Importance of Corporate Approach and Standards in Crypto

This article aims to outline the importance of a corporate approach and standards in Crypto. How should a startup go about launching a token or blockchain business in 2020? What kind of critical mistakes did the plethora of new upstarts make in the ICO rush of 2017?

Ideas for this article came from informal discussions and observations in and around BitShares and the wider Crypto community. Opinions are expressed freely and do not represent official statements of the BitShares blockchain, or any other individual/organization.

Genesis of Blockchain Startups

Blockchain technology has been with us only a few years and spawned an explosion of new blockchain startups. The world witnessed a 'crypto boom', and comparisons made to the Dot-com bubble or California Gold Rush. Although when you actually do the sums, Crypto is yet to rival those events. The numbers are not full Wall St. trillions as Dotcom was in the early 2000s. Many say it's still to come. So for most arguments, we can say this industry is still in its infancy. Why should staying out of the deadcoins graveyard be so much different than any 'other' business startup? Even for a decentralized technology.

What did we learn from 2017?

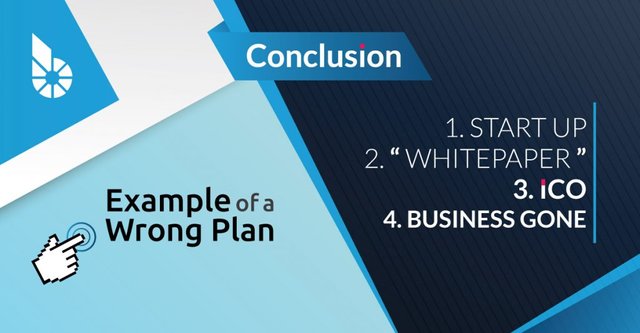

Or, what would be the correct approach to a Blockchain startup in 2020? The 'ICO rush' craze of 2017 is littered with bad examples. Back then, there wasn't a day that went by without a new project coming on the scene. Typically boosting a flashy WordPress template with promises of untold fortunes. Well if it sounds too good to be true it probably is, and a lot of them were blatant scams. Many such schemes still exist - and will multiply if markets are going up. So the best advice? Stay well clear of them and their annoyingly blatant and persuasive propaganda campaigns.

During 2017 as general gold rush fever gripped, members of the public were equally to blame. One word, 'greed' meant some were too easily betting the whole farm. Blockchain startup investments were made with zero checks and balances on either sides. So another twofold problem appeared - not only the 'get rich quick' scams. Also those running ICOs had not done enough 'tokenomics' sums and faced consequences of being manipulated/pumped/dumped etc. This was especially the case in stakeholder scenarios where 'Whales' could collude for power. It's another case in point for having a corporate and standards based approach, especially managing tokenomics for long-term economics of a business and/or consumer eco-system on blokchain.

Post 2017 finished up with a crash back to reality, and slow markets for over 2 years. Further the Crypto industry public image became tarnished. The investing public and regulators more cautious than ever. Through these reflections, the call for a better corporate standards based approach for any blockchain based endeavor to stand good chances at success is becoming obvious.

State of Crypto 2020 - Greater Regulation and Awareness

You may have many opinions or theorize where the industry would be today if markets had behaved differently leading up to the events we spoke about. Truth is, 2017's "ICO craze" taught us many of the lessons we need now for today's topic of proper corporate approach and standards in Crypto industry. Events that led up to 2017 should be taken seriously for the industry moving forwards, especially public perceptions towards it.

This time around, in 2020 any crypto and blockchain startup needs to present themselves in a professional and corporate manner. Whether open source communities or for-profit businesses. Projects should detail their specific use-case(s) that are regulated and can actually on-board investors or investments e.g. through consignment forms for the assets of the investment (temporary loan with returns). Potential investors or new customers to any business are also going to be a lot more comfortable if presented with a formal and registered business entity. This includes having accountable and answerable departments and support functions, proper branding, legal, development portfolio and more - but no guarantees of untold wealth.

