Buidl Buidl, a DeFi platform focused on “Buidl Buidl” or building and developing the DeFi ecosystem

Buidl Buidl, a DeFi platform focused on “Buidl Buidl” or building and developing the DeFi ecosystem, has emerged as a major force in revolutionizing the DeFi market with BAP (Buidl Autostaking Protocol). BAP, an innovative protocol designed to automate the staking and yield farming process, has been key to Buidl Buidl’s success in providing more efficient, secure, and profitable solutions for investors.

“BUIDL” is a term popularized in the cryptocurrency and blockchain community as a mindset to actively contribute to the ecosystem. It is a derivative of “BUILD,” which is intentionally misspelled to align with the popular crypto culture term “HODL.” Unlike “HODL,” which refers to holding cryptocurrency during market fluctuations, “BUIDL” emphasizes the creation and development of solutions that push the blockchain space forward.

BAP’s Advantages in the Crypto World

High APY: Offering an APY of 526.5%, BAP gives users the opportunity to earn much higher returns compared to traditional staking. These returns remain stable despite market price fluctuations.

Auto Protocol: One of the most interesting features is the autostaking system. Users do not need to reset their stakes or engage in other technical processes. After purchasing tokens, all processes are done by the system automatically, reducing the complexity commonly found in other staking protocols.

Security and Transparency: BAP operates on a secure and transparent blockchain, allowing every transaction and reward to be viewed and tracked by users. This ensures high trust from the user community.

Passive Income: BAP offers passive income that is easily accessible to anyone, including those new to the crypto world. With an automated system and consistent income, BAP allows users to earn profits without having to actively manage their assets.

Is BAP Sustainable?

It is important to understand that while the 526.5% APY is attractive, the sustainability of such returns depends on a variety of factors, including the overall performance of the crypto market and the mechanics of the protocol itself. BAP has been designed to maintain stability, but investors should always be aware of the risks associated with investing in volatile crypto markets.

To maintain the sustainability of the system and reward stability, BAP implements careful economic mechanisms that have been designed to adapt to changes in the crypto market. For example, the protocol may make algorithmic adjustments to maintain the sustainability of the APY over the long term.

How BAP is Revolutionizing the DeFi Market:

- Stable APY: BAP is designed to stabilize APY (Annual Percentage Yield) by automating the staking and yield farming process. The BAP algorithm intelligently selects the DeFi platform with the best APY and periodically transfers user assets to the platform with a higher APY, minimizing the impact of market fluctuations on investment returns[__LINK_ICON]. — Asset Diversification: BAP implements an asset diversification strategy, reducing the risks associated with market volatility. User assets are allocated to multiple DeFi platforms and yield farming strategies, minimizing the risk of loss if one platform experiences a decline in performance. — Risk Management: BAP is equipped with a risk management mechanism to protect user assets. The BAP algorithm automatically adjusts the yield farming strategy based on market conditions and risks, minimizing potential losses and keeping investments safe. — Efficiency and Convenience: BAP automates the staking and yield farming process, eliminating the need for investors to manually perform these processes. This increases efficiency and convenience for investors, allowing them to focus on long-term investment strategies. — Transparency and Independent Audits: Buidl Buidl emphasizes transparency and security, with independent audits to ensure that the system operates safely and fairly.

Impact of BAP on DeFi Market:

- Increase Accessibility: BAP makes DeFi more accessible to investors with limited experience. By automating the staking and yield farming process, investors can enjoy the benefits of DeFi without requiring in-depth technical expertise. — Increase Liquidity: BAP helps increase liquidity in the DeFi market by optimizing asset utilization. BAP’s algorithm intelligently allocates users’ assets to DeFi platforms with the best APY, increasing market efficiency and driving growth. — Increase Trust: BAP increases investor trust in DeFi by offering a safer and more stable solution. With comprehensive risk management and independent audits, BAP helps address some of the major concerns associated with DeFi.

Buidl Token

Buidl is the native token of the Buidl Ecosystem, which automatically receives rebase rewards. Just by holding $Buidl tokens in the wallet, every token holder automatically receives 0.021% interest every 60 minutes.

Buidl Tokenomics

$BUIDL is a BEP-20 token with an elastic supply that rewards holders using a positive rebase formula. It started with only 21000 Tokens, that is 1000 times less than Bitcoin Supply.

Initial Supply: 21,000

Max Supply: 21,000,000

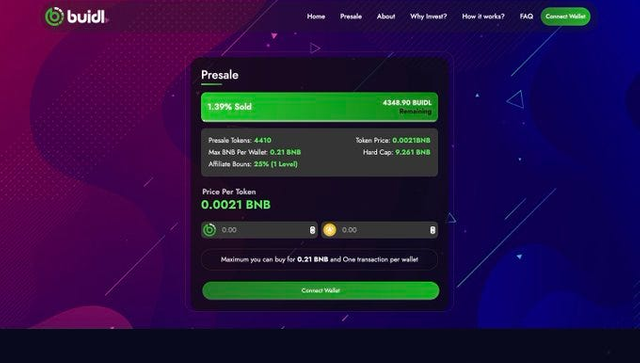

Pre-sale

Presale Token: 4410

Token Price: 0.0021BNB

Max BNB Per Wallet: 0.21 BNB

Hard Cap: 9,261 BNB

Affiliate Bonus: 25% (1 Level)

Conclusion:

Buidl Buidl’s BAP has been key to the platform’s success in revolutionizing the DeFi market. By offering more efficient, secure, and profitable solutions, BAP helps increase accessibility, liquidity, and trust in DeFi. As DeFi continues to evolve, BAP is expected to continue to play a key role in driving growth and innovation in this market.

Learn more and update:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Whitepaper: https: // buidl-token.gitbook.io/buidl-token

AUTHOR

Forum Username : Zhiepiet

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2437225

Telegram Username: @Zhiepiet

BSC wallet address: 0xd94651326495f96d66AE0c94872a3344560D7c87