bZx: An Intuitive Margin Decentralized Protocol: A Review

Introduction

What is bZx Platform?

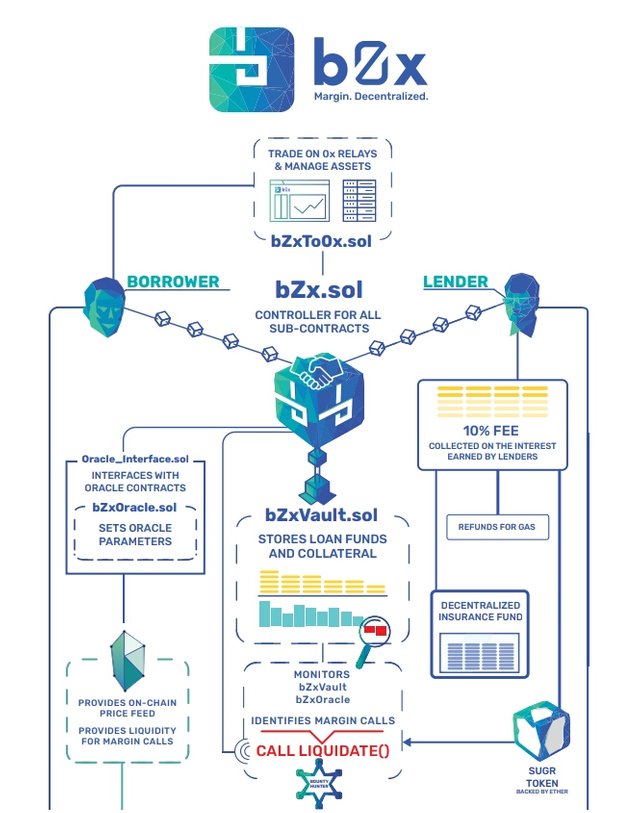

bZx is an Ethereum-based platform that is incorporated with the 0x protocol. It ranks as the first completely decentralized, peer-to-peer margin funding and transactions protocol. It should be noted that the bZx is not an exchange but rather a protocol that can be incorporated into the present exchange facilities.

Exchanges and relays are driven by fees belonging to the BZRX protocol token (BZRX) to give decentralized margin borrowing and margin trading services. On bZx, assets are rated and liquidated through different oracle service experts.

Through the separation of the valuation and liquidation of assets from the protocol, the oracle marketplace system that allows competition to push the oracle provider charges to the least minimum even as it promotes trials and dynamism.

What Prompted the Development of bZx Platform

One of the chief complications of the cryptocurrency world has been the central idea of decentralized assets sold on centralized platforms. At the commencement of 0x revolution, an entirely new method of decentralized exchanges are beginning to surface. Such, decentralized platforms resolves some of the current challenges with the erstwhile development exchanges.

People seeking to undertake margin lending or margin selling are compelled to channel their liquidity to a centralized token and coin exchanges, giving them extra form of counterparty issues.

Such risk is faces when chances are that a particular third party can default and jettison the assets of another investor. Margin borrowing opens the lender to such counterparty issues from the platform as well as from the borrowers.

This particular type of unnecessary counterparty risk borne by lenders and through the use of customized exchanges is referred to as custodial risks, enabling people to keep on to the control of the private keys to their wallets all the times can blot out this risk. Lenders are posed with extra counterparty risk from underground borrowers who do not want to be liquidated early enough.

Disaggregated margin present major technical issues. The most primary of those challenges is the building of a dependable oracle that can rhyme with the settlement safety of centralized platforms. Within the notion of margin lending, the oracle challenge surfaces as a result of Ethereum contracts that are not remotely conscious of asset prices on or away from the blockchain.

Should smart contracts not be able to monitor asset prices on the open market, they can not persistently compel liquidation on borrowers on the market to shield lenders from negative movements. The most grave hindrance to disaggregated margin lending is becoming able to dependably and safely liquidate challenging positions.

The bZx protocol is an on-chain solution to these problems.

