BTC – Elliott Wave, Price Targets, and Chart Patterns – PLUS: A Chart-Cast VIDEO overview!

…The Weekend Update

As promised in my previous “market related” post, (see link directly below), this may perhaps be the first installment of what (based upon your collective responses) may become a weekly endeavor of mine – and yours!

https://steemit.com/bitcoin/@passion-ground/modified-btc-wave-count-or-plus-elliott-waves-and-music-two-of-my-favorite-things

At present, I tentatively plan to format these “Weekend Updates” in a fairly consistent manner by providing three charts of BTC, (Long-Term, Medium-Term, and Short-Term) followed by a Chart-Cast video, which shall review all of the relevant perspectives contained therein.

The Chart-Cast videos provided will explain each of the charts and my thoughts regarding such in far more detail than my brief written summaries can otherwise furnish. So let’s get on with it, shall we?

…Maiden Weekly Summary

Shortly following the recent and rather swift 70% decline in the perceived value of bitcoin, the legacy (mainstream) financial markets concurrently encountered a bit of long-overdue, and a well-deserved measure of natural turbulence of the bearish kind.

How each of these recent market shocks shall affect future values over the near and intermediate terms is of major interest, however, the plausible outcomes of such remain extremely elusive to the most casual of observers.

By the way, toward the end of this presentation, I’ll be providing a complete visual history of all the major “crashes” that occurred throughout BTC’s history to date.

One way in which to best anticipate such future outcomes is to employ a solid framework of technical analysis, which studies and assesses past price behaviors and patterns in order to project what is most likely to occur, - or stated in another way, to provide a future window of what can possibly take place as the future course of price action as it unfolds in real-time, on a month-to-month, week-to-week, day-to-day, and hourly basis.

…The Word on the Street

In reviewing the battery of websites, podcasts, and YouTube channels I’ve been visiting regularly throughout the years, I found it rather ironic how each camp, the “legacy financial camp,” and the “crypto camp” each were respectively pointing their quintessential “Ponzi scheme” fingers at one another.

What’s most frightening to me is that both camps may well be correct in such assertions for a myriad of reasons, which I will refrain from delving into at this particular time.

Amid my regular and usual spin around the mainstream and alternative financial universe, one quite interesting aspect of the “crypto realm” struck a rather sour note deep inside of me. Namely, that it is extremely difficult to “short” these markets, and as well, that it is somewhat difficult to extract one's funds from these various entities in kind.

Markets that do not accommodate investors and/or traders ability to adequately express their opposing market viewpoints or enable them to “make liquid” their investments in such instruments - are profound and intractable flaws with potentially dire consequences.

Be that as it may, many of the “legacy” online broker powerhouses such as “Fidelity Investments” had their “online trading sites” frozen for a couple of hours during the height of the recent “legacy” market turmoil. Yeah, those couple of hours sucked! One could not access their accounts to place orders to ‘buy or sell” – and were virtually disbanded (albeit temporarily) from controlling their own financial interests and destinies.

Granted, those few hours of legacy darkness was nothing in comparison to the sheer absurdity, which takes place amid the crypto realm, whereby completely unaccountable and “support-less” exchanges and services such as Coinbase and Binance simply go dark for days or hours on end with no recourse – not to mention the hacking and outright fraud that has been documented clearly within this new “Wild-West” crypto realm.

I mean, geez, it’s almost impossible for the average person to even open up a crypto account for f%&ck’s sake! So many venues such as Bittrex have suspended new registrations until further notice. Such reflexive industry postures do not sit well with the masses of potential customers – not in the least, my good friends!

These are not good signs at all, folks. The foul taste left by this new “Wild-West” of decentralization, though welcomed on one front, is forcing big players within the space to embrace such backward and self-destructive practices, leaving much to be desired for the foreseeable future – so far as the “average Joe” is concerned, anyway.

If the crypto realm is ever going to capture the hearts and minds of the masses in a meaningful and sustainable way, things are going to have to change in a rather substantial way – and soon, or this space risks perpetual dissension on a massive scale.

I mean, come on - most people have a hard enough time navigating the effective use of “PayPal for gosh sake! Until the crypto world (at the very least), becomes as easy and user-friendly to use and navigate as ‘PayPal” or “Amazon,” its long-term future prospects as a viable alternative to its natural born first cousin, the ongoing “Fiat Ponzi”, shall remain rather tentative and questionable by every possible metric of measure of long-term viability.

