Why this Crypto Bubble is Good

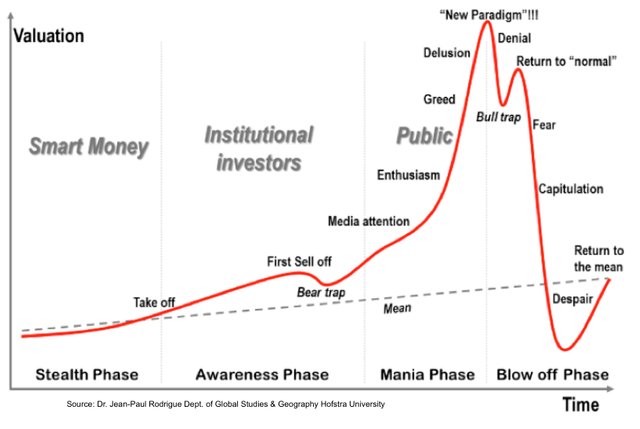

Many have previously critiqued the meteoric rise of cryptocurrencies in the global market as akin to the Dot-Com bubble of the early 2000s when massive speculation concerning internet-related IPOs caused the market to swell epically, followed by an massive correction of about 78%. Millions in investment were lost, many investors losing incredible chunks of their personal worth.

The parallels with the blockchain world are clear. A vast majority of ICOs were scams with only a tiny percentage making their way onto public exchanges. The bubble of hype popped in early 2018 and caused most coins to fall 50% or more in value. Billions were poured into these startup gambles, for the most part wealth that was accrued over several years in the BTC market. As Bitcoin and Ethereum rose to unprecedented highs over the course of 2017, many resorted to ‘reinvesting’ their gains into the newer parts of the promising market. This proved somewhat deadly in the short-term, nurturing a fanaticism that caused new investors to join during all-time-highs. Millions in investment were lost again.

Here’s a segment about the Dot-com bubble’s environment at the time as described by Investopedia and see if you can imagine replacing some of the vocabulary with ones that exist in the crypto space -

Companies underwent a similar phenomenon to the one that gripped Seventeenth century England and America in the early eighties: investors wanted big ideas more than a solid business plan. Buzzwords like networking, new paradigm, information technologies, internet, consumer-driven navigation, tailored web experience and many more examples of empty double-speak filled the media and investors with a rabid hunger for more. The IPOs of internet companies emerged with ferocity and frequency, sweeping the nation up in euphoria. Investors were blindly grabbing every new issue without even looking at a business plan to find out, for example, how long the company would take before making a profit, if ever.

It’s almost as if reading a description of the last several months. The similarities in price action between the recent crypto market and historical examples of stock plummets are uncanny and one thing seems to be clear.

Bubbles are good.

Venture Capitalist Fred Wilson, who lost 90% of his net worth during the Dot Com bubble, had this to say about his and his colleague’s experience -

“A friend of mine has a great line. He says ‘Nothing important has ever been built without irrational exuberance’. Meaning that you need some of this mania to cause investors to open up their pocketbooks and finance the building of the railroads or the automobile or aerospace industry or whatever. And in this case, much of the capital invested was lost, but also much of it was invested in a very high throughput backbone for the Internet, and lots of software that works, and databases, and server structure. All that stuff has allowed what we have today, which has changed our lives … that’s what all this speculative mania built.”

Any transformative technology needs an initial craze to push it into the public imagination. Imagination then often trumps reason and causes unprecedented growth and investment. That investment cannot be adequately substantiated at that young phase of development and causes reverse mania. And though things might plummet in price and backtrack in terms of public acceptance, it all lays the groundwork for very actionable experiences and takeaways.

The Dot-Com bubble might have been catastrophic for many people, but it also allowed many more access to revolutionary technologies and even their direct profits. I fully suspect that same thing to happen in the crypto space where we all know, as some of level of “investor” in the Steem blockchain, that despite the lull of media hype, the market and community in the blockchain space is growing rapidly.

I came across this Quora question asking if the hype and opportunity of Bitcoin and other cryptos had gone past invest-ability and really enjoyed the response by crypto writer Nele Maria Palipea -

Despite the markets correcting some 60%, new ideas, projects and real life use-cases are being invented and added every single day. So the difference between this correction and all the other corrections in the past is that the scene is experiencing activity never seen before.

Even though the market is shrinking in terms of dollar value, the base and backbone of the industry is actually expanding rapidly.

