Why BitShares Need Sustainable Pricing?

Why BitShares Need Sustainable Pricing?

Revenue is the lifeblood of any business and without it businesses and organizations typically do not last long long. Newspapers are full of stories of businesses that have failed and gone under for various reasons. Bad pricing is one of those reasons.

BitShares does not have sustainable price. This has been established here.

https://steemit.com/bitshares/@clockwork/bitshares-fees-the-fee-schedule-and-dex-profitability

And in a startup organization this is ok for a while.

However, pricing is important. If an organization does not have a good pricing model it can take two or three failed tries to “get it right.” Each try can take 6 months to a year, to fully realize all the negatives and consequences and figure out how to adjust.

If a company charges too little, it can grow too slowly.

If a company charges too much customers will not be able to afford the product.

A company can also charge the wrong the wrong people, warping behaviours.

A company can charge the fees in the wrong way, promoting unwanted or unneeded behavior.

A company can try to charge too much for the wrong wrong product. Where the profit is captured is important. (For example most US gas stations do not make money on gas, they make most of the money on convenience store sales (ie. soda candy) the gas pumps bring in.)

This is why establishing the right pricing model is difficult, it is why company have specials, sales, clearance, and are constantly adjusting different pricing in different places.

Generally, you are not going to get it perfect, but over time, and with experience, pricing models get better and better.

So how does one establish a pricing model in a new category or for a new service. Well in short you look at the data and take and educated guess.

Every time you go into a restaurant and pay for a 4.99 sandwich, someone guessed that it should be that price. They could have priced it anywhere. This can seem really weird until you understand marketing.

That said, the first few things you need to look at is cost. How much does something cost to make? Then you need to look at what competitors are charging? And then you need to look at the alternatives. After you have done these things, you are ready to start taking an educated guess. Normally, It is worth doing this in several rounds. One wants to get quick ball park figures first, then as improve them with more rounds of more detailed analysis.

That said, I would like to add a little to BitShares discussion.

What is the the costs?

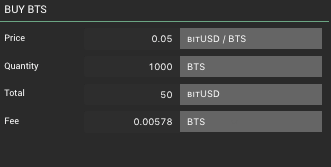

Currently BitShares has a daily budget of

287,975 BTS times $0.05 each is $14,000 a day or about $5.2 million a year.

BTS has recently dropped, these numbers may not be completely fair.

I believe BTS had 400,000 BTS available each day and an longer term average price of 10 cents per BTS may be more accurate.

It is really hard doing economic analysis in cryptocurrency because the numbers change so much. For that reason here is a little table showing some other numbers…

Table… BTS price and daily Budgets….

From past experience this summer I seem to recall that only about half of the daily budget was being utilized by worker proposals that were directly supporting development. One major worker was putting money into a CNY and USD market management account. At that time prices were higher and the 50% utilization would mean a core budget of $7 million a year.

I could go in all the worker proposals and add up USD expected costs… But that is too complicated for a first round of assessment. Lets just say we have a $6 million dollar core budget!

In the United States people cost about $100,000 a piece. That means a 6 million dollar budget gives us 60 people to hire to run BitShares.

(Now there are a ton of other factors to look at, health care costs, taxes, wages or each employee, but we are trying to get a very big picture here…)

I believe if you add up the number of people working BitShares, it is more like 20. Plus a lot of volunteers.

Now organizations like CryptoBridge and Open Ledger also have employees, they are not counted and that is a huge factor too, but let’s keep on track with a big picture.

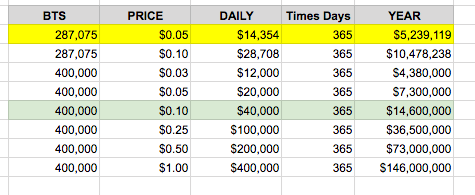

Now here is a chart of the daily transactions.

Source: https://www.cryptofresh.com/charts

On the chart, Ignore the big spike. That was a useless bot.

Ignore the recent drop. Transactions are down since the blockchain crashed last week.

