These Portfolio Tracking Tools Will Also Prepare Your Crypto Taxes

These Portfolio Tracking Tools Will Also Prepare Your Crypto Taxes

Tax season is months away, which is why you need to start preparing for it now. Leave everything to the last minute and you’ll only end up cursing your procrastination. Organize your cryptocurrency activity in advance and you’ll breeze through tax deadline day without so much as flinching. Despite maddeningly vague or unfair legislation, filing your crypto taxes is surprisingly simple thanks to an array of tools that make tracking and calculating your obligations a cinch.

Also read: Argentina’s Peso Collapse Shows Governments Shouldn’t Control Money

Crypto Taxation Doesn’t Have to Be Testing

Whatever your thoughts on paying tax, the fact of the matter is that it’s an unavoidable obligation. Unless you’re fortunate enough to live in a country that doesn’t impose income tax (here’s looking at you Bermuda, Monaco, Bahamas, Andorra and the United Arab Emirates), come April, you’re going to have to pay your dues. There’s no getting around it, but that doesn’t mean you have to approach the close of the tax year with a sense of dread. With the right planning, you can automate much of the process, saving yourself no end of time, hassle and expense.

Accurately filing your crypto taxes calls for maintaining detailed records of all your transactions and trades that occur over the course of the year. As a result, most of the specialist tax software on the market also doubles as an excellent portfolio tracker. That’s right: even if you have no interest in paying tax, you can still derive value from a product that records all of your crypto gains (and losses), and presents them in an attractive package that can be viewed on desktop or mobile. The following tools provide all that plus a whole lot more.

Koinly

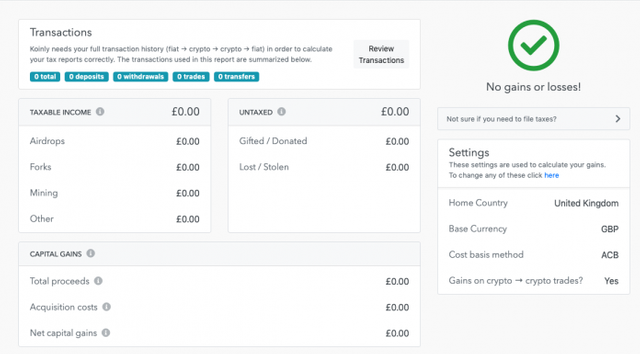

Koinly promises to help cryptocurrency owners calculate their taxes and minimize their bill in the process. It’s compatible with the tax system in over 100 countries and is free to start using: you’re only charged when you need to generate a tax report. When you sign up, you’re prompted to select whether you wish it to realize gains every time you trade crypto; if you select no, Koinly will simply serve as your portfolio tracker. Like the other tools profiled here, Koinly requires you to link exchange accounts and wallets, which can be done manually or via API. You can then review your transactions, tag airdrops, forks, and lost or gifted coins. 33 exchanges are supported as well as six blockchains including BCH, LTC, and BTC.

Koinly

Koinly automatically matches transfers between your wallets and shows you gains or losses for each transaction. There are also tools for analyzing your trading habits, tax loss harvesting, and cost tracking including mining expenses. The Hodler plan ($79 per year) covers 300 transactions and can record income and capital gains tax. The Trader plan ($179) covers 3,000 transactions, while Oracle ($399) has capacity for 10,000 transactions and offers enhanced support and import assistance.

Blox

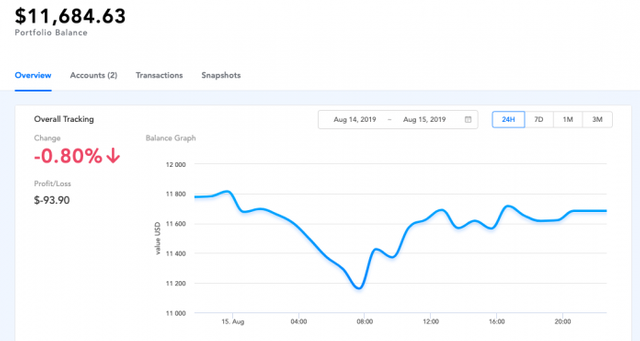

Blox offers many of the same features as Koinly, but is targeted at crypto businesses as well as individuals. It benefits from CPA tools that allow teams to create an auditable record of all crypto activities, which can be exported as a CSV or imported directly into accountancy software that Blox has integrated with. Your current portfolio is neatly displayed in the dashboard, where you can view an account overview, access specific transactions, and see a daily snapshot of your portfolio. With thousands of cryptocurrencies listed within Blox, even the most dubious of tokens can be tracked and the corresponding tax obligations calculated.