Especially No Guarantees of untold wealth

ICOs are pretty much illegal as of 2020, that much we know. This doesn't prevent launching of new blockchains or listing of tokens on coinmarketcap.com website. It doesn't mean much has changed aside from terminology - the scams were always the scams. You are going to have a lot of hoops to create any cryptocurrency as a 'security' (such as being a pure investment vehicle). If your token or coin is a kind of investment fund, then it better be following actual financial regulatory guidelines and holding licenses to do so.

Not only are the public more savvy about investing in the industry but governments, banks and regulators are also a lot more on top of activities since 2017. The rules (whether good or bad depending where you are) already exist in a lot more places (with actionable laws) than 2-3 years ago. If you start running a project now without setting up a corporate structure to deal with all these factions, defining well your token utility or function, following some basic AML, getting some licenses and other such requirements - then your failure (or jail time) might be much assured.

Blockchain Startups should avoid Privacy or Anonymity Coins

Another area of great debate and controversy for certain. Many of the dedicated and long-term cryptocurrency advocates call for liberties when it comes to Crypto. They call for 'revolution' in the most extreme cases, aimed at the long-standing global monetary establishments. Central banks, government and monetary regulation are all in their scopes. In doing so however, many of these projects choose to take a 'dark' approach. Still, an area of great interest as the technology implications go, because innovations are not to be dismissed. However, these projects will likely always remain in a 'dark corner', unregulated or mostly experimental.

Most importantly, you don't want to base a real-world business service on a privacy/darkcoin type blockchain. This will cause problems. For exchange listings, regulatory purposes and more towards any intended legitimate healthy business. On which point, we should note that BitShares Token Factory allows you to create your digital assets with flags and features which can greatly ease regulatory processing.

Case Study: As an example outside of our BitShares community, look no further than DASH.org. The success of DASH is widely attributed to solid branding, legal, with formal corporate structure. DASH has a very different public reputation today compared to this article in WIRED from 2014. Back then it was called 'DARKCOIN'.

Hypothetical Scenario

More an example towards the 'caveat emptor' approach one should take towards new projects. Would you order a new family car, pay a large deposit, when the manufacture hadn't even built their factory? They have nothing but what looks like impressively complicated plans, and never even built a single car. Speculation of huge growth marketed on top, and promises of products/technology that don't possess a single line of code or even had a proper whiteboard session. ICO projects were actually resembling such structures in 2017.

Caveat Emptor

Even today, majority of projects when you peer through the cracks are nothing more than ponzi investment/fundraising vehicles. The danger is where many of them are the sheep in wolves clothing; some you need a deeper technical or developers grasp to perform full diligence on them. Ensuring there is a top notch team of reputable professionals should be the first on any list of proper corporate structure and standards.

Investors should seek projects with good business structure. Elements include branding, biz registrations, trademarks, formal contacts, corporate inquiry/PR, and a named team. Following a good structure is surely going to stand a lot more chance of success. That's regardless of products and services whose quality nonetheless also plays a huge part of the story for another time.

Conclusion: Success never comes without effort

Ghandi said 'wealth without hard work' is one of the 7 detriments to human virtue. This was sadly too true towards many fails and 'gold rush' scams of the ICO rush. There will for certain be great success stories to come from blockchain startups. However none will be without serious efforts and sacrifices from a business standards approach. We hope this article has given you some food for thought in regards to proper corporate approach in blockchain startups.

Posted from BitShares News using SteemPress, see: https://news.bitshares.org/corporate-approach-crypto/

The last image with "BitShares" on it looks strange. Readers may think BitShares is an example that did wrong.

Yeah designer went a bit over with branding with that one :) I'll push change tomorrow AM

Chee®s and gnite :)

Yeah, if you cook a nice meal it takes a number of ingredients in just the right amount. BlockChain projects need leadership, innovation, real world use, integrity, honesty, sold research, users, good graphic design, good interfaces, effective politics, correct product, correct pricing, security, a good business plan and so much more. Getting several of these things right is not that hard, but getting all of them right and then being able to change as needed down the road has proven very difficult for projects.

Congratulations @bitsharesorg! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!