The crypto rout is nothing to do with whales or dumping and everything to do with the politics of the USD.

A common complaint I hear on facebook regarding the crypto rout is... "WHO'S DUMPING??!".

The actual truth of the matter is... "Nobody that's who".

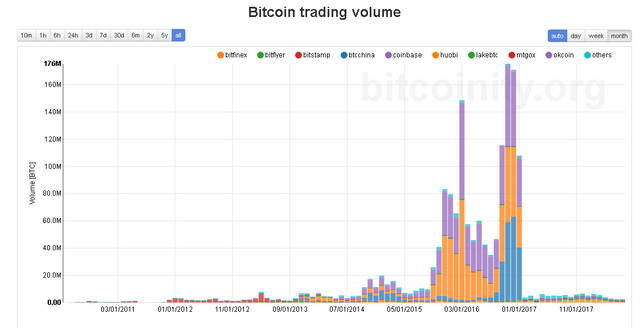

Lets get into this. Here is the global Bitcoin Trading Volume from Bitcoinity.

This lists aggregated historical volume from a selection of exchanges including Bitfinex, Bitflyer, Bitstamp, BTCChina, Coinbase, Huobi, LakeBTC, the old MTGox site, OKCoin and others.

As you can see, trade volume here is effectively zip. It's lower than it was in some parts of 2012.

This would seem to preclude the possibility of dumps on-exchange.

Now it is of course entirely possible that people are dumping on P2P sites and such but so far I haven't seen very much evidence of this.

So, without supply-side dumping to blame for the rout. Where do we look?

The answer is actually not in Bitcoin, but in the USD.

Here is a 1w chart of the USD Futures Index

A couple of interesting points here.

Firstly I would say that although a depression or a boom or a recession or a "golden era" seem like a long time when viewed in isolation that they can never be separated from the macrotrend or the overal trend of an assets' price.

In the case of the USD Index, we can note that the "great recession years" effectively form inverted head-n-shoulders formation giving a triple-bottom here at point A

You'll notice that this formation itself was a result of the fallout from the Dotcom Bubble collapse highlighted in figure B after the head n shoulders formation concluded in figure C.

C led to B led to A.

Figure A, of course, leads very neatly to where we are today and the huge dollar rally that is still in progress.

This was instigated by the Federal Reserve tapering off QE, and their ongoing effort to drain dollar liquidity from the global financial system overall. This in itself helped crash Brent Oil and is a vast unprecedented experiement leading to even more unusual unforeseen effects as this push continues.

This alone, brings us to the recent crypto market crash.

Now of course as shown by my volume chart earlier, there is actually very little volume being dumped through exchanges (though as evidenced in a previous article P2P and OTC volumes are much much healthier).

So of course it is debatable whether the volume along can sustain such a huge crash.

In fact, what I would suggest, is that what we are seeing is the very real effect of dollar price appreciation upon the cryptocurrency markets.

Here is the USD Index overlaid onto a BTC/USD chart.

As you can see, the diving BTC price has coincided with the rallying dollar very neatly.

So of course my argument here is that what's going on in the markets is much less about whales and dumping, and far more about the value of USD, and of course the politics of USD that may cause many more upsets down the road.

The good news is that the rout has little to do with the worthiness of crypto and very little to do even with the sentiment of crypto buyers and sellers. This should mean that the markets return to normal as soon as the dollar and the politics and performance of the dollar does. Hence why I'm hodling.

Watch out for my next piece on why the dollar rally could cause more upsets yet.