This strong base forming underneath the market means that we will likely see a much faster comeback for cryptocurrencies compared to before — and are not likely to see the kind of long cool down period witnessed after the last major correction.

All in all, I’m fairly relieved in hindsight to see the market correct as it did and set itself up for a better brighter future. It started to weed out the pump n’ dumpers, the fearful “investors,” and raised great awareness concerning how to be more discerning around ICOs (see image below). Though this means a cut in our profits in the short-term, it will likely equate a more healthy ecosystem in the long run.

Let me know what you think, Steem on!

Very detailed sharing of crypto bubble and dot com bubble! I wish I was calm enough to remind myself about the market correction when its bullish

It's always tough to do but I encourage a constant big-picture outlook! Steem is still 20-25x what it was worth a year ago and although the drop from January is painful, it's a relative blip in the trajectory of the token's 'worth'.

Thanks for the great article @hansikhouse! Its great to see more positive posts about crypto! By the way I really enjoy reading your posts! I post similar content on my blog, we should follow each other!

Hello @hansikhouse

I totally agree with the content of this post especially this line...

Dues to incessant TV highlights of happenstances in Crypto world, my friend who have been refusing my advice to invest in steem as he is not conversant with cryptos, called me after listening to one of TV highlights on cryptocurrencies, and gave me $2000 to help him get some units of steem/SBD.

I don't think he would have invested without having to listen to TV highlights on cryptos. I think this industry still need lots of noise and buzz just as you stated in the above quoted passage.

@eurogee of @euronation community

Thanks for sharing this @eurogee. It really puts into perspective how news reporting actually lags the most and comes out last after the real innovation and legitimate interest has been established. Especially when it comes to investing, one should be very wary of media buzz and understand that media is usually the least informed. I had a number of friends reach out to me in December and I purposefully dissuaded them from making decisions like this during all-time highs.

Yes you are quite right. Like wise me, I also discourage some people from putting more when market was so high. However, this period is okay for investment. So I am encouraging anyone who wanna invest to go ahead. Thanks for such a well thought out response.

@eurogee

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

You make a good point about the ultimate benefits of the dot com bubble. I think theres a balance. Its all good for businesses to fail as long as the individuals can survive to fight on another day.

I think this is the route for real resiliency to emerge from the space. If things just kept going up, the crypto market would be bloated with pseudo-adopters who add little value and in fact help spread misinformation.

It "would be" ?? lol

Haha still is, but the problem would be much worse without any consequence.

wow........! this is really a great post coming from you @hansikhouse.

its really resourceful.

Thanks for reading @braveit!

Nice post but a big difference with the dot com bubble is that the dot com's were far more mainstream and owned by the public, crypto is not. People on these boards and other crypto circles vastly overestimate the public's involvement in crypto. The average person (or even above average person) has no crypto holdings, most professionals have no crypto holdings, the baby boomers generally don't even know what it is let alone own any, it's nowhere near mainstream yet and won't be until you can purchase it via a brokerage account, or when it's recommended as part of an investment portfolio by investment advisors, mutual funds etc etc

This doesn't change the fact that both act similarly with similar consequences, hence the point of the post. The aim of the article is not to overlap apples and oranges but to understand the underlying factors of why market movements are stimulated by the same root emotions and what happens during the fallout.

There is also the consideration that what we're experiencing is not the true crypto 'bubble' over the last few months' correction but an initial bump in the real bubble yet to come when cryptos are in fact more widely consumed, integrated into investment options, are purchasable on Robinhood, etc. Regardless, I think we'll see similar action and development in the ecosystem of blockchain as we did in the DotCom era.

Cheers @nrad.

Agreed, hopefully the recovery & larger bubble begins to form soon because I simply got in at the wrong time and sitting on huge losses.

How low can it go?

그곳은 어떨까요

지금 제가 지내는 인천엔 봄비가 내리고

있어요 곧 모든 생물들이 활기차질 거예요

그렇듯 주춤한 가상화폐의 시장도 그러하리라 생각해요

무엇이든 초창기엔 열광과 불신이 있지요

그렇게 처음 접하는 경제의 산물들엔

거품이 비대해질 수밖에 없겠지요

그러다 결국 어느 지점엔 열광이란 자리에서 안정의 자리로 옮겨 가 있구요

그 열광과 불신의 시기에 투자의 희비가

극명히 나뉘는 건 당연한 거라고 여겨져요

놀라운 수치네요. 스캠이 81%고, 살아남는 것은 겨우 8%라니.