Generally, in November 2018 there were 2 million transactions per day.

2,000,000 total transaction

1,000,000 limit orders put in

800,000 limit orders canceled

200,000 limit filled.

There are other fees as well

There are 500 accounts created daily.

There are 6,000 transfer transactions

A few <10 daily asset creations (actually a large source of revenue)

There are about 30 other fees of various sorts.

Now How many People are there on BitShares.

Well, while we have over 1,000,000 accounts only about 33,000 of them are real people active in the last month.

Look at my analysis here.

https://steemit.com/bitshares/@cryptick/bitshares-has-about-33-000-active-users

These numbers change. This analysis is a few months old. We are only trying to get into the ballpark so let’s just work with 50,000.

Great, we can finally take a stab at some numbers. If we have a 6 million dollar organization and we want to support 50,000 people how much do we need to charge per year?

That is easy… (finally)

$6,000,000 divided by 50,000 is $120 a year per account.

That could also be thought of as 33 cents a day.

That could be $10 a month.

OK

If we have 2 million transactions daily? How much do we need to charge per transactions?

OK first I assuming a transaction rate of 2 million (about what we see in November) for the whole year.

That is 730 million transactions a year.

Divided by a 6 million dollar budget.

That is .8 cents per a transaction.

Now Lets simplify that…

That is 1 penny per transaction.

OK Now lets talk about a few big factors…

This is charging every transaction the same price. This is not the case

Canceled transactions are refunded.

Lifetime members pay lower fees

The vast majority of transactions are done by bots.

(Which have or will get life-time memberships with 80% of fees back.)

The bottom line right now is it doesn’t pay to get a lifetime membership to save fees when fees are so low. (Another discussion we are avoiding for now.)

I know from past analysis that about 80% of all transactions are bots.

You will also note that about 80% of all transactions are canceled.

So if we look at the above number and just assume 100,000 filled transactions a day by full fee member. And divide it out. We get 36,000,000 million transactions a year and with a $6,000,000 budget we get $0.16 per transaction costs.

OK so we got a lot going on… However, our cost per transaction. Is somewhere in the area of 1 to 16 cents per transactions.

There are a lot of factors to consider. Let’s pause here. Yeah. We got solid numbers. Two ways.

If we charge annualy… 120 a year, 10 a month or 33 cents a day

If we charge by the transaction it is about 1 to 16 cents per transaction.

Now, There is another big elephant in the room we need to ignore:

Currently, there is an old referral system is place.

Of fees paid:

20% goes to the Network

30% goes to the referring lifetime member.

50% goes to register (aka open ledger/cryptobridge)

Let’s ignore this for now.

What do competitors Charge?

Alternatives:

Credit Cards

I did a bunch of research earlier on Credit Card Usages in the USA. Habits are significantly different in different countries. Nonetheless there was about a 3% fee on all money spent on a credit card transaction. That is about a $1.55 charge or a 55 dollar purchase.

Western Union

This is exorbitantly expensive. If you want to wire $100 internationally, I generally think it is going to cost $20 to $30 in fees.

Stock Brokers

These are very similar. A typical stock broker transaction has fees from $3 to $50 dollars. An active trader is going to pay $5 or less per transaction.

Other Crypto Exchanges.

Typically, it seems there is a 0.20% to a 0.5% commision on every trade. (Just an estimate from my experience.) Many of these centralized exchanges are actually cheaper than BTS because of the portal fees our assets have.

Bank Fees

Banks make most of their money by loaning out money you have deposited. Some banks change a $20 a month maintenance fees, many ATM’s have a $1 to $5 fee for withdrawing cash.

There seems to be a lot of room between one penny and general bank fees people pay everyday to find a happy middle ground.

Marketing Plan… Strategically low Prices

Currently, BTS has had low fees in an attempt to get widespread usage of the BitShares. This has been going on for a while. There are legitimate arguments to this, but I don’t think it is working. Let’s avoid that debate.

Portals.

