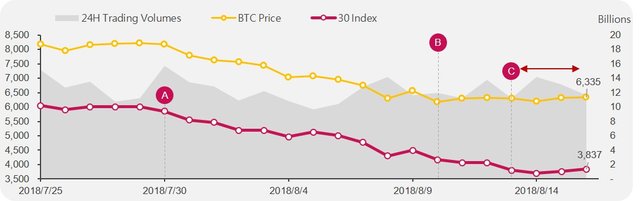

[Weekly Roundup] SEC’s delayed bitcoin ETFs approval fuels the market fears and BTC dominance for hedging, causing altcoins to plummet.

Most market capitals moved to BTC for hedging purposes to cause the altcoins collapsing.

The plummet of coin prices makes an excellent excuse for exchanges such as OKEx to delist over 100 cryptocurrencies. In fear of losing funding, The ICO teams sold their tokens and dumped their ETH.

The cryptomarket performance was disappointing in the past week. The main reason is SEC postponed the approval announcements for several bitcoin ETF to September or even February in 2019. According to the applications submitted to SEC, our research teams believe it still bears huge difficulties for the applicants to convince SEC on the issue of price manipulation. Therefore, we expect bitcoin ETF won’t be approved in September. It’s devastating for the market suffering from the capital outflows. Because of these negative factors, most investors moved their capital to BTC for hedging and caused the altcoins, especially those small-cap coins, to plummet.

Consequently, this created an excellent excuse to clear the listed coins for those exchanges which are suffering from the mess of hundreds of worthless altcoins. For example, one of the biggest exchanges, OKEx announced to delist over 100 altcoins. When the ICO teams find their tokens are going to be worthless due to the delisting, it’s urgent for them to dump their tokens to the markets and sold their ETH to the markets for operation funding at zero cost. This movement hugely hurts ETH’s price and boost BTC dominance. Ethereum platform surged as the second largest coins by attracting many ICO projects but also fell due to ICO project’s sell-off in 2018. The lowest price is down at $250.

A: July 30, SEC’s delayed approval for bitcoin ETFs

SEC delayed its approval for the application of SolidX-VanEck bitcoin ETFs to September, 30. There are bitcoin ETFs during the SEC reviewing process, and SolidX-VanEck is the only bitcoin-settled ETF. The others are all non-settled bitcoin ETFs.

The SEC schedule shows the deadline for a decision on two funds from ProShares is August 23, is just over two weeks away. Starting on September 15, the date by which two funds by GraniteShares will receive a thumbs-up or thumbs-down. The funds were initially proposed on January 5. The deadline for Direxion's four funds is September 21, as indicated by public records, after being first submitted on January 4. As CoinDesk reported, the SEC punted its decision on the SolidX-VanEck proposal to September 30.

B: August 10, OKEx announced to delist more than 100 cryptos.

One of the biggest crypto exchanges, OKEx, decided to remove more than 100 cryptocurrencies from its systems. For those exchanges management teams, it’s meaningless to keep those items with low trading volumes. By removing those items, more blockchain projects can be introduced to attract more users and trading volumes.

C: August 13, ICO teams dumped ETH.

After OKEx’s delisting announcement, the market rumor said many exchanges are planning to follow this delisting policy for long-term profits. For example, Huobi is also planning to clean out some small-cap cryptocurrencies with low liquidity. Many ICO teams are in fear of losing operation funding due to the shrink of their token’s market capitalization. To secure their funding, they chose to sell off their tokens and ETH. Accordingly, the market collapsed.

It will take a long time for the market to recover from the bear market. Those worthless coins will vanish to boost investors back to the real business application.

The regulatory risks still played an important role in this week’s market. SEC’s decisions on the delay of its bitcoin ETF approval raised significant concerns for many cryptocurrency investors who hedged the risks by moving to BTC or cash out directly. Seeing the price downwards, exchanges are planning to suspend small-cap cryptos trading to reorganize their product lines such as OKEx and Huobi. The market also has its rumors that many exchanges are considering the delisting strategies. As we mentioned above, the ICO teams would, therefore, dump their tokens and ETH for immediate cash-out. The fears spread until the market gained a decent recovery on August 16.

When the speculation is decreasing in cryptomarket, investors will come back to examine each coin’s potential business application and technical value. However, the market capitalization is currently not equal to its realized value. There are two scenarios for the cryptomarket to gain its great recovery. In the first scenario, the blockchain technology needs to solve current technical problems and generate the real business application value by getting wide adoptions. By doing this, both crypto investors and traditional investors will be attracted to invest their capital in this market again.

Consequently, ICO markets will enjoy a positive growth by having more potential projects. Secondly, SEC’s approval on bitcoin ETF is another way to boost more speculation by introducing traditional capital to the crypto market. However, we don’t expect there would be billions of dollars coming to the cryptomarket if ETFs are approved. The bitcoin ETFs are just another stimulant for more speculation. The real market players are those old crypto investors instead of traditional institutional money. If so, only those largest coins can be benefited by the ETF approval. Those altcoins would still vanish in this market.