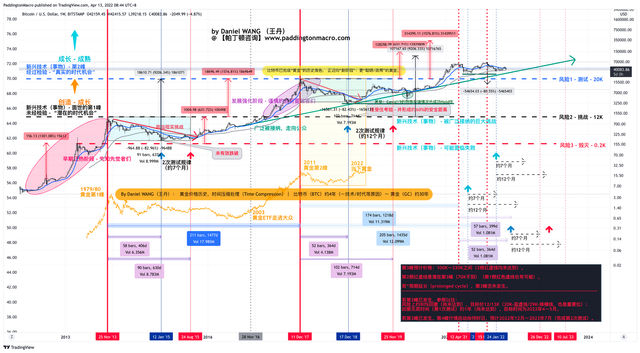

BTC macro analysis

Key Bullets:

- macro risk levels - 20K(test)/12K(challenge)/0.2K (ruin)

- macro trend - bold green arrow line

- frequency of major drawdown tests - 7~12months

- ideal testing scenario - price bottom of 2nd test > price bottom of 1st test

- positioning for a bull run - ideal: low volatility with small trending bars - accumulative buying pressure.

Current Focus: whether BTC's 3rd peak has happened or not?

- if happend, then macro top of this phase is only round $70k, which is lower than previous estimates of $100K~320L

if happened, we should position for a 4th bull run:

- 1st test could be around Apr/May 2022

- price target could be scary of around 12/13K (although 20K, 29K levels are also very important)

- 2nd test could happen between Dec 2022~May 2023

- if hasn't happen, then this cycle is definitely very much prolonged and we can still wait for the previous target of 100K~320K.

Anyway, from the macro perspective, we can't pinpoint the exact timing, so, a planned DCA strategy should be employed.