Okay, so enough of my ranting and raving. Let’s move onto the immediate business at hand, shall we? So, what the heck is going on with BTC???

Right-click images and open in new tab to view at full size.

…Long-Term Perspective

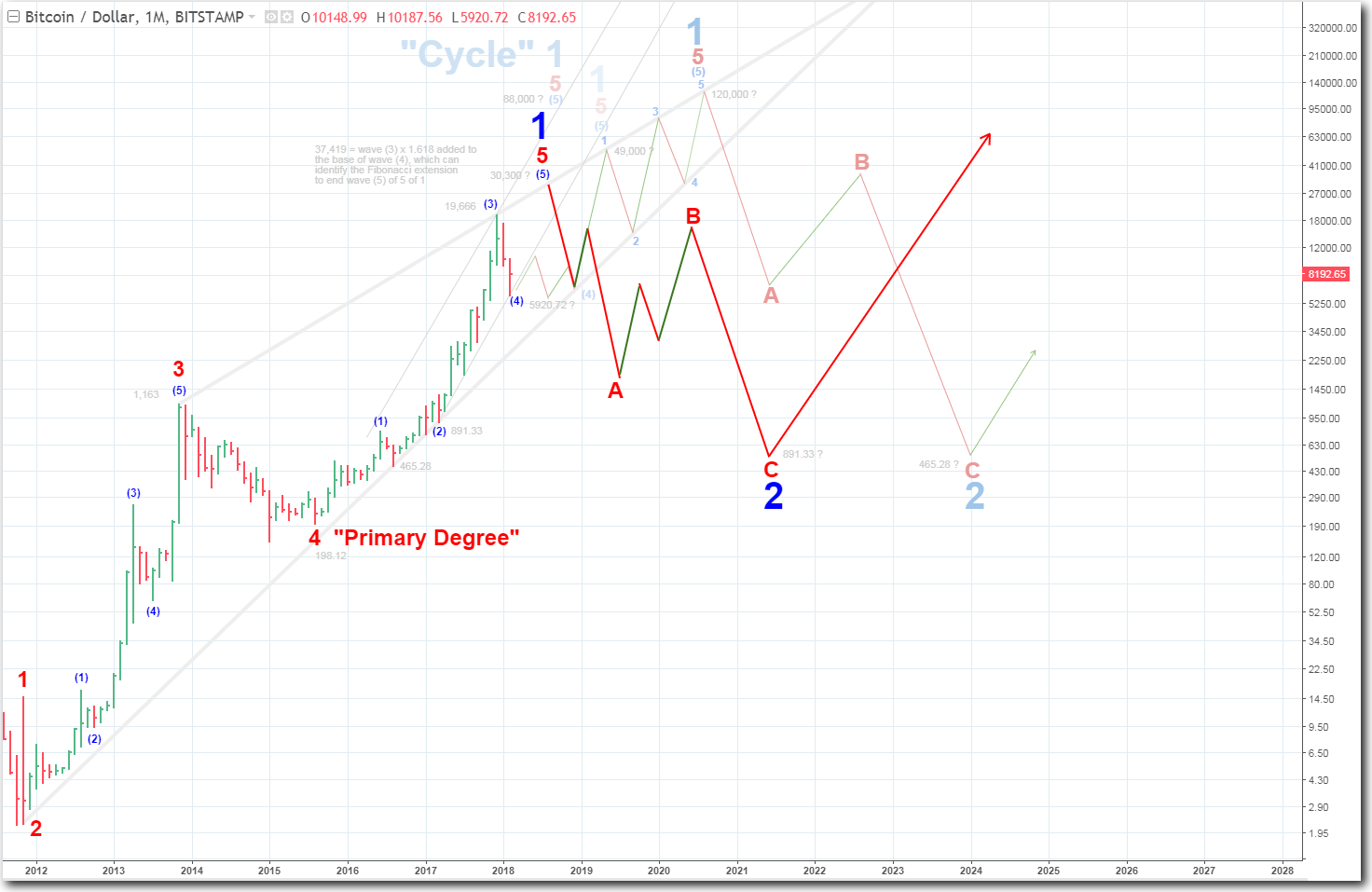

Okay, so after a further in-depth review, I’ve come up with this long-term logarithmic perspective of BTC insofar as the classic tenets of the “Elliott Wave Principle” are concerned. Do click on the “Chart-Cast Video” at the bottom of this post for further clarification, price targets, and forward-looking insights.

