The injective protocol as a public utility and Future Exchange Facilitate

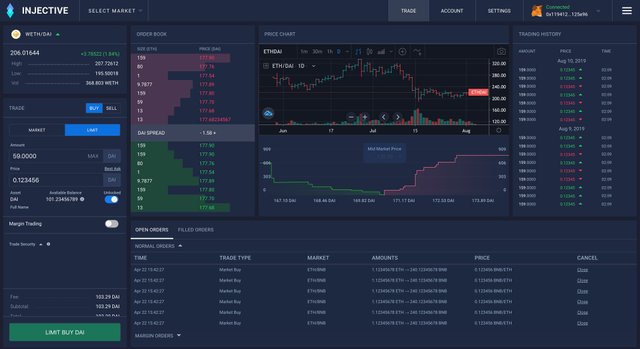

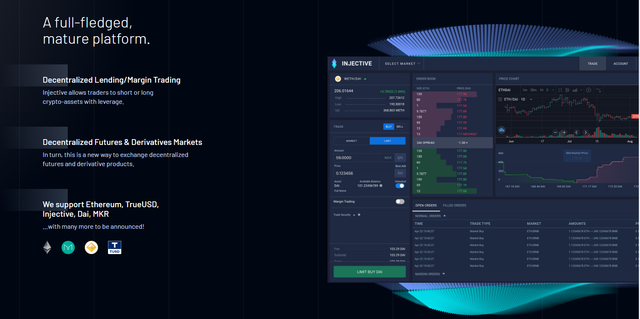

The injective protocol is an integral "evidence" of Injective. It is an open protocol that helps the enchancment of open derivatives markets. It is moreover the world's first thoroughly decentralized P2P futures and perpetual swap contracts exchange, which helps effortless get admission to to extra than a few markets.

According to the team, in distinction with specific merchandise of the same type, Injective is the fastest, absolutely decentralized derivatives shopping for and promoting platform barring fuel charges in the Defi market.

Based on the Injective chain, Injective's shopping for and promoting platform has moreover carried out a definitely open-source design, which approves it to be a certainly decentralized network.

It moreover gives a market-maker exceptional API interface, which is shut to the contemporary mainstream exchange interface, enabling the individual time out to be similar to that of a centralized exchange. Additionally, in the management.

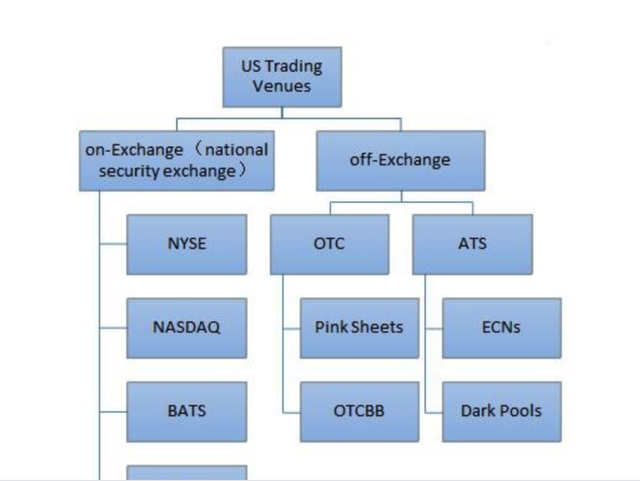

The enchancment and modern-day popularity of traditional exchanges

An change is a shopping for and promoting platform with severa products, which affords charge discovery and liquidity for traded products. Technological traits have facilitated and effected moreover the business organization model and infrastructure of the exchanges.

Not many human beings stand in offline market areas and shout out the charges of their objects to entice customers nowadays, alternatively try to get their objects provided via digital shopping for and promoting systems. In phrases of the agency model, most exchanges in Europe and the United States have lengthy long past from membership-based to form for-profit companies.

As the hub of financial activities, the enchancment of exchanges is carefully affected via the use of regulatory policies. However, as technological understanding develops, insurance policies loosen, and employer competitions carry on, Alternative Trading System has emerged thinking about the reality that 1990 in the US Multilateral Trading Facility, which include flexibility and range to the financial world.

Internet finance and the digital age

In this century, human civilizations have made full-size increase in digitizations. In actually two decades, the internet has lengthy previous by means of three ages: the age of the portal, the age of search/social, and the age of the internet. The continuous enchancment of the internet has altered and revolutionized the procedures that human beings think, behave, and interact.

