Chainlink bubble bust soon

"Price is what you pay and value is what you get." Warren Buffett

Over the past month, LINK has turned into the most discussed cryptocurrency on social media outstripping both BTC and ETH. The community is debating Chainlink’s integrations, technology and competitors.

However, no matter where we start from, the dispute eventually converges towards a passionate fight over LINK’s price. The LINK marines have been particularly sensitive about our intrinsic valuation of their beloved token. How could it be worth a few cents when the price is 15 USD?

What Determines the Price: A Crash Course on Economics

Pretty much every single transaction is motivated by a simple law of supply and demand, which explains the interaction between willing sellers of a resource/asset/service and the buyers for it. Generally, low supply and high demand increase the price and vice versa. Indeed, holding everything else constant - the higher the price, the fewer buyers are willing to buy and the more sellers are willing to sell.

Supply and demand pull against each other until the market finds a price where the number of sellers exactly meets the number of buyers. We call this an equilibrium price.

Finally, the slope of the supply and demand curve/line is determined by the pace of increase/decrease in the number of sellers/buyers for a marginal change in price. On the demand side, if the product is a basic necessity the drop in demand given a price increase will be smaller compared to a product that is not that essential to the buyer. On the supply side, depending on the product and the cost structure, producers might not be able to increase their supply immediately as they need time to react.

To put it in economic terms, if a small change in price leads to a large difference in the number of buyers, we say that the demand is elastic. Otherwise, the demand is inelastic.

Understanding the Supply and Demand Dynamics of the LINK Token

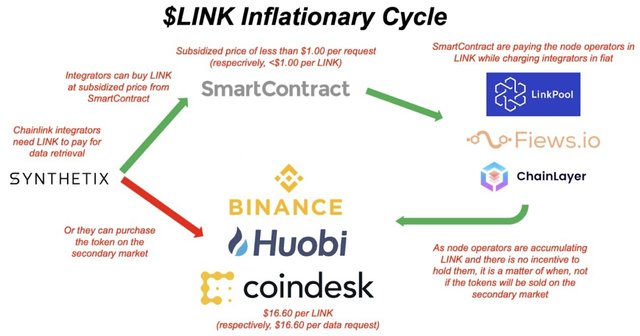

Shifting the focus to the LINK token, the supply should ultimately be driven by node operators’ propensity to hold/sell the LINK earned. The demand, on the other hand, comes from Chainlink integrators sourcing LINK to pay for the data requests they are making. In practice, however, the supply and demand are primarily determined by SmartContract, the company behind the Chainlink project.

Sitting on a hefty reserve of 350,000,000 LINK created out of thin air, SmartContract is obligingly selling LINK to the Chainlink users at a staggering 90%+ discount. Presented with the options to either buy LINK for 15 USD in an open market transaction or purchase it for less than a dollar, SmartContract is the natural choice. The price, however, is not the only difference between the two options. Each time an integrator takes advantage of SmartContract’s subsidy, a new LINK token is added to the circulation, slowly but firmly putting pressure on the supply side.

Let us explain the process in more details:

To reward the node operators for the work delivered (namely, the data retrieved), each operating user of the Chainlink network needs LINK tokens (remember, it is the only acceptable unit of exchange within the ecosystem). The two sources presented to integrators are either buy LINK from the secondary market (the tokens traded on exchanges like Binance, Huobi, and 1inch) or purchase it directly from SmartContract at a 90% discount.

When choosing the obvious option, SmartContract quotes and charges the integrators in USD per job done. At the same time, SmartContract is rewarding node operators in LINK. Where are these LINK coming from? They are newly minted tokens from the reserve that is fully controlled by SmartContract. As more and more jobs are performed, the LINK in circulation is increasing, putting pressure on the supply side of the equation. Hence, the current LINK demand is speculators’ ability to absorb the existing supply and one coming from SmartContract’s reserves. Will integrators start buying LINK from the secondary market anytime soon? No. As calculated in our initial report, considering the current level of Chainlink adoption and assuming aggressive user growth of 5% per month, SmartContract will be the primary seller of LINK at least until August 2027.

Now, let’s focus on the supply. As network activities intensify, the node operators are accumulating more and more LINK tokens. With no incentive to hold them (apart from purely speculative one), it is a matter of when not if these tokens will hit the secondary market and put pressure on price. Do they sell their LINK at the moment? Yes:

SmartContract is transferring tokens to addresses that pay the node operators;

These addresses are paying the node operators;

The node operators are constantly accumulating tokens, that are later sent in chunks to 1 inch, Aave, or Binance.

The extra supply/tokens coming in circulation from the reserve is the lesser evil, however. On top of the 350M LINK that should foster adoption, SmartContract also controls 300,000,000 LINK that are meant to fund the development of the project. Unlike Ripple, which has set an escrow in place to limit the XRP that could be released at any given quarter and regularly reports the number of tokens sold out of it, SmartContract has full discretion over the total 300M LINK it will eventually sell. The company cannot be less transparent about the timing, size, and use of these funds when these LINK are sold.

