The Founder's Struggle

A few days ago I wrote about some of the difficult negotiations my partners and I were having as we try to take our VR company to the next stage. The debates were pretty dank, and involved a lot of posturing as people attempt to make themselves look more valuable while making others look less valuable.

By the time it was over, a white board was covered with equity percentages that had been erased and re-written dozens of times, moving a percentage point here or a point there into each founder's pools. To be fair, we had already done this over a year ago, but a new co-founder wanted to join, and insisted we re-capitalize our whole structure in the process.

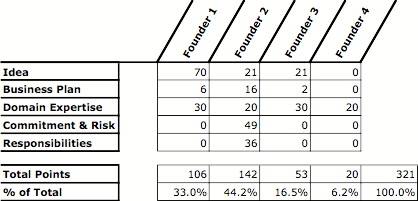

What we didn't exactly use was a tested methodology for ascribing value to each person. We all know what we bring to the table, but you don't simply get 20% of the company for having the idea, or 10% of the company for making the business plan. Today I was thinking about our numbers, and came across a table that helps you assign values for different founder attributes, and I liked it so much I linked it at the top. There are plenty of other equity calculators, but I just filled out this basic table, and found to my amazement that we had reached almost the exact same numbers on our own after hours of debates. That makes me happy, because nobody was terribly under or over-valued, we just couldn't budge on the last few percent.

Despite how close we were, yesterday negotiations ended without us finding a compromise. Only a few % points separated the parties, but somehow those points were a hill to die on. Nobody wants to be undervalued. Nobody wants someone else to be overvalued. I'm strangely ambivalent about the outcome, after one party who had previously accepted an offer of 18% equity, proclaimed he wanted 20%, and would not budge from there. Both sides probably expected the other to give in, but in this game of chicken, the cars crashed.

This is all probably boring as hell, or interesting to anyone who has tried to found a company with friends, or with strangers. You always agree...until you don't. The agreement may actually be the most dangerous part, like a gambler who gets addicted from an early win but can't recognize they have been losing ever since.

Aside from setting up a share split that makes everyone feel respected and well compensated, start-ups desperately need to have a decision making process built on the idea of disagreement, not agreement. Having a 51% partner who can veto everyone else may sound insane to many people, but to others it can avoid squabbling. In our scenario, we were going from a 51% situation, to one where any two out of three co-founders could outvote the other. Beyond that, you can have a Board of Directors, who can even outvote the founders if a resolution is needed. All those structures exist because literally everyone argues, everyone will disagree on something, and even best friends may need to ask the board to vote, or flip a coin to determine which call to make.

I've learned all this crap the hard way, by starting companies and seeing new and innovative ways for them to struggle and fail.

The most alluring thing about a start-up is taking your "best" idea, and trying to find a way to make it into a business. But as I look at previous "best ideas," part of me wishes I had chosen a crappier idea early on, so that when I inevitably failed, it didn't hurt so much. In everything else, you start small and then get bigger/stronger/more confident over time.

You don't try and paint the Mona Lisa FIRST.

You don't try and bench 225 before making sure you can bench at least 100.

You don't warp to the end boss of a game on the first try and expect to have the skills needed to win.

Except for a few lucky bastards, the first attempt at everything is more like a test to see what you are capable of, with the expected result being a valuable failure that can inform future endeavours. This is the same with business and start-ups, where some assholes get lucky, but the rest learn just how much they don't know, precisely as it bites them in the ass.

There are a LOT of entrepreneurs in the crypto space, and I worry about how many of them got lucky on the first investment and now expect that success to be commonplace. I've heard people who scoff at regular investments that only have a 20-50% return, because a crypto investment could yield multi-thousand percent gains in a year. These individuals will surely try to start their own companies, run hasty ICOs, and then learn all the valuable business lessons the hard way, but with tons of money at stake.

Sorry for the ramble. I have a lot to think about with my company, and this feels like a great way to put it out in the world to maybe help others.

Cheers,

Invrse

뭔가.. 인돈사님 글은 읽으면 저도 경험하는듯한 기분이 들어요ㅋㅋ

Congratulations @invrse! You received a personal award!

Click here to view your Board

Congratulations @invrse! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!