…Mid-Term Outlook

Stepping down one-step further (insofar as “timeframes” are concerned), from the longer-term monthly bars toward a more “near-term” perspective of the price action from an “Elliott Wave” / “@passion-ground” perspective – I present to you my “daily” linear chart of the “Wild-West” market otherwise known as BTC.

Yeah, man! There is a good case to be made for a meaningful and lasting low at the recent (70% decline) print low of $5920. For a more detailed analysis as to the aforementioned, do take the time required to check out the complimentary “Chart-Cast” video provided at the bottom of this post.

…Short-Term Viewpoints

So here is the intra-day “hourly” bar chart of BTC. Yeah, it’s cool and all; however, the closer one gets to charting in “real-time,” the harder it becomes to evaluate the true intent of the actual price action. I mean, everything is subject to change on a moment’s notice! So please, do keep that in mind when digesting the data and the respective forecasts set forth herein with regard to such.

Insofar as my hourly assessments are concerned, BTC appears to be exhibiting a bullish stance relative to its recent print lows. See the “Chart-Cast Video” directly below for further clarification.

…Chart-Cast Video

For best clarity, set to HD and view in full-screen mode.

In closing, it is my hope that this “Weekend Update” provides a meaningful assessment of the recent price action along with viable prospects for several price paths going forward.

So far as I can tell, this most recent 70% decline marks the third largest amongst the plethora of price smashes this virtual currency has undertaken thus far.

What this means, or implies - is anyone’s guess. As “no one” truly knows what the future specifically holds. All we have to base our understanding of such prospects emanates from the past, which perhaps - may or may not lend itself to accurately uncloaking the future course of things to come.

All such prospects shall remain within the hands of the “whales,” “movers and shakers,” and not in the hands of your every-day average “Joe’s.” Until the blockchain becomes user-friendly for widespread adoption, the long-term sustainability and prospect of Crypto-Currencies” and “Smart Contracts” becoming permanent and reliable fixtures within the average person's day-to-day economic life shall remain somewhat tentative.

Until next time,

sincerely appreciate your insight and analysis, @passion-ground. Do agree that blockchain could benefit from more user-friendly transaction methodologies - easier ins and outs. blockchain users will endure growing pains in the meantime... Who knows, Steemit transaction speed and ease may have potential within that arena...

Your comment and insights are greatly appreciated, Randy! Thank you!

Great stuff.

I cannot imagine though that we will breach the ath and then only go up to 25 or 27k i feel we would more likely go towards a 5-20x increase from.

Very i teresting will be if btc stay dominant, as if not everything may change.

Thank you for your comment and insights @knircky!

I feel the same way. only time will tell :)

Great idea to do this on a weekly basis. Would love to also include you in my overview (maybe you have seen that I am doing a daily) - have to figure out anyway how I can honor the different perspectives of the analysts better.

Yes, I just checked out your post on the topic! Great job in giving credence to the various perspectives of respected analysts here on Steemit! Thank you for considering including me in such a line-up, and thank you for your support and re-steem, my brother!

Great post man, in my opinion your chart patterns analysis are top-best in the steemit community.

Thank you, @paplob! I am honored that you are of such opinion! :-)

Great post, keep them coming! Finally got around to watching the video and it was well worth it. I will be looking forward to the weekend. Maybe there will be some excitement by then.

Thanks, man, glad you enjoyed it!

Thanks for a great couple of posts on bitcoin. I’ve learned so much about EW theory through them. Question is what gives you confidence towards your primary count vs the alternatives? Experience, intuition? Thanks

Thanks for your comment @kywt! To answer your question: It's probably an intuitive "bias" to be quite honest. Another factor in selecting a "preferred" count (for me) is if it is in general keeping with the largest of long-term trends, which in this case remains bullish - for now. In truth, if one is careful enough, both the "biased" preferred and the alternate counts should convey a virtually equal confidence in plausible outcomes. I hope that helped.

Yes, very helpful. Thank you! Does fundamentals/headlines ever play into your “bias” when choosing the primary count or do you blank it out as best as possible and let the chart speak for itself? Also safe to assume, you have a long bias toward bitcoin?

In theory, all of the headlines and fundamentals are already factored into market prices. As such, the charts pretty much rule. Although I do not have a position, yes, I have a bullish bias in bitcoin simply based solely upon the long-term price action to date.

Thanks again for your time and response. Your initial blog got me interested in your alert services. I’ll be signing up for a month trial!

Great! Look forward to having you!