Now as "data" continues to evolve as it receives produced, stored, organized, and utilized on higher levels, we commence to see a new system with new insurance policies slowly penetrating and seizing our world, that greater justice, fairness, price accruals, and distributions have been demanded thru all.

Given the above, that is why we are witnessing the "decentralization" of matters taking place and being facilitated increased passionately than ever via way of the general populace.

Now as things and people get linked and built-in into an "unseen network," the characteristics of blockchain decentralization or on the different hand you identify it, have come to be rather incentivizing for human beings to act and innovate upon.

Specifically, works have been accomplished on all layers of the internet from, again, records productions, storage, to functions (dApps), and of route alongside with all the upgrades come with cutting-edge company fashions and even "token economies."

Among the severa features of blockchain technologies, Defi, or decentralized finance has been one of the most hyped these days given the room of creativeness and schemes like liquidity mining.

Traditionally even even even though we did see the extend of internet finance in the preceding years ranging from payments, crowdfunding, neo-banks, P2P lending and more, however, non has furnished the trendy anticipation of "evolution" then again as a replacement virtually "iteration," as they did now now not alternate the guidelines and systems.

Decentralized Exchange utility works

With the improvement of blockchain science and the emergence of greater public blockchains, there are now a vary of decentralized exchanges. DEXes are remarkable due to the reality of the severa public blockchains they are primarily based absolutely on and their respective thoughts and technologies. Here we totally discuss about the decentralized exchanges about the everyday traits.

One of the key factors of decentralized exchanges is that the alternate money owed equate to smart contract accounts. In brief, storing property on DEX is to shop them in smart contracts which is to hold them in codes, and in codes you trust.

Generally, most DEXes will completely ask for registration some even require KYC, and it has been criticized for a platform to title itself a DEX at the equal time as asking for KYC and to deposit, withdraw, and trade:

Deposit

you financial savings by using transferring your assets into the wise contract address assigned to you by means of ability of the platform.Withdraw

withdraw from someplace at once from the smart contract address.Trading

your asset is transferred from the sensible contract address right away to that of your counterparty. This change can be checked on the blockchain by means of the blockchain browser, and the complete change approach relies upon on the smart contract's computerized execution by means of codes.

The increase of exchanges exceptionally based totally on blockchain technology

With the software program of blockchain technological information in asset tokenization and the shopping for and promoting of it, many digital asset exchanges have emerged, such as Binance, Coinbase, Bitmex, etc. These acquainted exchanges are moreover categorised as centralized exchanges in the blockchain and digital asset industry.

Centralized exchanges, as the title suggests, ability that the property deposited via the clients are saved in the hands of the exchange owners, and matching of trades and even fees of merchandise are trouble to centralized controls operated on centralized servers. In unique words, we, as users, do the entire component on the platform primarily based absolutely on our accept as true with in the team and agency strolling it.

In comparison, the essence of decentralized exchanges is to allow clients property to be under decentralized custody, with every transaction record saved on the blockchain giving transparency and traceability. Simply put, this whole decentralization is supposed to stop malicious human behaviors and to facilitate clients to trust in codes and science then again of special human beings. Let's probe in addition in details:

DEXes can be in a similar way divided into two focuses: spot and spinoff markets. Most of the DEXes in existence focuses on the spot markets, and are now now not many derivatives DEXes given the complexity of financial designs enchancment workloads.

However it has develop to be palpably clear that derivatives markets have grown exponentially in the digital asset domain, and we are already seeing the subsequent

boom coming from derivatives trading. Few sturdy contenders that have emerged in 2020 embody Injective Protocol, DerivaDEX, and Serum. Here let's find out Injective Protocol, which will be launched in August.

To get to the backside of general troubles confronted by using the use of DEXes such as user-friendliness, speed, and more, the Injective Protocol proposes a world solution: Injective chain, Injective derivatives protocol, and Injective DEX.

Official Website: https://injectiveprotocol.com

Bounty Link : https://bitcointalk.org/index.php?topic=5256993

Telegram: https://t.me/joininjective

Whitepaper Link: https://docsend.com/view/zdj4n2d

Github: github.com/InjectiveLabs

Twitter: https://www.twitter.com/@InjectiveLabs

Reddit: https://www.reddit.com/r/injective