Financial Blog: Reverse Factoring

What happens to businesses that don't report their earnings and or losses properly in their financials? Often times nothing. In the majority of cases where companies commit financial happens until it is too late and the damage is already done for those who invested in the company. Once the company is past the place of no return, investors usually find out the truth of a companies true financials like we saw with one of the most famous financial scandals of all time in Enron. Enron was able to hide billions of dollars in losses and debt by using deceptive accounting practices. One of those deceptive accounting processes was to count future project projections into their profit and writing in possible income from projects that weren't even started yet on their current financial statements.

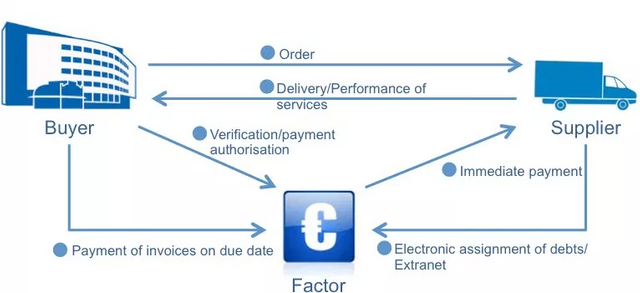

While accounting practices like these have been revised and made highly illegal the idea behind deceptive financial practices is still being used today at a large scale. One of the practices that is currently starting to be found in many businesses around the world is Reverse Factoring. What is Reverse Factoring? Reverse Factoring is a process where a financial entity like a bank becomes a middle man between a supplier and a buyer. Instead of the buyers paying for the supplies directly to the supplier, the financial entity pays the supplier immediately and bills the buyer at a later date.

This process benefits the buyers and suppliers in multiple ways:

- Improved relationship between Buyer and Supplier

- Buyer can purchase supplies at a discounted rate as the Financial Entity will pay the invoice to the Supplier immediately

- Supplier will receive payment at the earliest of opportunities so will not be cash strapped

This seems like a legitimate business practice that has little to no downside for the corporations right? Well like all good things some people have to take advantage of the opportunity and ruin it. Just recently a UK based company called Carillion was found to have hidden around 400 to 500 million pounds using deceptive practices like reverse factoring. On Carillion's balance sheet they had their net debt at 219 million pounds however, over a 4 to 5 year stretch they were able to hide the remaining 400 to 500 million pounds in other "payable" accounts. During this stretch of time there was no press release or any news about the companies increasing debt to their investors and the public. While those outside Carillion believed the company was doing well, it was actually falling deeper and deeper into debt and finding ways around the system to hide that debt from their investors.

Why is this an issue? Companies are realizing they can tie up large amounts of debt in "payables" accounts and increase the length between payments in order to hide money for longer stretches of time. Because the financial institutions are making deals with the buyer they are often times allotting the buyer a longer period of time to make good on the payment. Where the supplier might have demanded payment within 60 days, the financial institution often times will give the buyer 120 or even 180 days. Not only are they extending the length between payment periods, they are using these accounts payable to hide massive amounts of debt that should not be put in these accounts on a balance sheet in the first place.

Fitch ratings, one of the big three credit rating agencies started investigating this problem and has found this problem with reverse factoring to be running rampant throughout the US and Europe. If companies are able to push the time out of their debt owed they might need to come up with millions of dollars that they do not have and are often times just buying more time as we saw with countless companies right before they collapse and file bankruptcy. This is an extremely dangerous business practice that hurts the shareholders and creditors of the companies involved. While more light is being shown on this topic it only looks like these type of practices are increasing in popularity as Fitch reported that out of 337 companies they looked at in 2017 "parables increased by 6%". While this can't be directly connected to reverse factoring it is easy to assume that a majority of businesses are using some sort of practice like this in order to get a better deal on goods or to hide some of their ever growing debt.

For those out there looking to invest in companies and buy stock always remember to do your research on the companies financials and look at their debt, cash flow, cash reserves and payable's.

If you have any questions regarding reverse factoring or any comments you would like to add please share them below. If you have any topics you would like me to go over let me know in the comments below.

Article:

https://www.zerohedge.com/news/2018-07-31/hidden-debt-loophole-could-be-widespread-fitch

Congratulations @ricjames! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Maybe someone has encountered an invoice problem? I've only recently started working and so far have had difficulty developing a uniform invoice format for my services. In order to appear more professional in the eyes of my clients I started to create invoices with ease with Oki Docs and it was the best solution. I like that these templates have built-in formulas so that I don't make mistakes when filling out the invoice. This has been the best solution for me.