghai Gold Exchange's yuan-denominated gold fix means that it may one day be possible for a country (like, oh, say, Russia) to sell oil to China in yuan and exchange that yuan for gold, thus completely bypassing the dollar.

Cue the "end of the dollar paradigm" theme here.

But hold on just a minute. That certainly is the long-term vision that is being pursued here, and there's no doubt that China, Russia, Iran and many other countries around the world would jump at the chance to create a viable alternative to the petrodollar...but are we really that close? Short answer: No. No, we aren't.

Longer answer: Remember when China promised to build an alternative to the SWIFT Network that the banks use to transmit transaction data between countries? You know, the one that's "totally not political" even though the EU strong-armed it into de-listing Iranian banks for political reasons in 2012? And then remember how it emerged that China's so-called SWIFT "alternative" was actually going to be run on the SWIFT Network itself?

Do you think there might be some similar shenanigans going on with this petrodollar "alternative?" If so, then might I just say you are an extremely jaded and skeptical person. You are also correct, so give yourself a cookie.

Just read the fine print on the SC1809 contracts, as related by Xinhua: "At the beginning, US dollars can be used as deposit and for settlement. In the future, more currencies will be used as deposit." So (for the moment, at least) this isn't a golden ticket for bypassing the dollar. Overseas traders will still be putting dollars in and getting dollars out. The yuan will just be the denomination of the contract.

Also, the prospect of SC1809 challenging Brent Crude or WTI for the title of "global oil benchmark" is still a long ways off. China's capital controls and pegging of the yuan mean that it is still useless as a world reserve currency or an international settlement currency. Until Beijing releases its death grip on the yuan, it's not going to be embraced by China's foreign trading partners, let alone non-Chinese trading partners elsewhere in the world.

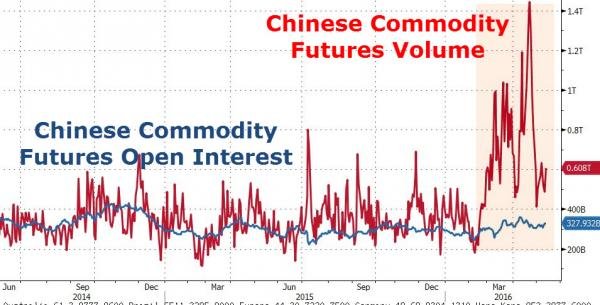

Another factor: China's commodities markets are no stranger to the same speculative frenzy that have led to the highly-risky, highly-leveraged “umbrella trusts” and “Wealth Management Products” and stock-collateralized loans of the Chinese stock bubble and bust. When nickel debuted on the Shanghai exchange in 2015, trading volume surpassed that of the benchmark future on the London Metal Exchange within six weeks. But that volume was part of a general speculative madness. Most Chinese trading steel rebar futures, for example, had no idea what they were trading; they just saw it as another investment opportunity.

So it is not difficult to imagine a similar frenzy happening with yuan-denominated oil futures. It's just another chance for the big returns that Chinese investors have come to expect from the rigged-i-est of the world's rigged markets (to coin a phrase). If such a frenzy does eventuate, though, those investors may want to take note of what happened in China's commodities futures market in 2016. When things got too hot, the Chinese government stepped in to tighten regulations, restrict trading hours and boost fees. In the oil futures space, too, the government can and will intervene whenever they don't like the direction of the market.

Having said all of that, make no mistake: the long-term trend, should it be allowed to continue, is toward the rise of the petroyuan. Consider:

- China is now the world's largest oil importer.

- China has a bid in to buy a 5% stake in Saudi Aramco, and Beijing has been openly courting Riyadh with its Belt and Road Initiative.

- State-owned oil and gas giant PetroChina is buying up companies all along the Belt and Road path, preparing for the Chinese-dominated global trading future.

All of these developments point the way toward a future where China and its trading relationships tip the scale away from the petrodollar and toward the petroyuan. Assuming Beijing does loosen the reins and allow liberalization of the yuan, it will eventually make more sense for nations to settle their bilateral trade with China in yuan directly rather than going through the dollar.

Of course, this all depends on these trends being allowed to continue, which is still an open question. After all, we know what happens to nations that try to step out from under the petrodollar umbrella.

At any rate, don't look for the world to change overnight. But historians of a future era may just be recording March 26, 2018 as the day the change started.

I've been following the petrodollar for quite some time, knowing this moment would come. It's amazing to me how some of the most important moments in history are often not seen for what they are at the time they happen.

Thank you for being one of the few balanced voices in the alternative media that doesn't unnecessarily dramatize things while at the same time giving a real view on the important moments in time as they happen.

I think its worth pointing out that China thinks it can open a futures contract with a pegged currency. In other words, the exchange rate for the yuan is a giant red flag for Chinese and American leadership.

If the value of the dollar to the yuan were to slip by 30%, and stay there for months, even years, millions of jobs would come back to America. China is absolutely dependent on this perverse exchange rate condition in order to maintain their trade surplus. The Chinese trade surplus is not normal economics, and is based on a conscious policy shift resulting from the Asian banking crisis of 1997. Hundreds of thousands of American MBA's hung their careers on this policy shift since then and continue to rely upon this "lets make it in China" idea.

If China wants to create a benchmark for the yuan, that will only increase the value of the yuan. Such a benchmark would show that the pegging of the yuan currency is unsustainable. Worse from the perspective of Chinese leadership, their trade surplus with the US could be wiped out completely if the yuan becomes too strong.

Seeing the dollar lose it's crown would probably be the best thing that could ever happen to the American economy, particularly the middle class. No longer would the MBA's of American feel compelled to ship jobs overseas when the Chinese worker finds that they are making wages comparable to the America worker.

The possibility that China could create a benchmark oil futures contract that sidesteps the dollar completel, would be a very welcome development for the American middle class, and perhaps, not so much for Wall Street.

I have a suspicion that China wants this more than they want their trade surplus with the world. Pride may indeed be their downfall, as it was ours in America.

Keep your eye on congress bill 5405 to reintroduce the gold standard. It's news worthy if nothing else:

https://steemit.com/gold/@unclehermit/us-to-introduce-new-dollar-gold-standard-bill-hr5404

I'm not sure it's so much whether the Petro Yuan is suited to take down the Petrodollar but rather the idea that there's some theoretically viable alternative...THAT is significant

Think China is different? I think it is. I think it's the target that the globalists wanna take on, and let win, so that the Chinese social control system can be applied globally.

I don't think they expect China to turn on them, but it will.

Love your videos james!

If you had time i would suggest taking a look at this video:

https://steemit.com/china/@bestoftube/why-china-will-not-become-the-dominant-power-in-asia

Has a few experts on China who are giving another view point on the rise of China.

They talk alot about a few essential things China is missing to be counted as a true super power.

"China's capital controls and pegging of the yuan mean that it is still useless as a world reserve currency or an international settlement currency."

I have to agree (for now). But China is not dumb. They will have a plan to shift away from a ForEx peg when they have run other economies into the ground.

Interesting. However, i think Beijing would have to loosen more than the reins on the yuan. Some social reforms would have to be implemented as well. China has been buying out oil countries, such as Venezuela, politically and ideologically weak enough as to submit to the "generous" loan offers of a friend so different from the horrible gringos. Yet, that does not guarantee China's influence or respect on the region. Venezuela is on the verge of collapse and whatever influence China has now will collapse with it (and we are not even talking about the animosity most Venezuelans feel against anything Chinese).

Thank you for this outstanding analysis and the State of China has huge projects

"Happy birth day "who was born this week !!