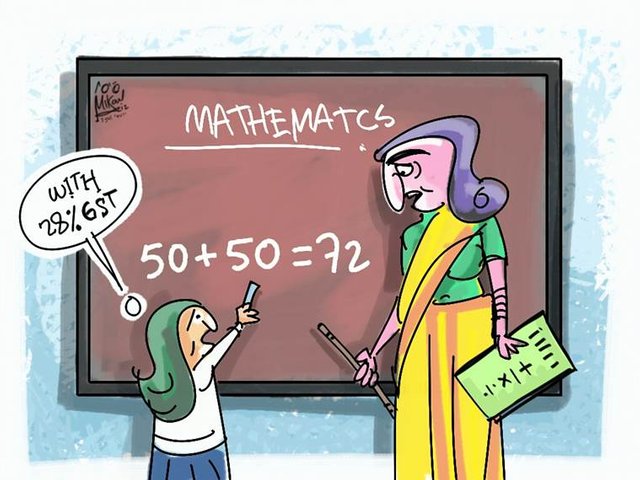

What things came along GST ?

India’s goods and services tax collections fell to Rs 83,346 crore in October, from more than Rs 90,000 crore in each of the first three months after the new tax regime was rolled out on 1st July.

A finance ministry statement attributed the lower collections to the release of state and central GST out of integrated GST (IGST) paid in the first three months, reduction in taxes and payment of GST based on self-declared tax return.

So far, 95.9 lakh taxpayers have registered under GST, of which 15.1lakh are composition dealers who are required to file returns every quarter. As many as 50.1lakh returns were filed for October till November 26, the statement said.

“While the overall collection for the October month is lower, this may not be a cause of immediate concern as it might be due to refunds given to exporters and opening credit claimed by businesses, along with some reduction in the rate in October,” said Pratik Jain, leader-indirect tax, PwC.

“The collection for November may also be on the lower side due to substantial rate cuts from mid of the month. While to a large extent the shortfall is likely to be offset by increase in demand, the results may take another 2-3 months to become visible.”

BREAKUP OF GST

States collected Rs 87,238 crore of SGST in July, August, September and October, it said. States get a share in th e IGST collection from inter-state trade when IGST collected is used for payment of SGST. By way of such share, states received Rs 31,821 crore for August, September and October, and Rs 13,882 crores far October.

The states are also entitled to a compensation for loss of revenue from the rollout of GST. A compensation amount of Rs 10,806 crore has been released to the states for July and August 2017 and Rs 13,695 crore for September and October.

“States’ revenues have thus been fully protected, taking base year revenue as 2015-16 and providing for a projected revenue growth rate of 14 per cent ,” the statement said. This adds up to Rs 1.57 lakh crore for states. The Centre’s revenue on account of GST in July, August, September and October added up to Rs 58,556 crore.

In addition to this, the statement said, Rs 16,233 crore had been transferred from the IGST account to CGST for the first three months and Rs 10,145 crore for October. “Taxpayers are using the balance credit available with them in the previous tax regime,” the statement said.

LOW REVENUES

The government has offered three reasons for revenues to be lower in October. One, the first-time requirement of paying IGST on transfer of goods from one state to another state, even within the same company.

This meant an additional cash flow of IGST in the first three months, but the same was not being utilised for paying CGST and SGST when the final transaction of these goods took place. Two, the overall incidence of taxes on most of the commodities had come down under GST.

Three, because GST is now based on self-declared tax return, the assesse decided on his own how much tax liability he had and claimed input tax credit as per his own calculations.

Great post

Thankew it's GST bdw ...have lot to know bout👍