[ENG] [BTC] TECHNICAL ANALYSIS UPDATE 28/08

UPDATE ANALYSIS 28/05/2018

Contents :

I : Debrief of the previous analysis

II : Background

III : Opportunitie

IV : Indicators

V : Conclusion

I : Debrief of the previous analysis :

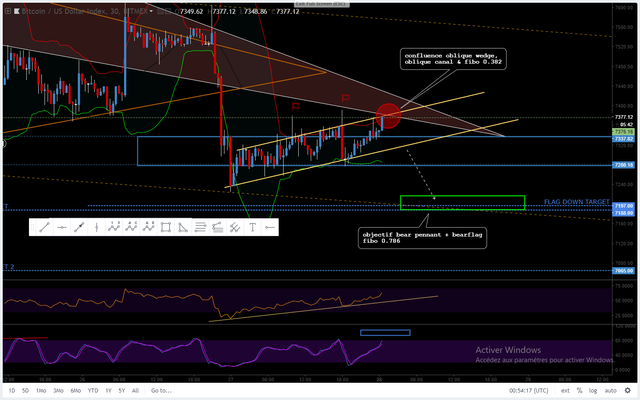

Here is the graph I posted last night, don't hesitate to go back to the previous analysis before continuing reading it.

And so that's how it evolved, with a 3rd (and last rejection) that almost triggered my stop, (fortunately placed slightly above) we then fell well into the green box as expected.

II : Context :

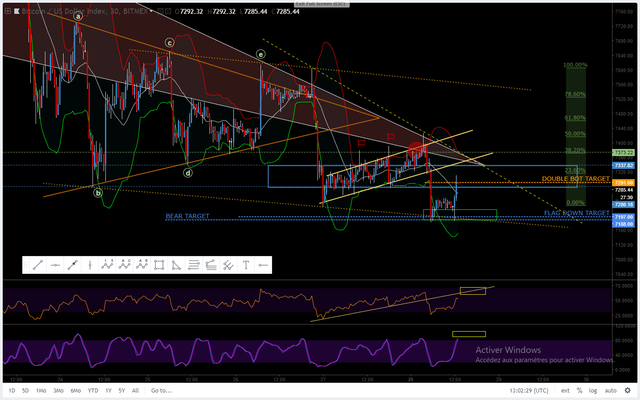

The context in which we are in is rather uncomfortable, no clear trend is emerging, we can see that the green box has been the area of construction of a double bottom a&a support (see: http://thepatternsite.com/aedb.html) with a target 7291, price we are currently.

If it is clear that we have absolutely no impetus to penetrate the 7300/7400 zone which is completely blocked in the direction of the rise at the moment, we cannot say the same for a fall, which seems much easier to achieve than an increase in this context.

I would tend to say that we are in a NO TRADE ZONE between 7180 & 7400 now until we get out of this price range either via a pump or a dump.

III : Possibility :

As I told you yesterday, I am in the perspective of an end of bear cycle, you will understand why thanks to the graph & analysis below.

As described previously, the situation is rather delicate it remains nevertheless rather legible, we are stuck under the wedge since now almost a week, and, the rare moments when the BTC wanted to go to be oxygenated at the surface, it was rejected each time and this in an immediate way. However, after repeated chess the BTC started to create a nice falling wedge that could also be interpreted as a bull pennant.

Both have similar objectives to 7863 & 7974, so the first possibility would be to return to the channel followed by a pump to reach the top of it allowing our BTC to correct 50% of its previous fall.

IV : Indicators :

We now have the context in which this day is going to take place, the scenario for which we are leaning towards, all that remains is to confirm (or invalidate) it thanks to our indicators.

I would treat here mainly oscillators (stoch, rsi, cci) & moving averages (ma) and this only in H4 for readability reasons.

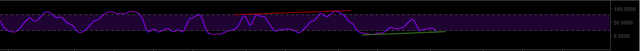

1)(a): Stochastic (14-2-3):

Note a nice bullish divergence at the edge of the oversold, with a nice double bottom on line 20, it's completely bullish. So we validate this one.

1)(b) : RSI (14; close):

Here also a beautiful divergence, one will note nevertheless a less agitated curve and a rather serene rise, as the RSI likes to do it. This oscillator is therefore also validated.

1)(c): CCI (20; closed):

And here even a beautiful bullish divergence entirely in oversold. We obviously validate.

So it's 3/3 on the oscillator side, what about the moving averages?

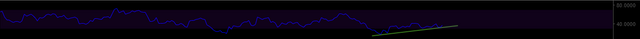

2(a) : MAs (8; 25; 50; 100; 200):

(a scale is available at the top right to distinguish the different averages)

There it is rather simple, one sees very clearly that with each attempts of pump of the BTC, the MA8 although on its momentum never succeeded in passing again with the top of the MA25 for good, always stuck below it indicates us that when it will rebiquera upwards and that it will pierce the MA25 for good it will then be an enormous rising sign (of course to wait confirmations on a pullback on the MA25 for example or by observing if this last follows or goes to oppose it of the MA8).

So much for the indicators, they are all green and therefore comfort me in my bullish scenario.

V : Conclusion :

So here we are (finally?) at the conclusion of this analysis, so I am in a bullish scenario that would tickle the 8000. I am accumulating some long since 7200 that I will release in take profit between 7700 & 8000, or in stop loss <7000.

I wish you a good day and I'll see you tomorrow.!

Congratulations @cryptoteethow! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your Board of Honor.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!