How to Organize Security Tokens Offering to Gain the High Profit

The year of 2017 became a breakthrough for the Blockchain and ICO boom. More than 435 initial coin offerings have raised over $5 billion in 2017. The market also exploded with an initial token offering (ITO), but not every one of us knew what it was. That there were utility and security tokens... Utility ones were traded with success too, however, 2018 is already moving on to being the year of security tokens offering (STO) – the next big thing in crypto assets trading. Time to sort out who is who and how to conduct your own STO.

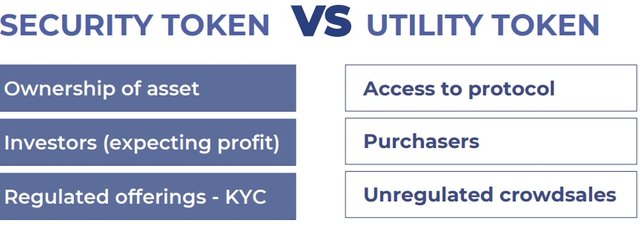

So, what's the difference between the two initial token offerings? These are the two major token types – security tokens and utility tokens. However, most of the tokens we are familiar with are the utility ones.

A utility token or coin offers a buyer future access to seller’s product or service. Technically, it’s not an investment – it’s a purchase that will eventually become profitable. A person buys something like a digital key to the box of services some brand sells. But it’s not a company’s share. Also, the utility tokens have an automatic price stabilization system – the price and the market demand stabilize each other in reverse proportion. If the price goes up, the demand goes down, after this price will also drop in order to match the demand.

“Almost every token that exists today is a utility coin. Bitcoin, Ethereum, Ripple are all utility coins. A utility coin is simply just access to a protocol. They’re not technically considered a security by regulators because they’re products. You don’t actually invest in them. You buy them and you use them to access the protocol. That’s why they’re called utility coins. Security coins are financial products. These are tokenized funds, tokenized real estate, tokenized commodities. These are tokens that literally represent ownership in a real asset.”

Trevor Koverko, CEO of the Polymath Network

Now, time to explain what the security tokens are and why they are so special. In comparison to the previous category, security tokens occupy a much smaller market space. Though the leading crypto world experts predict that such state of things is going to change until the end of 2018. The Wall Street prepares to invest tons of its capital into the security tokens ecosystem and not into the utility field.

So, before proceeding to the STO subject, let’s establish what the cyber assets are in this case. The security token definition is pretty simple – these tokens actually represent companies’ shares (stocks), they are backed by tradable external assets. Basically, when some organization issues its security tokens offering this means you’re offered to buy a share of this organization. Therefore, such security tokens are controlled by federal securities regulations.

To draw the line, the main difference that distinguishes security tokens from utility coins is that the security token buyers gain the ownership rights to the service. In other words, you own an asset without taking possession of it. Whilst any utility token plays a part of a gift card – a holder has no ownership rights or shares in the company’s assets.

I already mentioned the regulations, and it’s no surprise that cryptocurrency market with billions capitalization became a primary target for the government’s consideration. The implementation of regulations is a clear proof that the cryptocurrency and Blockchain platforms are recognized in the financial world. And they won’t be going anywhere soon. For now, the government regulations for security tokens offering are just at their initial stage and we should expect more in the future.

When you buy the security tokens your money transforms into capital that’s why the legal restrictions are needed in the first place. However, despite this rules, the businessmen, actually, are legally protected and have more financial freedom than ever before.

Traditional ICO allows you to buy utility tokens or coins from various companies in a form of crowdfunding. Investors exchange their cryptocurrencies for some specified number of tokens offered on the market. But, there are no shares on the table, as we remember.

Unlike ICO, in the security tokens offering you buy a company’s share/stock, which is controlled by a specific set of rights and obligations (shareholder dividend payouts, board voting rights, etc).

In order to classify a token as a security or utility one, The United States Securities and Exchange Commission (SEC) conducts the Howey test. This test was designed in 1946 and its main goal is to establish if a particular transaction is, indeed, an investment contract. So, to fit into this category, a certain STO must comply with the following requirements:

- The buyer will invest money or assets

- The buyer will get profit from this investment

- The investment is intended for a ‘common enterprise’

- All benefits will come from the efforts of a third-party or promoter

If a token follows all of these conditions it must be classified as a security tokens offering and become a subject to additional disclosure and government regulations. Companies who issue the security tokens offerings must register their token to avoid the charges for violation of securities laws. However, there are still some troubles in paradise – the way SEC applies this test to the cryptocurrencies is a bit vague. But the future promises us changes in this field.

Due to KYC/AML regulations, conducting a security tokens offering project is cheaper, easier and more efficient than launching an ICO with utility tokens. The legal risk for both a company and a buyer is also reduced. But there are limitations on who can invest in STO and how the security tokens can be traded. Which results in the great reduction of these tokens liquidity.

