SealemLab is built from NFTs , DeFi , GameFi

GameFi has agreed to license a new digital reality cryptocurrency anywhere with completely unique components (such as social media, games, immersive reality, entertainment, etc.) location, etc.), video location, etc. Macros combine the two main physical elements of a location in a terrestrial environment, linked to real-world images and sounds, and other sensitive elements. A virtual location will respect the attacker's understanding, whereas digital reality is a fully digitized and augmented reality terrain with which Stoner can interact with a specific location. Possibly on a digital macro model.

GameFi has agreed to license a new digital reality cryptocurrency anywhere with completely unique components (such as social media, games, immersive reality, entertainment, etc.) location, etc.), video location, etc. Macros combine the two main physical elements of a location in a terrestrial environment, linked to real-world images and sounds, and other sensitive elements. A virtual location will respect the attacker's understanding, whereas digital reality is a fully digitized and augmented reality terrain with which Stoner can interact with a specific location. Possibly on a digital macro model.

GameFi rush hour has been known to coincide with crypto amplification a few times, so this used to be a more secure link, seemingly suburban virtual enclave with blockchain and much-anticipated fashion based on its tumultuous beginnings.

About SEALEMLAB

The Sealem platform creates a new generation of DeFi + Gamefi protocol. Participating in governance by buying bonds to obtain ST token, and at the same time obtaining game tokens by staking, and enjoying a variety of high-quality games on the platform.The DeFi + Gamefi model reduces the risk of unlimited inflation, and the two parts will interoperate to maximize returns.

Sealem Lab Background

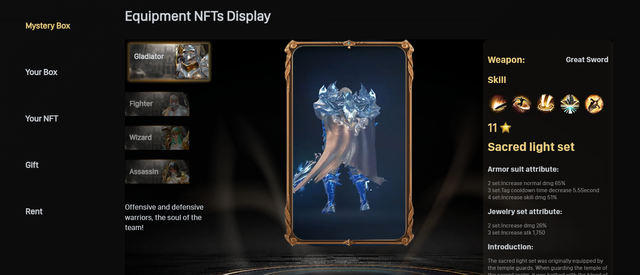

Sealem Lab is a comprehensive cryptocurrency research and development company headquartered in Dubai. It has intellectual property rights and other services for all core technologies of its products. It owns a number of chain games developed based on Unreal Engine, such as Sacred Realm.

What is Staking?

Stakers can stake their ST tokens on the Sealem website to receive SR staking rewards. Staking rewards come from the proceeds of bond sales and the fees for withdrawing tokens in the game, and can vary depending on the amount of ST staked in the protocol and the reward rate set by monetary policy.

Staking is a passive long-term strategy. Your increase in ST shares translates into a falling cost base, tending to zero. This means that even if the market price of ST is lower than your initial purchase price, with a long enough staking period, the growth of your staked ST balance should eventually outpace the price drop.

Strategies for Building Sealem Products

The Sealem team employs 2 strategies to build innovative Sealem products.

Problem Statement: In-depth research and understanding of DeFi+Gamefi issues, continuous update of iterative versions, to provide users with maximum benefits, and the transition from DeFi+P2E to Play for fun and P2E.

Solution Statement: Assess market gaps and iterate until we find a product idea/solution that allows us to capture a large number of unresolved needs in a specific problem statement With these two strategies, the Sealem team is actively thinking about DeFi + Problems in the GameFi space, come up with various innovative product ideas to capture huge market gaps, run simulations to validate ideas, then build user-friendly innovative products to capture truly unsolved problem requirements.

How can I profit from Sealem?

For stakers, the main benefits come from asset price appreciation and supply growth. The protocol sells ST bonds (mints new tokens) when there is a healthy premium. The premium earned by the protocol will be distributed to stakers. Due to the nature of producing ST tokens, it is in the best interest of the protocol to ensure a healthy premium for ST tokens. The only way to guarantee a healthy premium is for the token to accumulate more assets to increase the intrinsic value of the token. Over time, the agreement will be adjusted according to policy to increase the ST floor price. The bill would reduce inflation of the total token supply while allowing protocols to buy back their own tokens, further reinforcing the idea of a rising price floor.

The main benefit for bond dealers comes from price consistency. Bondholders can invest capital up front and promise a fixed return at a set point in time; this return is given in ST tokens, so when the minted ST is completed, the bond dealer’s profit will depend on the ST price. With this in mind, minters benefit from the rising or static price of ST tokens.

The main income of players comes from the game itself. Players earn daily income and quarterly income by competing in the game.

The main way I profit from the ST protocol

The main way I profit from the ST protocol

Bonding: The ST protocol needs to purchase the assets required for its strategy, namely ST tokens. It does this by issuing bonds. When users buy bonds, they need to provide the tokens the protocol wants to provide ST liquidity. These may include tokens such as ST-BNB, ST-BUSD, ST-ETH, etc. When users buy bonds, ST tokens will be issued to users within a 14-day vesting period. Depending on the total liquidity, users will also receive different interest.

Staking: Staking is easy to understand, and most users in DEFI should know about it. This means staking your ST tokens in a pool that issues you SR tokens! The reason for this is that ST token holders earn "interest" while waiting for the price of their ST tokens to rise.

Price appreciation: This is the most direct. As with all investments, we want prices to appreciate. In this case, our goal is for ST tokens to appreciate in value due to multiple protocol reinvestment strategies. For users, just HODL ST and wait for the team to work their magic to build a proper Dex exchange fund, allowing the ecosystem value to increase over time.

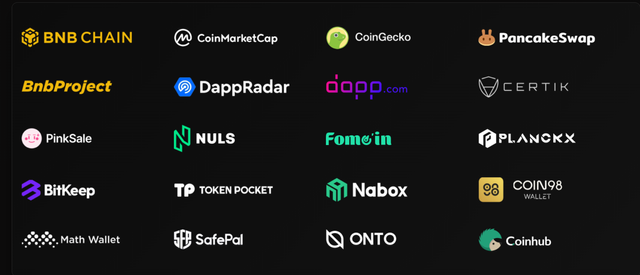

Partner

Conclusion

Conclusion

Making the results they provide unsustainable. SealemLab is looking for a way to communicate between functions. The need for a platform that provides companies with a streamlined, easy-to-use, secure end-to-end chat with lots of options is critical to communication. From innovative results-focused approaches to suburbs, create any real estate option for all appraisal firms to improve competitiveness. SealemLab is one of the pioneers in the word of mouth industry.

Website: https://sealemlab.com/#/home

Whitepaper: https://lab-sealem.gitbook.io/sealem-lab

Telegram: https://t.me/SealemGlobal

Twitter: https://twitter.com/SealemLab

Audit: https://www.certik.com/projects/sealem

Discord: https://discord.gg/5dC2cXcmtp

Facebook: https://www.facebook.com/Sealemlab

author : Godfrrey

Profile : https://bitcointalk.org/index.php?action=profile;u=3411047

BSC address : 0x2AD0358043A2313981139D06A49E3382C95a17e7