Pondering Out Loud re: Reserve Currency Fiesta this week in Africa adds to the De-dollarization a Technical and Fundamental POV

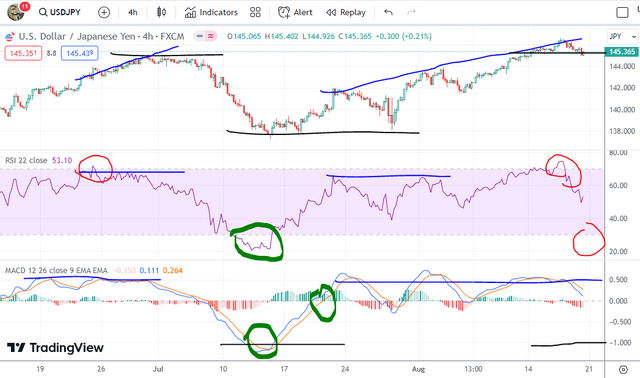

Dollar versus Japan yen and the carry trade unwind is also the more likely the tool that can be seen in use soon or maybe not at all. There is a bunch of speculation at it being triggered by the Bank of Japan buying their own bonds instead of the USD bonds which would indicate a sea change for sure. On the weekly we see the potential for a drop in the USD.

In the meantime the USD did rally a bit is still some room for a small rally for the dollar against the yen short term, but almost showing a reversal gonna have to wait and see what happens in the next weeks. The news of China no longer buying US bonds already should start a trend out there. Japan should be close behind as they are breaking records in bond buying but just not in US bonds but their governments own JGBs and this is really starting to mess with interest rates and good ole yield curve.

https://www.reuters.com/world/brics-summit-2023-whats-likely-be-discussed-2023-08-18/

Who could of guessed it? So now we are at the after party with the BRICS and were all talking about the Summit and just what ACTUALLY has gone on. The multilateral local currency trades was for sure confirmed, as well as the dollar reserve currency hegemony ending, and the cherry on top (so far) the expansion of the BRICS members. The biggest impact of the addition of countries was the African continent being expanded mainly in oil.

Now everyone is getting a bit of rest before the next big party this week at Jackson Hole. What are you going to wear?