Zero-Based Budget Template: A Practical Guide

Managing finances effectively requires more than just tracking expenses—it demands a structured approach to budgeting. A zero-based budget template helps individuals and businesses allocate every dollar with intention, ensuring financial goals are met while minimizing waste. Unlike traditional budgeting methods, which rely on estimates and previous spending patterns, zero-based budgeting (ZBB) starts from scratch, assigning a purpose to every dollar earned.

What Is a Zero-Based Budget?

Zero-based budgeting (ZBB) is a financial planning method where every dollar of income is allocated to specific expenses, savings, or investments until the budget reaches zero. This method ensures complete financial control by eliminating unnecessary spending and encouraging intentional money management.

Key principles of zero-based budgeting include:

Income Allocation – Every dollar is assigned a category, whether for necessities, savings, or discretionary expenses.

Expense Justification – Each budget item must be justified, ensuring that spending aligns with financial goals.

Flexibility – Adjustments can be made based on priorities, making it adaptable to different income levels.

Goal-Oriented Planning – Helps individuals and businesses focus on savings, debt repayment, and investments.

By following these principles, ZBB helps maintain financial discipline and ensures that funds are used efficiently.

Why Use a Zero-Based Budget Template?

A structured zero-based budget template provides multiple benefits, including:

Better Expense Control – Forces accountability by requiring justification for every expense.

Increased Savings & Investments – Encourages prioritization of financial goals.

Debt Reduction – Ensures extra funds are directed toward paying off debts.

Improved Cash Flow Management – Prevents overspending and ensures income is used efficiently.

Adaptability – Works for individuals, families, and businesses across different income levels.

By implementing a zero-based budget, individuals and businesses can make informed financial decisions and eliminate wasteful spending.

How Does Zero-Based Budgeting Work?

The key idea behind zero-based budgeting is that your income should match your expenses exactly. Here’s a step-by-step breakdown of how it works:

Calculate Your Total Income

Start by calculating all your sources of income for the month. This could include your salary, freelance work, side hustles, or any other regular income streams. Be sure to use your net income—the amount you have left after taxes and other deductions.List All Your Expenses

Next, make a comprehensive list of your expenses. These should include both fixed expenses (like rent or mortgage payments) and variable expenses (like groceries and entertainment). You may also want to include occasional expenses like car repairs or insurance premiums.

Be as specific as possible—every dollar should be accounted for. Some common expense categories include:

Rent or mortgage

Utilities

Groceries

Debt payments

Savings contributions

Subscriptions and memberships

Allocate Every Dollar

Once you’ve listed all your expenses, it’s time to assign each dollar of your income to one of those categories. The goal is to match your income to your expenses so that by the end, your budget equals zero. If you find yourself with money left over, you can allocate it toward savings or investments.Monitor and Adjust

The final step is to monitor your budget throughout the month and make adjustments as necessary. Life can be unpredictable, and unexpected expenses may pop up. The beauty of a zero-based budget is that it can be flexible—you can adjust your allocations as needed, as long as you ensure your final budget still totals zero.

What Should You Use Your Zero-Based Budget For?

A zero-based budget is one of the best tools for managing both short-term and long-term financial goals. Here’s how it can help you:

Build an emergency fund: Allocate a portion of your income toward creating a safety net for unexpected expenses, such as medical bills or car repairs.

Control spending: By assigning every dollar a job, you can avoid impulse purchases and stick to your financial plan.

Pay off debt: A zero-based budget allows you to focus on debt repayment by allocating funds specifically for paying off loans, credit cards, or other liabilities.

Boost savings: With all your spending accounted for, you can easily direct any leftover funds toward your savings goals, like retirement or a vacation.

Plan for the future: Whether you’re saving for a down payment on a house or a new car, a zero-based budget helps you manage your money with long-term goals in mind.

By using a zero-based budget, you gain more control over your finances, reduce financial stress, and increase your confidence in managing money effectively.

Advantages and Disadvantages of Zero-Based Budgeting

As with any budgeting method, there are both pros and cons to using a zero-based budget. Let’s explore both:

Advantages

Complete control over your money: With a zero-based budget, every dollar has a specific job, which gives you full control over your spending and savings.

Flexibility: While the budget is strict, it’s also flexible enough to accommodate changes. You can adjust your allocations if unexpected expenses arise.

Improved financial discipline: This method forces you to focus on your financial goals and avoid wasteful spending, which can lead to more responsible money habits.

Better debt management: You can prioritize debt repayment in your budget, helping you pay off loans faster.

Disadvantages

Time-consuming: Setting up a zero-based budget can take time, especially if your income and expenses vary each month.

Requires attention: This method demands close attention to detail, which may be overwhelming for some.

Limited flexibility for high-variable incomes: If your income fluctuates significantly from month to month, it can be difficult to stick to a rigid zero-based budget.