Blox provides a detailed guide to prepping your taxes using their software, after which you can file your crypto taxes or export the data to your bookkeeper, who can take care of the rest. There’s also a suite of tools devised specifically for cryptocurrency miners, including cloud-hosted mining solutions. Blox even operates its own nodes to help ensure that transactions and balances are accurate. The Pro plan is free and covers 100 transactions (tx) and up to $50K AUM, while the Business plan, at $99 per month, covers 10K tx and $20M in assets. There’s also an Enterprise plan ($249) for heavy users that will accommodate a whopping $60M AUM.

Bittax

Complying with amorphous and frequently shifting tax guidelines can be challenging. Bittax aims to set cryptocurrency owners at ease by providing expert guidance on the latest decrees from the IRS. At its heart, Bittax is a crypto tax organizer that works similarly to the other products profiled here: import your wallet addresses and exchange data and the software will calculate your taxes. It uses a proprietary tax planning algorithm that helps to efficiently organize and consolidate your liabilities, without compromising your precious privacy. For U.S. citizens seeking to do everything by the book, and to meet the most rigorous standards set by the IRS, Bittax has got your back.

Cointracking

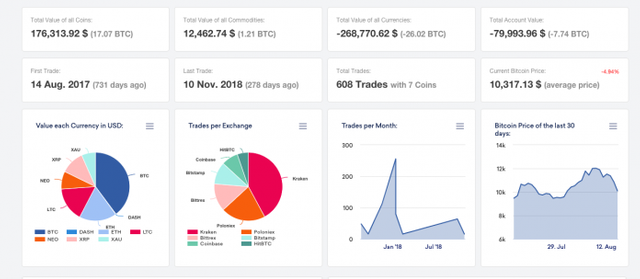

Cointracking’s greatest strength is as a cryptocurrency portfolio monitor. Its tax prepping properties are also useful, but the quality of the insights it provides active traders is particularly good. There’s a timeline tool, which populates with trading milestones, there are charts displaying your balance per day, trades per month, trades per exchange, average purchase price and much more. When it comes to taxes, Cointracking supports the FIFO, LIFO, HIFO and LOFO methods, of which FIFO (first in, first out) is the most commonly used.

Cointracking

There’s the ability to track coins that have been held for longer than a year, and which can thus be sold tax-free in certain jurisdictions. Other tools include the ability for U.S. citizens to create an FBAR report in the event of them owning foreign financial accounts containing assets worth over $10,000. The number of exchanges and wallets that Cointracking supports via API or CSV is impressive; there’s even legacy support for closed exchanges, from Btce to Mt. Gox. The free plan covers 200 tx, rising to 3,500 for Pro. There’s also an Unlimited plan for heavy traders. Another good thing about Cointracking is that you can pay for your subscription in BTC including the option to take out a lifetime license.

Don’t Let Tax Take Over Your Life

In many countries, the U.S. especially, the laws concerning crypto taxation are unfair, vague, and subject to interpretation. Only last month, North Carolina’s Rep. Ted Budd reintroduced the Virtual Value Tax Fix Act in the U.S. House of Representatives. The bill seeks to put a stop to the double tax that is currently imposed on cryptocurrency, making it unnecessarily complex to calculate and record tax every time a purchase is made.

As a cryptocurrency user, there’s little you can do to influence government policy when it comes to taxes; the state moves ponderously, and it may be a while yet before citizens in the U.S. and elsewhere see anything approaching a fair crypto tax policy. In the meantime, the best thing you can do is record your transactions using a purpose-built tool and then get on with your life in the knowledge that the hard part is done. Automate your tax and then you can relax.

What other tax tracking tools do you recommend? Let us know in the comments section below.

Disclaimer: Readers should do their own due diligence before taking any actions related to third party companies or any of their affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any third party content, goods or services mentioned in this article.

Images courtesy of Shutterstock.

Do you want to keep an eye on moving cryptocurrency prices? Visit our Bitcoin Markets tool to get real-time price updates, and head over to our Blockchain Explorer tool to view all previous BCH and BTC transactions.

SHARE THIS STORY:

TAGS IN THIS STORY

blox, Cointracking, Crypto tax, IRS, koinly, Tax, Taxation, Taxes

What is this nonsense. Satoshi created the Bitcoin blockchain as a deregulation tool so why is there crypto tax?? 😤😤

Is steemit truly a decentralized platform or not???

Congratulations @malik.malik! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!