BTC It's also over $8,000, What's the difference between 2017 and 2019?

In November 2017, bitcoin crossed the $8,000 mark. Three weeks later, the price of the currency jumped 150 percent to its highest level ever.Today, the price of bitcoin is soaring above $8,000 again, but it has changed a lot since 2017.

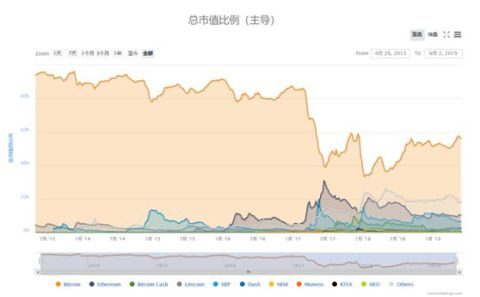

1.Market share

On November 25, 2017, bitcoin reached $8,000, accounting for 52% of the total market value of all cryptocurrencies.

On May 15, 2019, bitcoin topped $8,000 again, increasing its share of the cryptocurrency market to more than 57 percent.

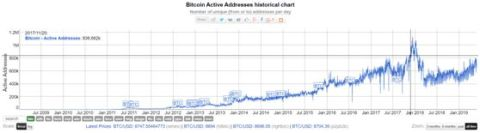

2.Daily amount paid on the chain

On November 25, 2017, 838,000 bitcoin addresses were active, and 336,000 transactions took place that day.

On May 15, 2019, 367,000 transactions took place at 726,000 active bitcoin addresses.This indicates an increase in the number of transactions on the chain, but a decrease in the number of active addresses.

After a year and a half, the reason why more and more addresses become "silent addresses" is on the one hand due to the increase of the number of bitcoin Hodl, on the other hand is the loss of bitcoin wallet and private key.The increase in the number of transactions on the chain also represents the increased liquidity of bitcoin to some extent.

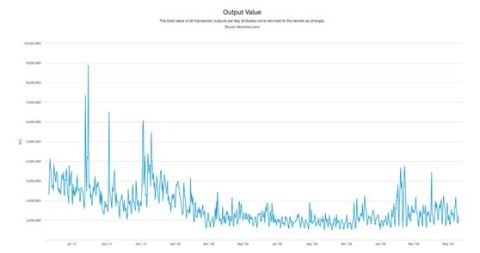

3.The daily output of bitcoin

Another indicator of bitcoin's performance is its daily output.

Typically, each bitcoin takes an input and produces an output, and the output helps analysts determine when and how much of it is in HODL's hands.If the daily output of bitcoin continues to decline, then trading activity has returned to life, and vice versa.

A year and a half ago, the daily output of bitcoin was around 865,000, and 2.9 million bitcoins were traded every day.While production is now up by about 128,000 a day, fewer bitcoins are being traded -- just 1.7 million of them.

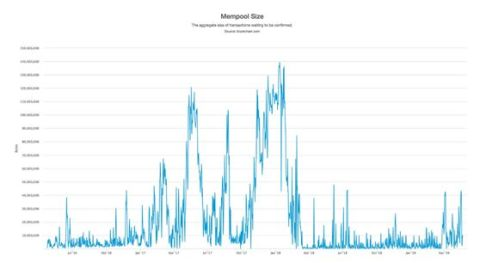

Bitcoin memory pool size

We know that to complete a bitcoin transaction, it must be verified by all the nodes.The higher the transaction fee, the more likely it is that a miner will be given priority, and the lower the transaction fee, the more likely it is that miners will wait to process the transaction, which will be temporarily stored in the bitcoin mempool.

At the end of 2017, the number of bitcoin transactions exploded, flooding its memory pool with thousands of transactions waiting to be processed and sending transaction fees soaring.On November 25, 2017, the total size of the memory pool reached 58 million bytes.

Since then, several off-chain and off-chain solutions have been proposed to improve bitcoin's ability to handle transactions.Today, the memory pool is only 7.7 megabytes, down 87 percent from its peak.

Since 2017, three technologies have been developed to lower transaction fees and speed up transactions:

Batch processing (combining several transactions into one bundle) can reduce the total number of transactions in the bitcoin chain and reduce network congestion.Generally, exchanges and mining pools are used more.

Isolation witness was added to bitcoin in August 2017 via soft forking.Isolation witness is to take out the digital signature information within the block, so that each block can carry more transactions, so as to achieve the purpose of capacity expansion.

The lightning network, which puts transactions outside the bitcoin blockchain, aims to expand the bitcoin trading capacity.First proposed in 2016, it is now being used on a small scale.People can use the lightning network to create countless transactions before settling, without having to upload information to the blockchain.

A year and a half ago, the cost per transaction was about 147 to 230 gigabytes, or $3 to $5.When bitcoin went up to $199, the cost per transaction went up to $50.

Over time, as different solutions have been rolled out, bitcoin's transaction costs have steadily fallen.Currently, each order costs only 44 to 87 gigabytes, or $0.82 to $1.60.

From 2017 to 2019, it is not hard to find that bitcoin has become faster to trade, cheaper to trade, and the overall network has become more secure. It can be said that bitcoin has become increasingly close to satoshi nakamoto's vision of "peer-to-peer electronic cash".