Bitcoin miners are making a killing in transaction fees

Bitcoin miners are making money hand-over-fist.

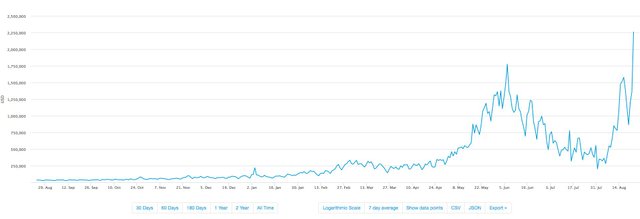

According to data from blockchain.info.com, the value of transaction fees paid to miners has reached an all-time high of $2.3 million.

Miners are basically the hamsters in the wheel that keep bitcoin's network going. They use rigs of computers to unlock the blocks (underpinning bitcoin's network) on which transactions are made.

Every time a miner unlocks a bitcoin block, vis-a-vis mining, all the transactions on that block are processed. The miner, in return for his hard work, is rewarded with 12.5 bitcoins for unlocking the block. They also get to keep the transaction fees bitcoin holders pay when they transact with the cryptocurrency.

In the early days, miners would only get a couple bucks in transaction fees. On Wednesday, however, miners received a whopping $2.3 million.

"That's on top of the millions of dollars they received in their bitcoin rewards," according to Aaron Lasher, the chief marketing officer at Breadwallet. He estimates miners, in total, were rewarded with 1,800 bitcoins, or $7 million.

"That's going to about five to 10 companies," Lasher said. But he says the exact number is hard to pinpoint.

Since more people are using bitcoin, the demand to make a transaction has gone up. As such, the price to get to the front of the line has gone up.

"I just made a transaction this morning," Lasher said."It cost me $25."

That's on par with the average wire transfer fee. Still, it's a far cry from the pennies it cost to send bitcoin back in its earliest days.

Screen Shot 2017 08 24 at 2.31.51 PM

Transaction fees have been on a tear since August 5, a few days after Bitcoin split in two. Blockchaininfo.com

Transaction fees have whipped around, in line with the uncertainty underpinning the cryptocurrency space. Transaction fees slid from late May to early August from about $1.7 million on June 6 to a bottom of $205,000 on July 31.

Aaron says this dip was likely the result of a decline in bitcoin transactions leading up to the fork, which split bitcoin into two different digital currencies: bitcoin and bitcoin cash.

"Once the fork completed on August 1, people began using bitcoin again," Lasher said. "But now that Segwit has activated, we should see some easing over the coming weeks and months."

Segwit is an update to bitcoin's software that was agreed to by the cryptocurrency's powerbrokers in order to address the scaling problem that it faces. Segwit proponents hope the update will make the network faster and in turn bring down those pesky fees.

Josh Olszewicz, a bitcoin trader, told Business Insider that bitcoin cash may be the culprit.

According to Olszewicz, some bitcoin miners moved over to bitcoin cash, thus lowering the network's hash rate (HR). In other words, there were fewer hamsters in the wheel.

"HR moved to bitcoin cash temporarily," Olszewicz said."As a result, confirm times spiked to over 15 minutes."