BTC - The Current Down Trend

Update

I have been building on the Bitcoin trend for the past year now and started by collecting the price action from the most reliable sources going back as far as possible. This information can be found in my previous posts.

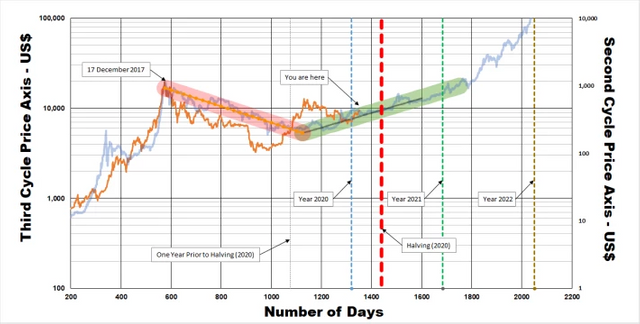

Three weeks ago I wrote my first post on Publish0x and during that time we bounced of the trend line heading up towards the 10k level. This post can be viewed here. The graph at the time can be seen below and the date was 3 February 2020. The transparent blue line is the previous cycle price action and the orange line is the current cycle price action with all the other lines explained on the graph.

For more recent price action, we hovered around 9.3k for about 8 days and shot up over 10k in less than a week but at the time I suggested that a correction is required to bring us back to the trend line.

Most went wild, and just like the Bitcoin obituary where people called for its death more than 350 times by now the latest hysteria is for everyone to call that Bitcoin will never go under 10k again. There was a lot and even more disappointing was my friend who joined the crowed in chanting: NEVER AGAIN UNDER 10k! Well I just laughed because the whales play on this 10k emotional boundary and what people don't understand is the fact that most of these so called expert YouTubers making videos on Cryptocurrency is all being paid behind the scenes. Those who profit most from the volatility of Bitcoin are not those that FOMO in when we trend up and get out when we fall below 10k. They are the ones manipulating the price and profit from people that do. The only way to get over this is to have a long term goal (that's if you're not a day trader). I for one buy to HODL which is a lot easier to do if you're in the green short term and to do that I suggest we consider the Bitcoin Trend.

Trend Cycle

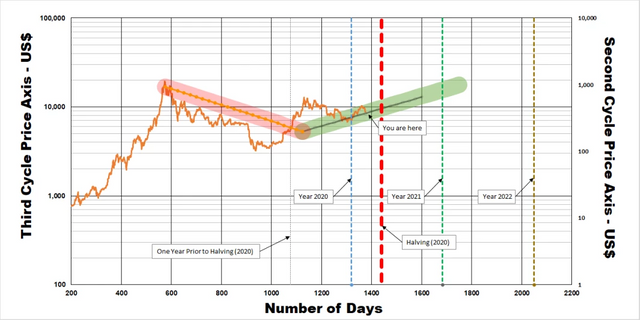

In my previous post I explained how well we tie up with the previous cycle trend (that's setting aside the massive manipulation for this cycle) and that further confirmation will be required to confirm this cycles trend line. In this post I wish to update the graph with the latest price action to see where we are. The graph seem a bit cluttered so refer to the bottom of this post to find the clean trend for this cycle.

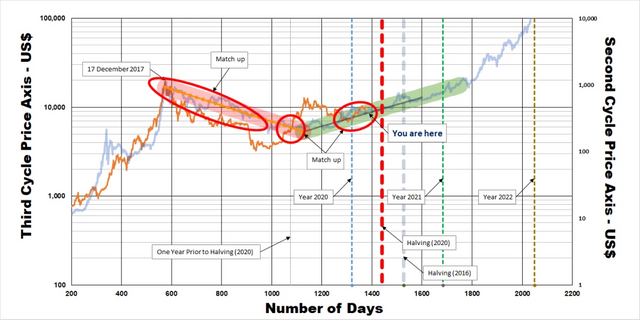

The main reason for the below graph is to show how well we always return to the trend every now and again. I have encircled the crossing points in red and titled it "Match up". Yes, the circle in the middle where we briefly crossed may have been luck but it can't be denied that the two circles on the sides show a good match up for the predicted trend line.

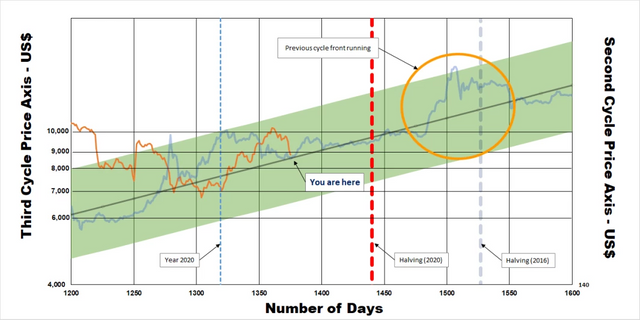

For a blow up we zoom in on the current price action. Please bare with me, I am still developing this graph which is difficult because I am working in log space and balancing the price of the previous cycle with the current cycle on the primary and secondary y-axis. It is not an exact science but it is evident that there is a trend that the price is following and after the last Tether pump we are now back on this cycles trend.

Another interesting event to watch out for is the halving front run. If we consider the previous halving event (refer to the transparent blue line encircled orange) people started front running the event a month or two before it took place. Now we already considered making the grabbing point the halving event in the previous post but I am not convinced yet (refer to that post). Therefore the halving events does not overlap in this graph and if we consider the size of the orange circle we are not far off from this front run if it takes place the same as previous cycle.

The Bitcoin Cycle

If we go on the previous cycle and the pump the was experienced just before the 2016 Halving event we are not far off from a good pump as people jump in to front run the halving. We have dropped from 10k back to the trend line as seen on the "clean" graph below. We cannot however account for massive manipulation and whales would expect this move and would most likely try and do the opposite to what everyone believe will happen. A scenario where they dump the price profusely in an attempt to pick up some Bitcoin cheap before the halving should not be off the table. The best advice however is HODL!

Don't Forget Your Role In the Financial War

For previous post on your role in the financial war please refer to this post. I'll leave here a thought of the main components in the financial war.

Bitcoin is still small at this stage but in the coming years the world will start to know it.

.gif)

Consider donating should this post have been of value:

BTC - 18atWSWrN2bDxNWeoc3Q68coQBEk69FvUY

ETH - 0x71844057eec156843af64b2b8021daf3615b0e06

LTC - LPji8igXQ1cqjhZDFZUYgEWvVshGVi4AA1

PREsearch (My referral)