China is reportedly closing cryptocurrency exchanges, so bitcoin and ether are crashing

China’s authorities are planning to shut down the country’s cryptocurrency exchanges, a sweeping move that will effectively close the market for trading of all digital currencies, including bitcoin and ether, in addition to the digital tokens issued by the red-hot “initial coin offerings” (ICOs) that investors have flocked to recently. That’s according to a report (in Chinese) by the business publication Caixin, citing unnamed officials familiar with the matter.

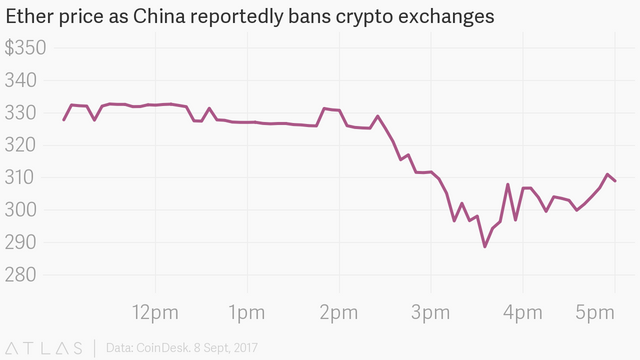

Bitcoin and ether have plunged on the back of the report. Ether was down 12%, falling from $329 to $289 as news broke. Bitcoin was down 9% on the news, falling from $4,650 to $4,224. Both have now rebounded somewhat. Bitcoin’s fall is now 5% below its level before the news broke, while ether is down 7% from its price before the report surfaced.

Four days ago, China’s central bank declared ICOs illegal, and ordered exchanges to halt trading tokens that have been issued that way. The notice at the time stopped short of declaring that trading in all digital currencies, such as bitcoin or ether, is illegal. The Caixin report says a multi-agency committee led by the central bank has decided to halt the trade of all digital currencies on exchanges, citing an anonymous person who is close to the regulatory body. The report is explicit that the ban would extend to all digital currencies, not just ICO tokens.

A representative of one major Chinese exchange, Huobi, told Quartz the firm had not received any notices from the regulator, and that business was proceeding as normal. Shanghai-based BTCC told customers that it has not received any directives from regulators and that it’s running normally.

China is a major market for cryptocurrency trading, and at one point commanded over 90% of global trade volume in bitcoin. A ban by the Chinese authorities would put a major damper on a booming part of the global cryptocurrency trading markets.

Thanks for sharing... Love it.

Thanks for sharing... Love it.