Portals are very important partners. If or organization is going to succeed, it needs to make sure that everything is fair for everyone. This does not mean everyone will always be Happy. That is almost impossible. But it is important that whatever revenue model we have, we get it fair and straight.

How much money are the portals making?

Well they are doing OK.

If you go here.

https://www.cryptofresh.com/assets

You will see how much money is traded a day.

Unfortunately, with the crypto downturn these numbers have been dropping. This is bad. They are going to drop sende everything is denominated in USD. That said, Bridge.BTC has had 1 million dollars in volume over the last 24 hours. The first thing to do in divide the numbers in half. (When you trade BRIDGE.BTC for CNY it counts volume of both BRIDGE.BTC and CNY)

So $500,000 times 0.2% is $1,000 a day.

A quick way to estimate all fees it to look at the total volume ($1.8Million) and use fees (0.5%) on all of it. That is about $9,165 today or about $1.6 million a year. Earlier in the year these number were much better. Daily volumes were in the 10 million to 20 million range.

If it shows 2 million in daily volume.

That is 1 million of trading in each asset.

Most assets have a 0.5% fee from the portal.

That is a $5,000 a day. That would give about 1.8 million in revenue to all the portals.

I don’t know how many people it takes to run each portal. I heard CryptoBridge got started with like 5 guys part time, but then increased to a staff of 20 or something like that. I think Open Ledger was doing well for a while, but the hack and seems to have adversely affected the popularity. How many each of these employ, need to employ and at what costs? I don’t know. However, they are the primary beneficiaries of fees.

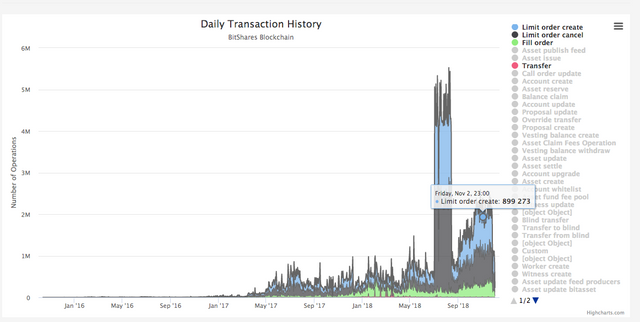

So lets look at one transaction.

How big is one transaction I averaged a few recent transactions and got quite a range of numbers. $72, $6, $16, $13, $98. Now with some the bots, they will make lots of small trades and that will seriously bring down the averages of the amount of money per transaction. Especially, when the bots run wild and put out lots of tiny transactions for days on end… (hey it happens…)

So if we go with $50 a nice number for an average trade. Right now there is a market fee of 0.2% (or 0.5%) on such assets as bridge.btc. Then there is the -effectively free BTS fee of .00578 BTS. Lets just run the math for perspective.

$50 Total Transaction

$0.10 (0.2% portal fee -aka cryptocbridge makes.)

.00578 BTS fee

BTS is at 5 cents. So that is 3 one hundredths of one cent.

Of that BTS the chain gets 20%.

So BTS gets $0.0000578 of a cent.

That is meaningless.

For every 178 trades that go though BTS -the blockchain gets 1 cent.

In other words, if BTS does the 730,000,000 million transactions (2 million a day) it earns about $42,000. Or about $115 a day.

That is not sustainable.

Now if we look at the total transaction fees.in order for BTS to earn 1 penny it has to do 178 trades. At that time the portal earns $17.80.

I can simplify this for practical purposes. BTS make no money, the porals make all the trading fees.

I am not begrudging the portals for having a logical fee program. I am saying we as a community have an unsustainable one.

Now if we take this knowledge back to the area above. Since BTS is only getting 20% of the portal fees, we need to raise the numbers above by a factor or 5.

That 1 cent for every transaction now newcomes $0.05

That 16 cents for filled transactions now becomes $0.80 per trade.

Yikes that is getting expensive.

