Bond YTD Performance Comparison (VIVAX & VIGRX)

Index - https://steemit.com/tax/@alhofmeister/3ibscz-accounting-and-finance-blog-index

Introduction

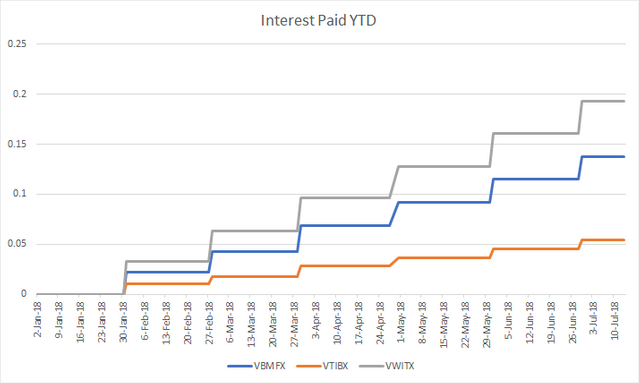

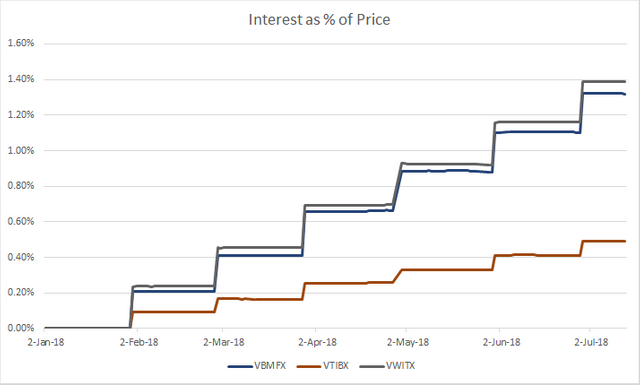

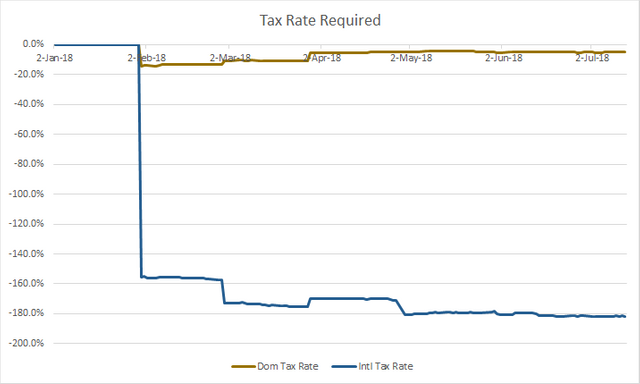

The purpose of this post is to examine the YTD performance of bonds by comparing various Vanguard index funds. Specifically, I am examining the dividends paid by the funds (interest paid by the bonds) and ignoring any fluctuation in price to demonstrate the effects of simply holding the index funds. The graphs represent the following:

- Total interest paid YTD;

- Interest as a % of price (YTD interest / index fund price); and

- The tax rate necessary for the municipal bonds to be the least advantageous investment (muni bond % from 2 / dom or intl % from 2 - negative values indicate that municipal bonds are the superior investment regardless of the individual's tax rate).

Based on the analysis below, municipal bonds (surprisingly) are paying a higher dividend (when considering price) than either domestic or international bonds. Examining the post considering price (Bonds v. Stocks YTD Performance (VTSMX, VGTSX, VBMFX, VTIBX, & VWITX)), reveals that International Bonds (VTIBX) significantly outperformed the other two index funds after price is considered. I will continue to track the progress of these index funds in future posts.

Interest Paid YTD

Interest as % of Price

Tax Rate Required

References

https://finance.yahoo.com/quote/VBMFX/history?p=VBMFX

https://finance.yahoo.com/quote/VTIBX/history?p=VTIBX

https://finance.yahoo.com/quote/VWITX/history?p=VWITX

@contentvoter

#nobidbot