There is no free trade when it comes to the security tokens offering. This obstacle can potentially destroy the effect of a network and compromise the development of a protocol or platform. But it’s not the time to worry. There are special Blockchain platforms (like Polymath, BlockEx, T-Zero and others) that provide their client who issues the security token offerings with the full support and guidance through all legal and technological pitfalls before the actual issuance.

In STO that meets the requirements of securities laws, security tokens have to be able to forbid the trade between third-party persons based on the conditions of the robust smart contracts. Such a high level of safety is possible only with a professional and trustworthy Blockchain-acquainted company that offers a security token service (STS). Talking about Amazon, Microsoft, IBM.

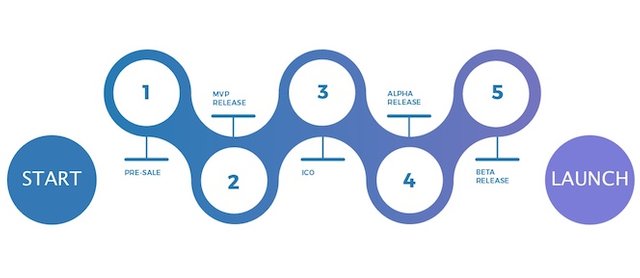

Next, the participation part. Participating in a STO is quite similar to an ICO trading. After the company issued the security tokens offerings and outlined the selling time period, a client may purchase the specific amount of tokens that can later be traded or sold, etc. And those security tokens would represent some actual things like assets, profits, a percentage of the company’s revenue and more.

As for those who can participate in a security tokens offerings, you must keep in mind that only the accredited investors are able to invest in private STO and VIP security tokens. Such investors have to meet particular SEC requirements regarding an annual income, net assets, and type of an institution taking part in the purchase (venture fund, trust, etc.).

As you see, the risk of money laundering will be controlled by the government regulators and KYC/AML rules, which make it somewhat negligible. The risks of fraud actions could be effectively beaten with the disclosure agreements. So, what other risks regarding the should you be aware of?

I think that most experts would agree with me on the thought that the biggest risk would be an overregulation or inappropriate regulation which may lead to the destruction of brave STO experiments and the lack of funding for the most creative ideas. The best is the enemy of the good. That’s why I believe that too many regulations could ruin the security token offering ecosystem.

The financial sector must quickly get the STO and STS sector under the control, understand its basics and embrace the technology if they don’t want to lose big. Just imagine... Limitless decentralized market with the easiest peer-to-peer payments that processes all assets and transactions in seconds. No need for a bank account, brokers, and intermediaries. STO stocks can become the most traded instrument in the world of Blockchain and crypto assets.

Technologically, it’s already more or less possible and this is what actually scares the financial industry. No one likes losing the monopoly on money processing and generating. But times are changing, a competitive age has begun for all the innovators around the globe. Someone will become the first to completely transform the financial sector by pursuing it to accept the need for appropriate regulation for the security tokens offerings.

In order for the security tokens to win the market as the ICO did, the STO buyers have to feel confident about the level of assets’ liquidity and their future profit. And there is a need for more security tokens exchange platforms that actually list and process these tokens allowing clients to claim their benefits (some will launch during the first half of the year). But it is already safe to say that the process began – in 2018 security tokens will gain their own proper infrastructure. Till 2019 they will surpass the utility tokens.

In addition to the open-minded regulatory initiative, the emerging cross-platforms that allow issuing the regulation-compliant security tokens offerings alongside with the development of crypto exchanges that provide liquidity prove that innovations in the field of security crypto assets are more than welcomed.

As soon as the regulators will start to provide their clear and thorough guidelines, tech startups and entrepreneurs will be sure that their business will be protected by the securities laws and regulations. They would be able to trade anything that can be tokenized from real estate, bank and individual loans, equities to company stocks, shareholdings and global debts.

So, we can expect that security tokens offerings and smart contracts will greatly transform the internal structure of global companies and corporations by allowing them to operate on a much more decentralized and boundless business model. All projects would be equally shared between security token holders that can make decisions and participate in the development.

Thus far, there is a couple of STO trailblazers whose path you can follow. Two of them that impressed me the most are:

- The Canadian Securities Exchange that aims to be Canada’s first clearing and settlement securities trading platform.

- US Praetorian Group that on March 6 filed with the SEC to be first ICO that sells registered real estate security tokens.

.jpeg)

The future scenario for the ICOs is that more likely than not it will give a way for the STO boom. But the disruptive innovations won’t be done by the industry giants – bold and open-minded tech entrepreneurs will dominate in this field. And you can be on of them. It will be the time for young and creative startup owners who will shape the future of the financial sector based on the Blockchain platform.

Despite the mentioned risks, bright and innovative technicians will not stop experimenting and creating brand new tools that will simplify the security tokens offering issuance. Those who will catch this wave and embrace the perspectives will gain the high profit.

In order to start organizing your own security tokens offering you must meet all SEC standards and register your tokens as the security ones. Choose the trading Blockchain platform that offers the security token service and issue your STO as soon as you have a business plan on how both you and your clients will benefit from your offering. Follow the STO news from around the world to never miss a single tip on launching security tokens.

Congratulations @kategan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @kategan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!