Market struggling with major losses!

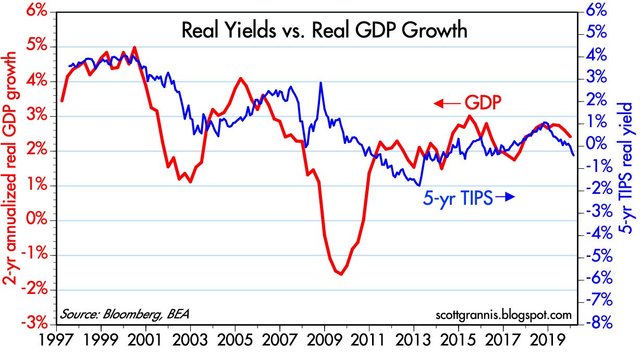

I don't know if you saw that on the news (or even on your trading account), but the yield curve is inverted and is collapsing fast. The Federal reserve has an inflation target of 2% which can not be achieved any more. US economy could not be worse. It's a disaster area, waiting to happen. And this has been reflected in collapsing yield curve. If the Fed does not drastically cut rates, this is it. This is the moment we were waiting for.

We have a moment in time, where central banks all over the world are desperate to issue in their final "solution". They want to be the only institution, every human will come for help to borrow money. So their wish is to be the lenders and buyers of last resort. So what the central banks will do, is one and only thing - cut rates. Are we all are going to fund them, one way or the other.

As you may or may not know, we are in multiple expansion cycle. Meaning... individuals are willing to pay more for shares of stock in a company, whose earnings are not going anywhere. This is happening because we are in suppressed rate environment, which is about to get much worse.

Financial situation around the world is a "frankenstein" at the moment. Banks have no other choice than to inflate the market. Also, that is their own purpose. You would NEVER see that in strong economy

Corona virus as good excuse

Do not forget - the blame is going to be on "Corona virus" for sure. Europe and US are already talking about pumping money into medicine, to "fight corona virus". Where do you thing cash is coming from? Mars? Lies are going to get bigger every time. It's all by design to help central banks to reach top of the top.

This game, banks are playing with the world, would look like an entertainment, if bigger supply chains wouldn't stop working for days or weeks. And this is a problem. If a company in China does not make things, firms around the world can not make their own products because they order parts from China to work with. So if China does not produce those parts, other companies can not make their final products. In China, there are the biggest corporations from all over the world, mostly US and Europe.

Yield curve situation is going to get very serious. But it's going to get even more serious when debt bubble bursts. We are not there. Yet. When it will, it's going to be....legendary.

In this kind of situation, holding hard assets and maybe few crypto-currencies is a way to go.

You got voted by @curationkiwi thanks to WorldFinances! This bot is managed by KiwiJuce3 and run by Rishi556, you can check both of them out there. To receive upvotes on your own posts, you need to join the Kiwi Co. Discord and go to the room named #CurationKiwi. Submit your post there using the command "!upvote (post link)" to receive upvotes on your post. CurationKiwi is currently supported by donations from users like you, so feel free to leave an upvote on our posts or comments to support us!

We have also recently added a new whitelist feature for those who would like to support CurationKiwi even more! If you would like to receive upvotes more than 2x greater than the normal upvote, all you need to do is delegate 50 SP to @CurationKiwi using this link.

This post has received a 3.13 % upvote from @drotto thanks to: @curationkiwi.

Congratulations @worldfinances! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP