2/9 BTC Daily Report

Bitcoin's weekly chart has been consolidating for two weeks. After a sharp rise, the recent weekly K-line completely engulfed the previous one, forming a solid candle with no shadows, which is not a good sign. We can see it this way:

After breaking through the midline of the descending channel at $61,000 and several key levels around $59,500, a strong resistance has formed. Unless it recovers above the critical $61,000 level after the weekly close, which I believe is very difficult, we need to be cautious of a potential retest after a rebound this week.

When approaching key levels like $59,500 or the midline of the descending channel, be cautious of a long upper shadow or continued decline after resistance. At this point, I will pay close attention to Friday's non-farm payroll data and the unemployment rate announcement. Before the FOMC meeting on September 18th, next Wednesday's CPI and other crucial economic data will also be released. Therefore, be very mindful of market volatility and short-term reversals. Historically, volatility tends to increase as the U.S. presidential election in November approaches.

We can see the dense trading area on the daily chart. After briefly consolidating over the weekend, it sharply fell below the $59,000 POC line before the weekly close, reaching the VAL area around $57,500. After failing to rebound on the 30th and filling the upper CME gap, it is currently consolidating narrowly around the POC. Unless it recovers above $61,000, we should be cautious of a rebound or brief consolidation after a decline, without overinterpreting it. I believe it may continue to test lower after briefly consolidating over the weekend and breaking the POC. The first levels to watch are around $57,500 and the crucial $54,000-$55,000 range.

After the weekend consolidation, we can see that the 4-hour chart sharply fell before the weekly close, reaching the end of the VAL line. We can see a weak situation with a decline, consolidation, and another decline.

Besides focusing on the $54,000-$55,000 range, if there is support and brief consolidation around the VAL, Friday's economic data release could be a positive catalyst for a rebound. I will be cautious of a lower high after a gradual decline, leading to another retest after a brief rally.

Connecting the highs and lows, we can see a clear descending channel.

Next, let's look at the funding rates. After the weekend consolidation and decline, the funding rates have been continuously decreasing, reaching very low levels.

Recently, low or even negative funding rates have become more frequent, even during rallies. The market has been shaken to the point of losing confidence and becoming very pessimistic.

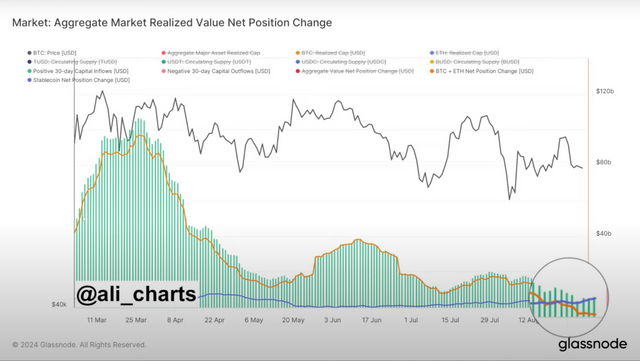

We can see from the chart that the blue and orange lines represent the net position changes in the Bitcoin and ETH markets and the Stablecoin positions, respectively.

The higher of the orange line, the more funds are flowing into the market at that time.

From the peak of $74,000 to the past few weeks, the funds flowing into Bitcoin have been significantly higher than those flowing into Stablecoins, both during rallies and declines.

However, after three waves of shakeouts, the inflows have gradually decreased, and in the past couple of weeks, there has been a reversal. Now, the funds flowing into Stablecoins are higher than those into Bitcoin. This indicates that after three shakeouts, the market has completely cooled down, and there are fewer bottom-fishers compared to previous times.

I believe this signifies the end of the capital convergence at the market's peak.

In the next couple of months, the real test may just be beginning.

Good opportunities often arise when there are fewer participants, not when everyone is rushing in. At this level, it is a weekly or monthly shakeout.

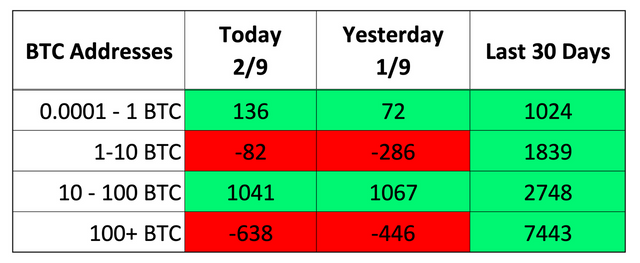

Next, let's look at the latest on-chain data. The overall quantity today is not much different from yesterday. Holders of less than one coin are continuously buying, while whales with over 100 coins are still selling.

If whales haven't started buying and only retail investors are buying, I would be cautious. It may indicate that the whales' target levels haven't been reached yet, so they haven't started buying.

If that's the case, there's no need to rush. Just hold your positions firmly and wait patiently. Remember, don't fall before dawn.

What do you think?

Are you worried or excited about the upcoming September market? Feel free to share in the comments below.

In my opinion, whether or not you made some short-term trades in the past few months, it's okay. Even if there were some small losses, don't be discouraged.

The best opportunity may be just around the corner. If there are additional positive news catalysts, I will definitely seize the opportunity.

🚨 Hey fellow Steemians! 🚨

I wanted to share my thoughts on the current market situation, as I see it. It seems like the capital convergence has reached its peak, and there are fewer bottom-fishers compared to previous times. This might signify the end of this cycle. 💡

In the next couple of months, the real test may just be beginning. 🌈 But don't worry! Good opportunities often arise when there are fewer participants, not when everyone is rushing in. At this level, it's a weekly or monthly shakeout. 🔔

Let's take a look at the latest on-chain data. 👀 Holders of less than one coin are continuously buying, while whales with over 100 coins are still selling. 📉 This tells me that the whales haven't started buying yet, and we should be cautious. 💭

But don't worry! If you're holding your positions firmly and waiting patiently, you're on the right track. Remember, don't fall before dawn. ⏰

What do you think? Are you worried or excited about the upcoming September market? Share your thoughts in the comments below! 💬

And remember, my team and I are continuously working to improve and expand the ecosystem . With your vote for xpilar.witness (https://steemitwallet.com/~witnesses), we can continue contributing to the growth and success of the Steem community. Let's do this! 🔥