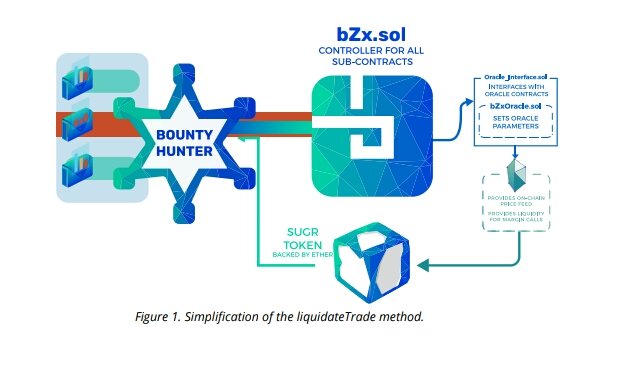

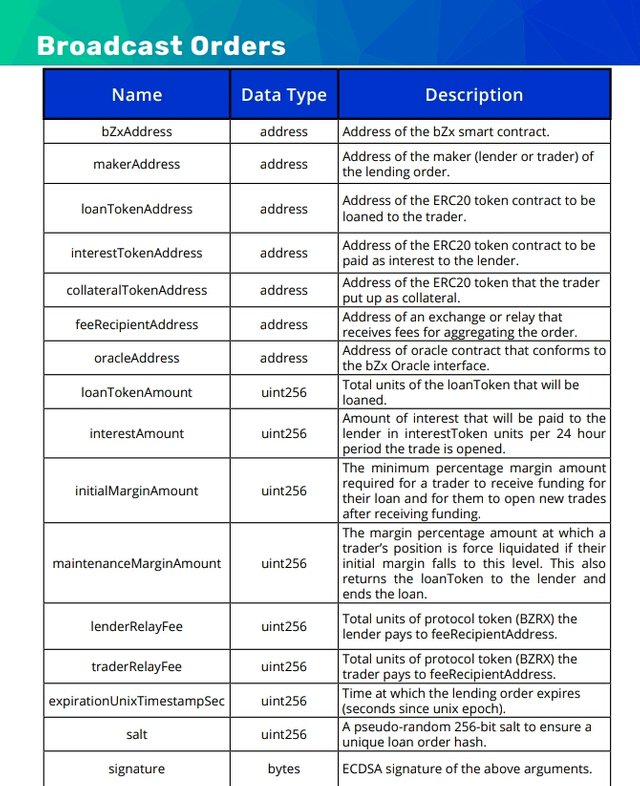

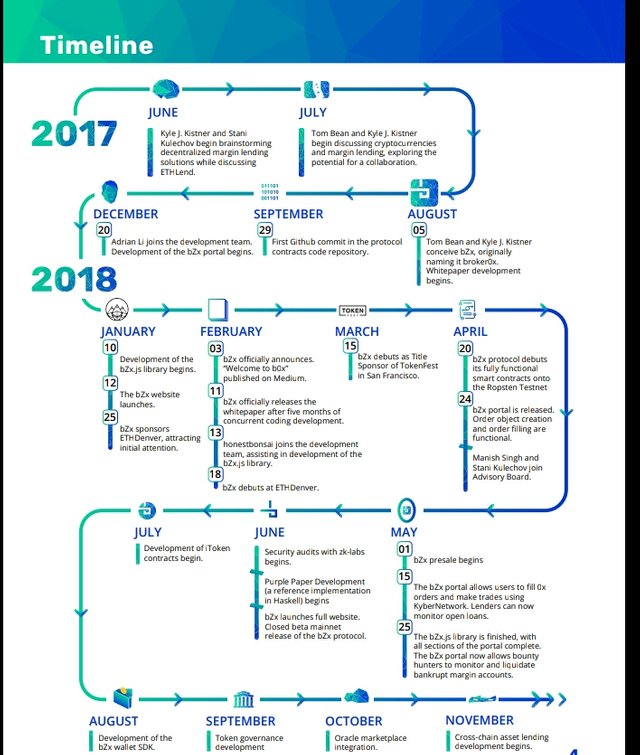

Components of the bZx protocol

bZx.is Library

This library is a trust-oriented independent JavaScript library which will feature every features required to relate with bZx smart contracts on-chain. Software builders can leverage on this library to easily incorporate with and build for the bZx protocol. Relays and exchanges will leverage on this library to develop an interface for margin borrowing and trading on bZx, offering a value-add to their customers.

bZx Portal

This is a web-oriented decentralized application that stands as a gateway to the bZx protocol, uses the bZx.js library and acts as a one-stop shop for persons seeking to relate with the protocol for the margin lending and trading. There is no demand for the people seeking to use the bZx protocol for margin lending via the trading on bZx, but it offers a easy access point for users that are not otherwise on an exchange or relay.

bZx Token

The BZRX token which us the native currency of the bZx platform is an Ethereum-based ERC20 standard token that is used for the governance of the protocol system and incentivation of order book aggregation for the platform by relays.

Conclusion

The bZx protocol makes trading on the decentralized exchange protocol very much easy by removing the counterparty risks involved in third party borrower defaults.

For more information here are some helpful links:

Website

https://b0x.network/

Congratulations @ebykamsiokoro! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP