Apple AAPL $159.80 Breaking News The Key Takeaways From Apple's Earnings and Forecast 08012017

The Key Takeaways From Apple's Earnings and Forecast

https://www.bloomberg.com/news/videos/2017-08-01/the-takeaways-from-apple-s-earnings-and-forecast-video … via @technology

What Tim Cook Had to Say About Apple's Earnings

https://www.bloomberg.com/news/videos/2017-08-01/what-tim-cook-had-to-say-about-apple-s-earnings-video … via @technology

🍎 Apple First Look: Strength Across The Board Aug. 1.17 | Apple Inc. (AAPL) 🍎

SUMMARY from D M Martins Research shared via APPLE Inc

🍎 Apple reported fiscal 3Q17 results that impressed even the more optimistic investor.

🍎 Sales and gross margins came in above the mid-point of guidance, with strength observed across the different segments - even iPads.

🍎 Today's results reinforced my convictions that the stock should have room to grow from here.

This Tuesday, Apple (AAPL) reported fiscal 3Q17 results that impressed even the more optimistic investor. At least at first glance, the results reinforced my bullish stance on the stock.

Credit: CNBC

Apple by the numbers

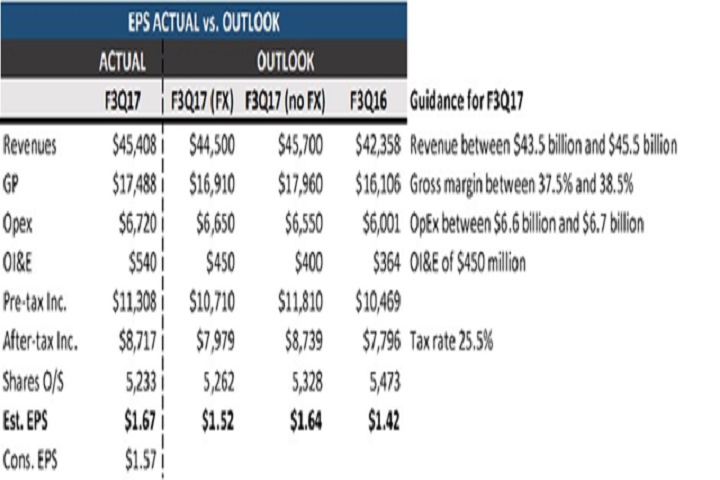

Revenues of $45.4 billion came in above consensus $44.9 billion. EPS of $1.67 beat estimated $1.57 on better-than-expected sales and gross margin at the mid-point of the guidance range (see table below), and despite richer-than-expected opex. On a segment basis, the brightest star of the quarter was Services, up +22% vs. last quarter's +18% YOY improvement (more on Services below). Still, strength was observed across the board, with even iPads performing solidly (more details below).

Source: DM Martins Research, using data from company documents

On the geography split, the most sizable Americas and Europe markets did better than last quarter, both posting double-digit YOY growth. Greater China continued to struggle to my dismay, -10% YOY, but less so than it had in fiscal 2Q17. I expect some of the same themes (FX headwinds, reduced spending in Hong Kong) to have driven the underperformance (see trend below).

Source: DM Martins Research, using data from press releases

On Apple's Services business

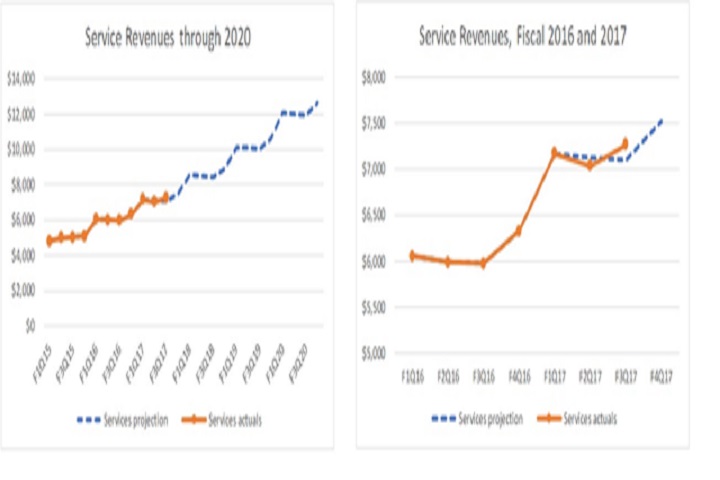

For a while, I have maintained the once obscure (now very mainstream) idea that Apple's Services should propel the company and the stock forward for quite a few years, as the company begins to more heavily monetize on its sizable user base. Management has put a target on it: to double Services revenues by 2020.

Last quarter, the Services division performed well, although not impressively so. This time, Services came in at $7.3 billion, up +22% in the YOY comparison. In regards to the 2020 goal, Apple seems to be well on track after a strong performance in the June quarter, although the road ahead is still long.

In line with the results of the quarter, I continue to believe that Services will provide Apple with (1) an opportunity to boost top-line growth that is (2) more recurring in nature (particularly subscription services) and that (3) can help to fight a decline in margins that I expect to see in the ever-competitive mobile device business.

Source: DM Martins Research, using data from company reports

On iPads

Last month, I published an article wondering if iPads could be responsible for some upside to fiscal 3Q17 results. The reason: in March of this year, Apple made a one-of-a-kind product refresh announcement (introducing a much cheaper version) in support of the declining product category and to aid Apple in its goal of doubling its Services business by 2020.

To my surprise (or perhaps not), iPad revenues came in +2% higher than year-ago levels, significantly better than last quarter's -12% performance. Even more impressively, units sold were up +15% in the YOY comparison vs. last quarter's -13%.

Indeed, it looks like iPads might start to matter for Apple once again.

On Apple's stock

More so than key names in its peer group, AAPL ran quite a bit since the start of 2017. As the chart below illustrates, forward P/E climbed from a 52-week low of about 12x (a rare bargain, in my view) to 16.9x today. But with the current projected EPS growth of 20% in fiscal 2018 above the 15% growth estimates of 90 days ago and with the company's cash pile growing by the quarter ($47.9 billion in cash from ops generated in the current fiscal year so far), I continue to find AAPL an attractive proposition.

Chart AAPL PE Ratio (Forward) data by YCharts

Looking farther down the road, I will likely continue to be an Apple bull for as long as certain key growth drivers remain intact (namely revenues from the App Store and other services, as well as under-penetration in markets like China and India). Today's results reinforced my convictions that the stock should have room to grow from here.

COMMENTS PLEASE? AAPL BUY, HOLD, SELL ? or convert to Bitcoin ?

Your vote is important to us. For which we thank you. And keep voting. @ahlawat

nice post