(I don’t think fees should get that high…)

I should also note that with the current arrangement. No matter how big BTS gets, the various portals will always get 2.5 times more money. (They get 50% of the fees BTS gets 20%)

That means if we leave that portal system in place, the the portals will always control the blockchain. (Is this what we want?)

I expect lots of people to pick apart every number offered up here.

Let me beat you to it… Each number needs work.

I want an exact number of the number of manhours/people we have employed in Chain. I want true expenditure numbers, I want real numbers. It takes a lot of work. There seems to be a limited understanding of where the fees and money is going.

From a trader perspective, a commission of a few cents is not going to make a difference.

We also need to address other issues:

We need some advertising.

We need some scam prevention. (This hurts BTS reputation)

We need basic analysis of market position ect.

We need developers building the best technology and building real solutions and real adoption.

But again those are different posts.

There are a couple of other things to note:

Currently cryptobridge has bots, to make prices flashy. They have bots sending out order on some pairs that change the orders (typically down in the orderbook for some super tiny amount) This makes the screen blink as orders refresh. Blinky orders is one by other exchanges. I believe this has limited value, do we really want out blockchain filled with crap?

If wall street is going to get involved, they could love us. However, people will audit the blockchain and when all the activity is useless or fake, it is not beneficial. I don’t like wash trading and I don’t like useless orders. But that is my 0.02 cents.

So there are several things that could be done.

First hike the fees.

How high? 1-2-3 cents per transaction?

This is where the community discussion needs to take place.

I think we make an adjustment now, and then make another adjustment in 6 months.

I think one or two pennies a transaction is a reasonable first target.

Second

Look at the referral/affiliate system?

If it is not working, why don’t we kill it.

Third

What is our budget for the total organization?

Do we have the people where we need them?

How do we compare to other organizations?

I think this means we need moderated Telegram rooms.

I think this means we need advertising

-at least experiments now

-expand it later.

Are we building the features today we will need in the future?

At BitShares it may be tough with the price of BTS falling. Can we pull together as an organization? Can we build a team? Can we cooperate? Can we get more developers involved? Can we stop in incessant bickering? Can we build the future technology that is going to change the world?

When Henry Ford started selling automobiles he had to choose a price to sell them. The price needed to be high enough he could make money. The price needed to made low enough that people could buy them. The country desperately needed a car factory. America -desperately needed cars. Cars transformed America. It allowed people to get to work, work faster, work longer, and be more efficient. It transformed the American lifestyle, and allowed the the high standard of living we have today.

If Henry Ford mispriced cars, none of that would have happened. Now I am not saying Ford got every decision right -like all things it gets complicated. Now BTS has the ability to supply a better form of financial transactions to the whole world. If Visa and Master Card are horses, BTS is the automobile. If Visa and Mastercard are the post office, BTS is email.

BTS is faster, better and has a great future, but only if it can pull itself together and make smart decisions.

Don’t get me wrong there are 100 things that can go wrong. We need to worry about all of them. We can fight in our communities, we can have a reputation spoiled by too many scams, we can have a decentralized organization that is clueless about what is the right move forward. I will admit there are a lot of risks and frankly, they scare me. I have doubts, that BTS can do what it wants to do.

But Today, in this post. I have done a quick comparison on the pricing.

We need to have revenues so that we are making money.

We need to have a pricing model that works.

We need to have a pricing model that promotes the right behaviour.

I think the community wants to grow and see the blockchain succeed. It wants to be able to message to Mr. Fox saying. Hey, lets hire another 25 devs. The blockchain is making so much money we don’t know what to do with it.

BTS is a real project. Many of the fake projects out there will fade away with time. Many organizations have come bad from near dead status? Apple, was almost dead in the late 90’s. It reinvented itself. Look at what it is today.

So back to pricing.

Pricing matters. We need to get this right.

We need higher fees so there is more money in the core to pay for development.

We need to align all players incentives so that things work.

Bots won’t like the higher fees at first, they will adjust.

Thanks for Reading!

