Bitcoin Misery Loves Company - The BMI Index Is Born for the very first time on Friday!

On Friday a new index was born to track how investors feel about the price and direction of Bitcoin. This new index named the Bitcoin Misery Index (BMI) has been introduced by Tom Lee Head of Research at Fundstrat Global Advisors,is a numerical index which ranges from 0-100 and takes account for the percentage of days Bitcoin is up less downside volatility.

Image credit Getty Images (I added the chart in background, was looking for a good flame filter for it but ran out of time.)

[coininstant note: Investing in digital currency is very speculative in our highly volatile, barely regulated market! Anyone considering investing in crypto should not worry about loosing everything, but should hodl (hold on for dear life) instead!]

How to read the BMI

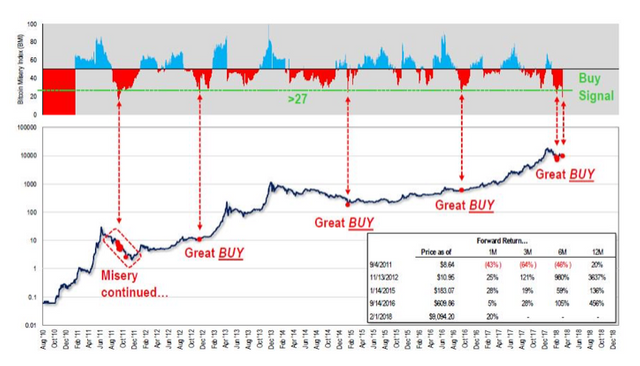

The BMI is similar to the RSI or MACD, when the chart is low, less than 30 for the RSI would be flashing an oversold indicator, above 70 would be overbought. The same is true for the BMI index, it is really easy to see, especially when you overlay it on the price chart of bitcoin. View the chart below from bitcoin.com.

Image Credit:

https://news.bitcoin.com/the-bitcoin-misery-index-finding-an-entry-way-with-sadness/

What is the BMI reading telling us now?

A simple guide for reading the BMI is to use Lee’s trigger points for your buy and sell signals. The specific numbers are 27 for a buy signal, and 67 for a sell. Currently the BMI sits is at 18.18 which is the lowest point since September 2011! There have only been four other times the BMI hit 27 and 100% of them were the best Bitcoin entry points!

Yes the BMI is flashing a Buy signal, however it is very possible for Bitcoin to drop a little bit more causing more panic. If the Bitcoin Markets takes another turn for the worse this coming week, and we have a down day Wednesday during the most volatile time of the month when CBOE futures are expiring, I think the BMI will be just right for a buy. If this happens I think BTC could see another quick double bottom at 6K! Currently I have 20K USD sitting waiting for this to happen, I was on the fence about buying tomorrow, but since misery loves company I think there might be a little bit more misery for us to get through first. As they say we might not be out of the woods just yet!

As of yesterday the price of Bitcoin was only $2500 away (less a $500 front run) from 6K, so we are pretty close already. I plan on using this new index to help me choose the best entry and exit points for trading Bitcoin.

Current Bitfinex Price of Bitcoin Sunday March 11, 7:18 PM HST (Hawaii Standard Time)

@coininstant sir...

The cryptocurrency market has been highly volatile throughout this week, as major cryptocurrencies including bitcoin, Ethereum, Ripple, and Bitcoin Cash have continued to move in between $340 billion and $380 billion.

Is Bitcoin Ready to Move?

Today, on March 11, the cryptocurrency market recorded a minor recovery after dipping below the $350 billion mark. Briefly, bitcoin fall to $8,320, and the price of Ethereum also fell to $637, significantly below its all-time high established at $1,400.

The daily trading volume of bitcoin has remained relatively low for several days in a row, in the $5 billion region. The high volume of Tether, a cryptocurrency that is backed to the US dollar at a 1:1 ratio, can be considered as a representation of the market’s volatility, given that many traders on the world’s largest cryptocurrency trading platforms utilize Tether to hedge the value of cryptocurrencies to the US dollar.

At the time of reporting, the daily trading volume of Tether remains at $2.3 billion, which is nearly four times higher than that of Litecoin and over $800 million higher than that of Ethereum.

Crypto Rand, a respected cryptocurrency investor and analyst, stated that the “Misery Index” of bitcoin is signaling a buy opportunity for bitcoin investors. Throughout the past six years, upon a dramatic surge in sell volumes, bitcoin has continued to recover from major corrections.

For instance, in December 2016, the price of bitcoin dipped below the $800 mark as sell volumes intensified. But, throughout early 2017, the price of bitcoin rallied to $4,000, eventually achieving $19,000 within the same year.

Thanks...

Tom Lee has gained wide popularity in the crypto community due to his regular forecasts of bitcoin prices. In particular, last month the co-founder of Fundstrat expressed confidence that by the end of 2018 Bitcoin will grow more than twice, and by 2022 its price will reach $ 125,000. I wonder how the index will affect its forecasts. Thank you @coininstant

For future viewers: price of bitcoin at the moment of posting is 9504.80USD

Sweet thanks!

@coininstant sir...

Many institutional investors are wise to use the futures contracts to lower the Bitcoin price to buy in lower by setting the stop-loss triggers at support levels to push down the price further and further to make it look like a crash. This scares novice investors to support the bears and sell to avoid a total loss. By taking this strategy, the Wall Street investors are strategically pushing down the price for in order to re-enter at much lower levels and potentially set Bitcoin up for another rocket rise to unprecedented highs. Then, assumingly, collect profits and repeat the cycle, increasing profits each time Bitcoin rises and falls...

Cheers~~~

Nice post. There many valuable points have been discussed.

Very informative post sir @coininstant

Thanks for the post .

100% resteemed your post

This is great article and very importunate info.thanks for sharing

Thanks @coininstant

Have a great day.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

Bitcoin Misery Index (BMI) is a great for gift investors by Tom Lee, Thanks @coininstant for the kind explanation

interesting thing it was to see seeing it for the first time thanks for sharing it :)