Why Bitcoin Needs Fiat (And This Won't Change in 2018)

Tim Swanson is the executive of research at Post Oak Labs, a U.S.- based innovation warning firm, and the previous chief of research at disseminated record innovation consortium R3.

Envision a parallel universe in which the U.S. economy could just develop at $50 like clockwork creating a negligible $2.6 million of yield for each annum. That because of a hard-coded financial arranging PC program, at regular intervals the salary its tenants on the whole created separated fifty-fifty. With the end goal that in year nine, its yield shrank and was $12.50 at regular intervals or $657,000 a year.

In other words, regardless of how gainful and gifted the work drive progressed toward becoming or how vast the work compel developed, the profitable yield in the U.S stayed settled and static with the main change (descending for this situation) happening just once like clockwork.

What number of individuals would volunteer to live and work in that "Topsy turvy" world?

This circumstance successfully reflects the static, inner economy of bitcoin and numerous different cryptographic forms of money.

For example, with confirmation of-work systems like bitcoin, the peripheral profitability of work is zero. It doesn't make a difference what number of more units of work are added to the pay age (mining) process as the system will dependably deliver a similar measure of monetary yield.

Today, after almost nine years of operation, the bitcoin arrange – better alluded to as Bitcoinland – produces 12.5 bitcoins generally at regular intervals. Regardless of outside financial conditions, of interest, the Bitcoinland economy will create around 657,000 bitcoins every year in its third age.

While correlations with total estimations like GDP and cash supplies might be a flawed relationship, the way that financial development as estimated in yield can – except for a fork and manage change – never show signs of change in bitcoin because of its inelastic coin supply is seemingly adverse to its unit of record.

The deliberately arranged equivalence is regularly lauded as a "component not a bug," and numerous digital currency lovers get a kick out of the chance to wander off in fantasy land for when controllers and budgetary organizations of our own reality vanish, eaten up by dim goo nanites subsidized by bitcoins.

Be that as it may, before bitcoiners can achieve their Upside Down nirvana state, they have to determine the basic ubiquitous financial count challenge confronting their security framework and work drive.

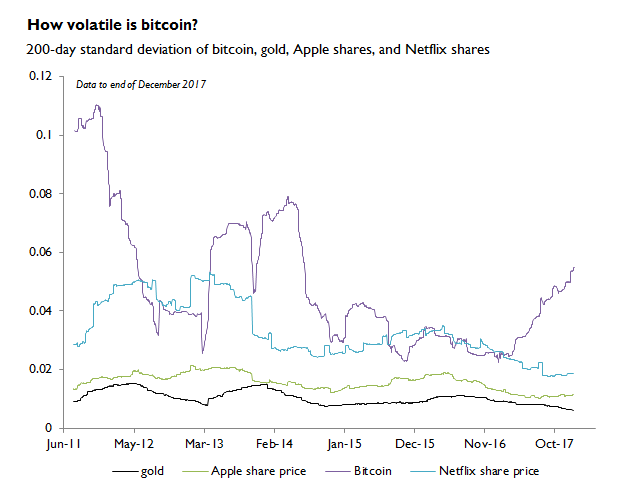

The marvel is easy to portray: for all intents and purposes no member in Bitcoinland conducts financial figurings, (for example, estimating) for any merchandise or administrations in digital forms of money, for example, bitcoin. There are many explanations behind this, including interminable unpredictability.