Chinese companies apply for bitcoin-ETFs, preparing for explosive growth in the cryptocurrency market

Apparently, there are many more incentives to increase the value of bitcoin here. And not just for no reason, but with the use of powerful resources.

Two of China's largest fund management companies filed applications to create bitcoin exchange-traded funds (ETFs) on Monday. Harvest Global Investments and Southern Fund are seeking approval from the Hong Kong Securities and Futures Commission (SFC) to launch spot bitcoin ETFs.

Harvest Fund, founded in 1999 (HGIUK), specializes in serving international clients, especially those investing in China.

In the context of a prolonged decline in the domestic fund market, HGIUK notes a surge in demand for international investment as Chinese investors seek more lucrative opportunities outside the country. It is also noted that another major player, Southern Fund (CSOP), is also applying for a spot bitcoin ETF. In addition, China Asset Management, also known as China AMC, is reportedly partnering with a Hong Kong-based cryptocurrency custodian.

Industry insiders expect Chinese bitcoin ETFs to receive approval by the second quarter of 2024. Southern Fund has already introduced Asia's first bitcoin futures-based ETF called the Southern Dongying Bitcoin Futures ETF.

A source close to Harvest Fund's strategic initiatives told local reporters, "We are also developing bitcoin businesses and launching related products in Hong Kong that are traded through our subsidiary's platform in Hong Kong, but they are not futures ETFs."

In addition, at the Hong Kong Web3 Carnival on April 6, 2024, Hong Kong regulators made it clear that they intend to actively support the industry.

Securities Times also reported that Hashkey Group, a comprehensive digital asset financial services provider in Asia, expects to make final announcements regarding the Hong Kong Bitcoin Spot ETF in the first half of this year.

For reference, Harvest Fund manages $121 billion in assets and Southern Asset Management has $285 billion under management. But these are just two funds whose applications for spot ETFs have come to light. In fact, there could be even more such funds.

In addition, the Chinese market now has favorable conditions for new investments. Over the past two years, China's stock market has experienced a significant crisis due to the withdrawal of money from U.S. investors fearing the outbreak of the Taiwan War.

Domestic investment in China is the second largest in the world after the U.S. market in terms of absolute volume. Now, investors who withdrew their funds from the Chinese stock market due to panic and fears for the national market are looking for a legal way to diversify their assets into promising assets, including cryptocurrencies, which are officially banned in China.

While the flow of funds into the bitcoin market from 11 U.S. ETFs has reached $100 billion in three months, Chinese investors, deprived of the ability to legally own bitcoin and worried about fears for the national stock market, can contribute much larger amounts to legitimate bitcoin ETFs.

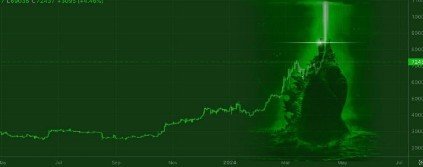

The red Chinese dragon is ready to awaken and actively participate in the creation of Godzilla's big green candle.