Part 3: How To Swing Trade With Cryptocurrencies

BY CRYPTOKARP ON JUNE 7th 2018 AT 2:30 PM

Image By Zoznam

Welcome back to the 3rd part in this series. If you missed any of the previous parts, I’d encourage you to at least skim through them so you have an idea what this series is all about. In this part I’m going to go through some basics on Swing trading, my opinions and experiences, and some more general advice.

Swing Trading

It is my belief, that the biggest difference between swing trading and value investing is the time frame, which is significantly lower (anything over one day and up to a few weeks; if you recollect — the time frame for value investing, from last article, was several years and it can even go beyond that). However, there are some other fundamental differences compared to different types of trading — and again, to remind you whether this style fits, it is only up to you to try and decide.

The base of what I consider a swing trade are the local tops/highs and lows. Compared to value investing, where you’re trying to catch the absolute bottom and ride to the absolute top, or as close as you can, swing trading can be utilized more often, because one market cycle has only one absolute top/bottom, but multiple local tops/bottoms, which are the opportunities you’d be looking for in this trading style.

Here comes another division though, different traders like different things. As such, again, you need to figure out whether you’re better and more comfortable while buying long — or — short selling. Although both are equally good as opportunities the main difference is the personal bias. It is more likely that you’ll be shaken out if you’re not comfortable during your trade, therefore whichever type is least comfortable for you, will also be the least profitable as well. This applies in general as well though, not only whether you’re uncomfortable short-selling for instance, but if your position size gets too big for comfort, too small to care about it, or even your risk tolerance.

A Rule To Rule Them All

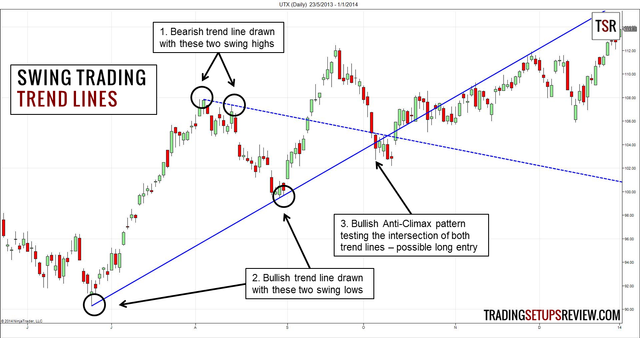

Example of both bullish trends and bearish trends / Trading Setups Review

Rules are rules for a reason. However, there are some daredevils that treat them as guidelines instead and continue to look for opportunities that can break the rules. The one that stands out for me is this:

“Don’t short bull markets and long bear markets.”

For you, a beginning trader, it might be too difficult to recognize trend reversals quick enough, at least due to a lack of experience, which, if you would take a short position in bull markets, you could do well in a short retrace. However, the bigger trend can sweep all your unrealized profits before you know it and leave you with a loss instead. To learn this skill, you’d need a ton of experience and practice, and even then, many experienced traders with years of practice still treat these rules as set in stone and would not dare break them.

Again, this comes full-circle, back to personal risk-tolerance and discipline as well. Although you can get into a short position in bull markets, that fact needs to be addressed, stops set accordingly, and once hit, no second thoughts or averaging down can be present. In this case it would be the worst option you could do, and if you’re a novice trader, you’re prone to make these decisions, especially if you’re lacking the experience in mental control. While trading, you should develop a separate mind-set. While in this mind-set, you need to be fully focused on your game plan. Once you decide the trade, that’s it. If a stop is set on a specific level, double-checked and you agree with yourself on it, there is no more adjusting. If it’s hit, you exit the trade, take a small loss and move onto the next trade. Take a breather if you need to, regain focus and continue looking for opportunities.

You Will Lose And You Will Fail

I’m repeating myself a lot, but these things need to be ingrained in you if you’re to start swing trading and that’s a fact. You need to get comfortable with losses and failures. You need to accept them. That’s the only way forward to improvement. Stubbornness is the exact opposite way. Lately I came to the conclusion, that trading has the same essence as life itself. Same principles to improve, grow, and even fail. What works to put a life together works the same way to put a trader back on track. They are both very closely connected, and that’s one of the reasons why trading needs to fit your life, not the other way around. Find a routine for your day and see what type of trading fits in.

Swing, Swing And Swing Some More

Put that aside though, back to swing trades. I just felt the need to make at least a short note on the rule, and to show you the dangers of breaking it (parallels can be drawn on other rules as well, I just chose this specific one as an example). As always, there are many different traders that prefer swing trading over anything else and so there are many different styles and setups used as well. Some use RSI, MACD, TK, Crosses, and many more indicators to enter/exit trades, but to find the one that fits you the best, you need to try yourself. I can’t tell you that “oh yeah, this one is the best and works all the time”, because that isn’t the truth and should anyone try to tell you so, be skeptical, question their opinions, challenge them and see how they’re going react to it. I find it incredibly difficult to retain adaptability once something is “proven to work”. As this quote points out,

What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so. — Mark Twain.

Once you’re sure of something, you stop questioning it and drop your guard. This is extremely risky for a trader and you need to remind yourself that. Especially if you trade on your own.

A Little Reflection

Image By Keep Calm-o-Matic

Although I didn’t say much about swing trades themselves, I put this general trading knowledge above a specific one, so I’ll expand on it a little to end this chapter. Many newcomers in the crypto trading sphere trade on their own. Not only that, but ask yourself this: Do you think of what you’re doing as “running a business”? If not, you should reconsider. Trading is a business. Think Wall Street, VC’s, Hedge Funds. Think of their structure. Some companies are huge, employ many people, different positions, and different responsibilities. You’re on your own.

This is where the realization of how much responsibility you need to adopt. You need to become all of those people. That means controlling yourself, your risk management, trade execution, etc. Once there is a risk of assuming that a setup is guaranteed to work, this should ring all the alarms while reviewing yourself. It’s one of signs that would mean for me that the edge that I found in the market is disappearing. That is what you’re looking for while making new setups — looking for a new source of edge in markets. Some exploitation. You want to use that, but never assume that it’s permanent. I’d use this parallel to stable coins and anything that is said to be stable — things remain stable until they’re not. Same is for your edge. It is there until it’s not. If you’re aware of this and always look for new sources of edge you should do well though. Adopt adaptability, make it your routine. That’s how you survive the long run.

Run-Down

To provide a quick run-down of this 3rd article, I very briefly sketched what I consider swing-trading. What you should look for while practicing, some of the most common indicators used. As none of these articles, previous or future, are financial advice, I will not tell you how to exactly set up your trades, execute or anything of the sorts. I am simply publishing my ideas, opinions and experiences that I feel like could be of use to more people.

As for the resource section, I’ll leave it open. The topic however, I’d encourage you to look up to the trading firms in your vicinity. See how a real trading business is lead. Learn from them what keeps them running, and adopt some of their structure, rules and routines to your own. It may look like fun and games, but it is a competitive business after all, and once Wall Street and the rest of them enters with full force, it will become very clear to you if you’ll fail to realize that before then. However, it will be late then to do anything about it. Trade to live another day.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

More On ME👇

I am a cryptocurrency enthusiast, novice trader, and an eager learner. My journey started in crypto a little under a year ago and I’m excited to share my experiences during that time and any insight that will benefit you in the space. Feel free to reach out to me via Twitter or Discord

However I can make this process easier for you I will — So please reach out!

I’ve Got Socials Too 😎

Discord

MaGiKarP#8865

Crypto Karp