Many of the Bitshares core workers are listed here.

https://www.bitshares.foundation/worker/

I did some quick math and got to an annual number of $4.8 million. Lets call it $5 million. That makes my $6 million number, used in the analysis above pretty accurate. (Particularly, reflecting my opinion that we need more development.) There are other worker proposals that are not part of the BBF. (particularly, committee management of bitusd/bitcny which not development work and is big.)

Very late reply, but wanted to post.

I like the idea of fees supporting BitShares as a whole. One thing I don’t see you bring up is the refund workers. The refund workers effectively put back BTS that isn’t being used. I believe the refund400k worker is still voted in.

As far as comparing BitShares to other organizations, I also agree about the advertisement needing to be stepped up. I have been pushing different things to Twitter and drawing attention to them. I think some of the marketing efforts have to be done by the community as well.

Yeah, I agree refund workers are an issue as well. That is a separate issue. The refund worker stops work and sends money back into the general fund. This stops any worker proposal that does not meet minimum requirements. The problem is that everyone want a worker proposal to meet a very high standard, and then not pay for the costs of a high standards. Getting a worker proposal past, takes and enormous amount of effort about 160 hours of work. (If you have 10 people who all work 2 hours a week for two months). There are no guarantees. And everyone has different ideas on what to do.

So while it is good that refund workers can "stop" worker proposals that do not meet a threshold, it is so much more complicated. The Big Proxies, are all trying to run businesses and don't have unlimited time to look at this stuff. Small worker proposal almost never get approved. And even good worker proposals do not get approved without a massive marketing campaign. It is too hard to get attention. Not every issue, is going to be something to get people excited. Voting is like going to the polls, everyone wants to vote for president, but no one cares about the other races and issues. We need more low level engagement. We need more workers, we need things to get done. And many times there are things that are not going to get attention or raise money. These need to be done too. I mean if you are polling kids, who wants to eat birthday cake and who wants to exercise and you need to win a "political campaign" in order to get permission to do both, which one do you think wins? There are things that need to get done and are not popular. In the real business world, business people put together a budget that addresses everything. In BTS no one is paid to do that, and everyone is second guessing what everyone else does.

Again, very late reply (been on Steemit much less in the past months).

I agree, having small workers getting approved is a stumbling block I have encountered myself. And creating a proposal now is more expensive than it used to be. Smaller proposals often go unnoticed. That should change.

As far as the last sentence: “...everyone is second guessing what everyone else does.” I do not see it like that. The opposition that I see in the forums are genuine questions and concerns of those who have been around for a while. I like to think of them as elders. They have way more “wisdom” as far as the BTS ecosystem goes and more knowledge of what goes into a good worker.

Amazingly, this article is still spot on, 9 months later. BitShares still needs a more sustainable fee structure. A penny or a nickel per transaction would go a long way towards improvement.

Another great article on the subject.

https://steemit.com/bitshares/@clockwork/bitshares-fees-the-fee-schedule-and-dex-profitability

This article really hits the nail on the head, one of things I did not mention was that fact that having a non-profitable business model can effect business decisions. Let's take the simple example of opening up a restaurant. This is a simple business model for illustrative purposes. If you open the restaurant with a sustainable business model (~$5 to $10 bucks a meal in America), you get to make money and know you are helping people eat good food. Now if you open the restaurant and do not charge, you might still get people coming, but are you doing the right thing? You don't really know. Did you open the restaurant in the right place? Are you offering the right food? Do you have the right type of service? (Fast food or sit down) Are you offering the right things (coffee, donuts, ice cream, burgers ect) There is so much you need to know. One wants the restaurant to be successful, and customer feedback is very important. Maybe there is a better way to open a restaurant that uses less people (hot dog stand) and is faster. Yes, surveys can be done, questionaires can be sent out, but the results can be very different when actual money is on the line. This is one area where a pricing model can help out significantly. It can provide vital feedback. While I doubt that all the effort and work that went into creating BitShares is going to be for naught, there is a point where we really want to make sure the market really wants us and is willing to pay fees as appropriate.