How to Create a Zero-Based Budget

Creating a zero-based budget is simpler than you might think. Follow these steps to set one up:

Step 1: Calculate Your Income

Gather all your income sources, including salary, freelance earnings, and side hustle income. Ensure you’re working with your net income (after taxes).

Step 2: Track and List Expenses

List out all your expenses, from the essentials like rent and groceries to discretionary spending like entertainment or dining out. Be honest about what you spend each month to get an accurate picture.

Step 3: Assign Every Dollar a Job

Now, assign every dollar of your income to an expense category. If you have money left over, direct it toward savings or debt repayment.

Step 4: Use a Budget Spreadsheet

You can make this process easier by using a budget spreadsheet in Excel or Google Sheets. There are also plenty of zero-based budget templates available online, which we’ll explore below.

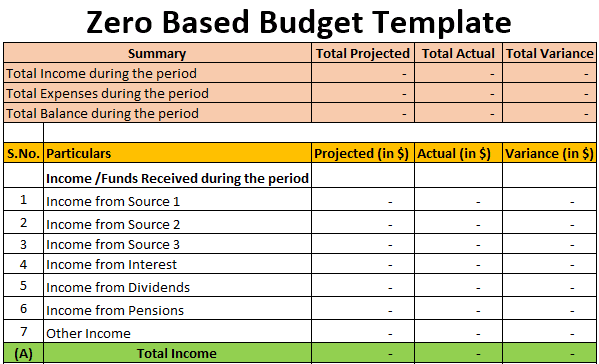

Zero-Based Budget Template Example

A simple template can help streamline the process. Here’s an example:

Zero-Based Budget Template

Category

Budgeted Amount ($)

Actual Amount ($)

Income

Salary

[Amount]

[Amount]

Side Income

[Amount]

[Amount]

Fixed Expenses

Rent/Mortgage

[Amount]

[Amount]

Utilities

[Amount]

[Amount]

Insurance

[Amount]

[Amount]

Variable Expenses

Groceries

[Amount]

[Amount]

Transportation

[Amount]

[Amount]

Entertainment

[Amount]

[Amount]

Savings & Debt Payments

Emergency Fund

[Amount]

[Amount]

Debt Repayment

[Amount]

[Amount]

Retirement Savings

[Amount]

[Amount]

Total Allocated

$0.00

$0.00

This template ensures that every dollar is allocated, preventing overspending while focusing on financial goals.

Best Practices for Zero-Based Budgeting

To maximize the effectiveness of a zero-based budget, consider these tips:

Prioritize Needs Over Wants – Allocate funds to essentials first before discretionary spending.

Review & Adjust Monthly – Income and expenses fluctuate, so regular updates are essential.

Use Budgeting Tools – Apps like YNAB (You Need a Budget), Mint, or Excel spreadsheets help automate tracking.

Set Realistic Categories – Avoid overcomplicating the budget; keep expense categories simple and manageable.

Prepare for Unexpected Expenses – Include a buffer for emergencies to prevent financial strain.

By following these best practices, zero-based budgeting becomes a reliable tool for financial stability.

Common Challenges & How to Overcome Them

While zero-based budgeting is highly effective, it comes with potential challenges. Here’s how to address them:

Time-Consuming Setup – Solution: Use automated budgeting tools for faster tracking.

Income Variability – Solution: Allocate a percentage of income to key categories rather than fixed amounts.

Unexpected Expenses – Solution: Build an emergency fund into the budget.

Overly Strict Budgeting – Solution: Allow flexibility for minor discretionary spending.

By tackling these challenges proactively, individuals and businesses can maintain consistency in budgeting efforts.

Zero-Based Budgeting vs. Traditional Budgeting

How does zero-based budgeting compare to traditional budgeting methods? Here’s a quick breakdown:

Feature

Zero-Based Budgeting

Traditional Budgeting

Expense Justification

Every expense must be justified

Based on previous spending patterns

Flexibility

Highly adaptable

Less responsive to change

Focus

Goal-oriented spending

Expense tracking

Savings Emphasis

Prioritizes savings & debt reduction

Savings often secondary

Difficulty Level

Requires regular adjustments

Easier but less precise

Zero-based budgeting offers more control over finances, ensuring funds are allocated based on necessity rather than habit.

Final Thoughts: Why a Zero-Based Budget Template is Essential

Zero-based budgeting is a powerful tool for achieving financial discipline. By assigning every dollar a purpose, individuals and businesses can reduce unnecessary spending, prioritize savings, and manage cash flow more effectively.

If you’re looking to take control of your finances, start using a zero-based budget template today. With careful planning and regular adjustments, you’ll gain greater financial stability and work toward long-term success.

Maximize your budgeting efficiency with Microsoft Office Suite—use Excel for financial tracking, Outlook for expense planning, and OneNote for budgeting insights. https://royalcdkeys.com/collections/office-suites