Book Review: “Your Money or Your Life”

Book : “Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence” by Vicki Robin and Joe Dominguez

Who it’s for: Anyone who wants to reach financial independence, sooner than later.

Readability: MEDIUM. It’s well written and easy to follow thanks to the authors’ obvious attention to layout and structure. The personal stories and visuals included in the book also help drive the authors’ points home for the reader, and keep the book entertaining as well as inspiring.

What I liked about it: “Your Money or Your Life” (YMOYL) helps redefine our relationship with work and money by forcing us to reevaluate their respective roles in our lives. The authors walk us through nine clear steps that help guide our thinking from status quo to financial independence, by addressing the psychology of money as opposed to focusing on the mechanics of money management, as so many other personal finance resources tend to do.

What I didn’t like about it: I may not agree with the idea of investing in treasury bonds as the default investment vehicle, but it’s such a minor point I feel silly even mentioning it. Talk about splitting hairs!

This is the perfect book for anyone who wants to change their relationship with money, and the source of money for most of us: work. The authors’ guide the reader through nine critical steps. These steps help us reevaluate our relationship with money, work and time, to determine whether our current actions are helping us maximize our potential to live a full and rich life.

(Note: If anyone wants a bird’s eye view of its contents, I suggest reading the epilogue starting on pg. 295. It provides a powerful summary of the nine steps as a quick reference.)

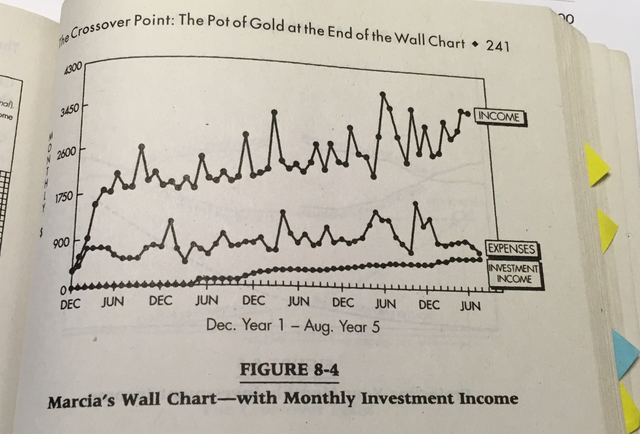

They also use simple calculations and visuals in the form of tables and graphs to help us map our behavior and our progress toward the ultimate goal: having investment revenue match our spending, which equals reaching financial independence.

The main steps in YMOYL help us create an understanding of:

1. Where We’ve Been: Gaining an understanding of how much money we’ve spent in our lifetimes and evaluating our return thus far in the form of life satisfaction.

2. Where We Are: Evaluating the magnitude and quality of our current spending to determine whether we’re maximizing how we use our life energy (0ur most precious resource).

3. Where We’re Going: Measuring our self-sufficiency by tracking our progress toward financial independence and beyond.

#1. Understanding How Much We’ve Spent in Our Lifetime

First, the authors’ invite us to determine how much we’ve earned in our lifetime and compare it to our current net worth. Ouch! Seeing how much money we’ve thrown away is sobering to say the least. The exercise is definitely worth the pain because, as we know, we can’t change what we don’t acknowledge.

#2. Evaluating the Magnitude and Quality of Our Spending

Second, they ask us to look to the present: They want us to get acquainted with our regular (monthly) spending to get a sense of where our money is going. What do we spend our money on and does it add to the quality of our lives? Are we better off for having spent the money?

If we’re truthful, there’s a great deal of money we spend for other people that doesn’t add to the quality of our lives, just to its “flashiness”.

Other people’s expectations don’t make you buy stuff. Television doesn’t make you buy stuff. Your thoughts make you buy >stuff. Watch those suckers. They’re dangerous to your pocketbook—and to a lot more. (pg. 194)

Once we know what doesn’t add to our quality of life, the authors invite us to either eliminate the expenditures and/or reallocate the funds to something we know adds to our life satisfaction.

Case in point: I could not believe how much I was spending on “work”: commuting, dressing the part, etc. YMOYL made me realize years ago that I was spending $26K per year just to get to work and look the part!

#3. Measuring Our Level of Self-Sufficiency

Finally, YMOYL invites us to measure our self-sufficiency by tracking our progress toward financial independence. We can do this by tracking our monthly:

- earned income (all money flowing in from working)

- expenses

- investment income (all money earned from investments)

The graph is powerful for a few reasons. It offers a visual reference that prods us to maximize income and reduce expenses. Plus, it promises the ultimate payoff: once the total monthly expenses and total investment income lines intersect, we’ve reached financial independence because we’re no longer dependent on earned income to meet our needs.

Financial Independence is an experience of freedom at a psychological level. You are free from the slavery of unconsciously held assumptions about money, and free of the guilt, resentment, envy, frustration and despair you may have felt about >money issues. (pg. 55)

I used this chart myself on my closet door for a few years and it helped to keep my eye on the prize.

Bottom Line

If you want to stop having to work for “The Man” sooner than later, YMOYL is a must read. It’s a powerful book and should be part of every person’s lifetime curriculum.

Be Sociable, Share! Resteem! and Upvote!

You may also like

Book Review: “The Little Book of Common Sense Investing”

Source : rockstarfinance