WHAT ARE SHARES? || SHAREHOLDING101

Shares are issued oftentimes by start-up corporations to raise capital for company operation and maintenance, but it is not limited to start-up companies. Big companies also at the verge of bankruptcy sometimes do the same as well. Recently there has been speculations that telecommunication giants, MTN, is about selling shares worth $500m to meet up with some expenses incurred in a deal.

Shares are one of the most common ways to raise funds by start-up companies, they can be thought of as unit of ownership interest in a firm or corporation. Investopedia defines it as;

Shares are units of ownership interest in a corporation or financial asset that provide for an equal distribution in any profits, if any are declared, in the form of dividends.

Too complicated? Think of it this way;

Let's say Mr. A conceives a multi-million dollar idea and decides to build a company around this idea, but he has no clue about how to market this idea into a million dollar. Mr. A meets Mr. B, a master marketer, who sure knows how to transform this idea and bring it to see the light day. Although Mr. A has got a million dollar idea, he hasn't got a penny in his purse at the moment, he is as broke as broke can be. So he negotiates with Mr. B for his services, offering a portion of the impending business( a share of the business). The negotiation is successful, Mr. b agrees, seeing the potential of the impending business, so they form a corporation.

A corporation formed with no funds is no corporation at all, so the baby corporation (Mr. A&B) begin to sought for funds. As they search, they come across Mr. C, a wealthy businessman who unfortunately is no philantropist or a fan of philanthropy, but fortunately a visionary investor. Mr. C offers to buy a portion of the business ( a share), but unlike Mr. B, he wouldn't be a part of the operation of the business, he is just in for his monthly or annual profits.

In financial markets, the profits received by Mr. C, who is a shareholder(an owner of a portion of the corporation just launched) are called dividends.

Hence basically, shares is a unit of account for various investments.

TYPES OF SHARES

Primarily categorized by how the dividends are paid, there are two(2) types of shares, they include;

- Common Shares.

- Preferred Shares.

Common Shares.

These kind of shares are the most issued by companies and coporations. They are "ONLY FOR THE BRAVE". This is because dividends(profits for shareholders) may depreciate or appreciate due to the profits and loss of the business operations and at liquidation of the company due to bankruptcy, preferred shareholders are given preference in payment(preferred shareholders are paid first), this makes common shares a risky ground.

Along with the risks comes the benefit of voting rights, giving the shareholders control over the business. With these voting rights, shareholders could vote in members of the board of directors, diversification of funds or whatever it may be. These kind of shares also grants shareholders pre-emptive rights in order to help them maintain their percentage of ownership in the corporation, by reservation of new shares slots, ensuring that they buy new shares. Common shares may be risky, but they come with some mouthwatering benefits.

Preferred Shares

This kind of shares provides shareholders with a constant pre-negotiated dividends. The huge losses or profits of the business operations does not affect the profits paid to the shareholders. The portion of preferred shareholders shares in the share capital is paid first at the liquidation of the corporation before common shareholders are considered and then the owners. These type of shares are not offered by most corporations.

To understand the distribution of payments during the liquidation of a business, one needs to have a crystal clear understanding of what liquidation means and an understanding of the Economic entity principle of accounting and what Equity means as well.

Liquidation primarily means converting into cash, the assets(raises funds for a business) of a business through selling. The easier it is to sell an asset, the more liquid it is e.g Mr. A&B's machines are more liquid than Mr. A&B's land because finding buyers for the machines is easier, hence it could be easily sold. An entire business is not so liquid but when it declares bankruptcy, liquidation is usually the next call.

The Economic entity principle of accounting teaches one to treat the business and its owners as two separate entities. Hence, the debit and credit transactions of the business is handled separately from the owners'. This also suggests that the owners' assets and liabilities are not the business'.

This brings us to Equity. Equity is simply Assets less liabilities. Represented by a simple mathematical equation;

Equity = Assets - Liabilities

Now how does all these terms relate to shares? You might be asking yourself

From the commencement of a business, it is in dept. How? Here is how.

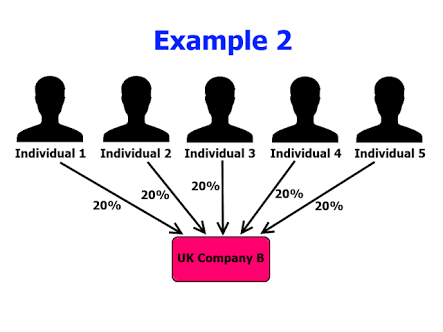

The business starts with zero funds in its account. It raises its capital called share capital from investors who buy portions of ownership of the business in form of shares. This share capital according to the Economic entity principle, is a liability to the business as these are the owners of the business and the business entity sees them as lenders. This share capital is used purchase assets. The company's equity can then be calculated with the above stated formula.

If you have been following, you might think that the equity of the company should be zero because the liabilities incurred were used to purchase the assets, so equity should be zero as Assets = Liabilities. This might be logically correct but not financially correct. The values of assets from the moment it is purchased depends on future economic prospects. This means basically that if the future market welcomes products from that asset and demand the products or the assets itself, automatically it becomes more valuable.

The company's equity is dustributed amongst shareholders, hence the popular term shareholders' equity. i.e while the business still operates, after the share capital(a liability) has been accounted for, the equity is what remains and this is what is paid to shareholders as dividends. When a company files for bankruptcy, it could either mean the equity is zero or negative. This negative equity is usually referred to as shareholders deficit.

In my subsequent business posts, I'd talk more about shares. Length will not permit me to go on in this one. I'd talk about;

- Shareholding terminologies

- Proof of shares

- How shares relates to stocks and bonds

- Where to buy shares - Stock exchanges

- When to buy shares

- How shareholding relates to the cryptoworld

And hopefully they'll answer your questions.

Hope you got a basic understanding about shares.

Drop your questions if any.

.jpeg)

.png)

.jpeg)