The trading volume and active addresses on the Bitcoin chain lack the characteristics of a bull market

On February 21, according to Cointelegraph, market analysis pointed out that although the price of Bitcoin has risen by nearly 50% so far in 2023, the transaction volume on the chain and the increase in active addresses lack the characteristics of a bull market.

CryptoQuant contributor Yonsei explained that active addresses are an indicator, including all addresses that send and receive bitcoin, to understand how active the market demand is. “The ‘price’ of an asset is determined by the laws of supply and demand in the market, and the crypto market is no exception. For an asset to rise in price, it must support market interest and demand.”

According to the chart in its article, after the end of the bear market in 2018 and the market crash in March 2020, the 30-day moving average (MA) of active addresses increased; in contrast, the same trend has not yet been seen in 2023.

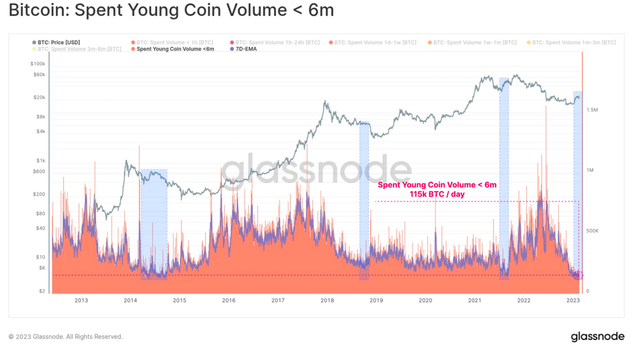

Glassnode, an on-chain data analysis company, pointed out that the transaction volume on the Bitcoin chain is still very low, and neither long-term holders (LTH) nor short-term holders (STH) are willing to spend money.

“Despite a net increase in on-chain activity and a record high UTXO total, transfer volumes were significantly subdued for both long-term and short-term holders.”