Taking advantage of the on-chain data from the Ethereum ledger, it is evident that SmartContract is regularly transferring 500,000 LINK from a developer’s address to Binance through a series of jump addresses:

Now, if users are buying from SmartContract and large quantities of LINK is sold by the founders - who is sitting on the other side of the deal? Where is the demand coming from? Speculators. The overwhelming supply of LINK is absorbed by naive investors who are either:

Buying with an intention to sell LINK to operating users at a higher price (as pointed above), the holding period, in this case, should be 7+ years. Moreover, it is foolish to think that a data retrieval could be worth more than 50 USD, which is the all-in price at the moment, or;

Are hoping to sell LINK to a bigger fool at an even higher price.

We believe the second is the case for the vast majority of LINK HODLers. If so, the ecosystem is a textbook example of a bubble. A modern version of the Dutch tulip mania.

LINK Valuation

Rather than throwing unjustified numbers against the wall and see which one sticks, we calculated absolute and relative valuation of the Chainlink service based on adoption, cost of replication and expected yield for the LINK stakers.

The valuation approach that we find most intuitive to the Chainlink network is related to the highly anticipated staking rewards.

Relative Valuation: Staking Rewards as Alternative to Dividend Yields

According to Chainlink’s die-hard fans, the staking feature will be the catalyst that will drive LINK’s price to the moon. Let’s assume for a second that the functionality is live and make some calculations. For simplicity, we will be working with US dollars and assume the price of a LINK is $15.

To arrive at a fair value of the LINK token, we will be using a variation of the dividend yield model. But first, let’s start with the basics. According to the efficient market hypothesis and the modern finance theory, investors should be rewarded for the risk they take. As it is proverbially said, the higher the risk - the higher the return.

Putting it into figures, the annual yield (this is, the return) of one of the safest assets on earth - the US 3-month treasury bills is just 0.1%. Moving to more risky assets - the expected return for 10-year US treasury bonds is just shy of 0.7% while the implied return for the companies in the S&P 500 composite is slightly higher than 5%.

Now, let’s assume that because of its "tremendous" potential and "limited" risk, the LINK token holders should be satisfied with just a 3% annual return for their investment in the LINK tokens. What does this mean? There are roughly 400,000,000 LINK in circulation. At a current price of $15 per LINK, the market capitalization of the tokens outstanding is roughly 6 billion USD. To deliver 3% yield, the Chainlink project should generate 180 million USD in staking rewards (the equivalent of dividends).

If the cost to run a job is assumed to be 2 USD and node operators are distributing 75% of the earnings to the LINK stakers, there should be 120,000,000 job runs per annum. How many job runs are there right now? Slightly more than 2 million for the past 12 months, according to bloxy. Even at a price of 4 USD per call, the LINK token will be 30 times more expensive than its fair value. The approach suggests an intrinsic value range of LINK token between 25 to 50 US cents, implying 96% to 98% downside potential.

Absolute Valuation: Cost of Replication

In our primary report on Chainlink, we argue that the service offered by the so-called network of decentralized oracles should be commoditized, as there isn’t much the project could do to differentiate its product. This will inevitably be reflected in the LINK price as users are becoming more and more price-sensitive (those - elastic in economic terms) with each competitor popping up on the oracle scene. And this shouldn’t surprise anyone - if any of the users pay large premiums for the Chainlink service, they will be put in a competitive disadvantage against rivals utilizing cheaper alternatives.

Having said that, an appropriate valuation method is the cost of replication to which we add a generous premium for Chainlink’s first-mover advantage and brand name/network established.

Considering the relatively low hardware requirements, a Chainlink node could be run on pretty much each and every personal computer or laptop. Those are available for an upfront investment of less than 300 USD and operating cost of less than 16 cents per day. Assuming we need 7 such "oracles", the daily cost of the setup will be 1.11 USD.

Getting back to node level, at 250% premium to its operating cost, the expected daily node income is 56 cents.

Assuming relatively good utilization of 150 data retrievals per day and cost of 0.16(6) LINK per job performed, node operators are expected to earn 12.5 LINK per day. Equating the two leads us to the conclusion that the fair value of the LINK token should be less than 5 cents to satisfy the logic above.

Conclusion

Price and value are two different things that cannot be further apart than the Chainlink case. We believe that the current price of the LINK token is a result of unjustified hype and a series of market manipulations rather than actual economic activities and prospects the project holds. As such, we remain bearish on LINK.

Last but not least, the next time you place LINK buy orders, recall that Chainlink’s GitHub has around 140-200,000 lines of code (not counting CSS, HTML etc). At current valuation, it comes to 17,500 USD per line of code. Do you think this is a fair price to pay for an open-source protocol with a limited number of doubtful users?