RobiniaSwap Technical and Financial Considerations

Introduction

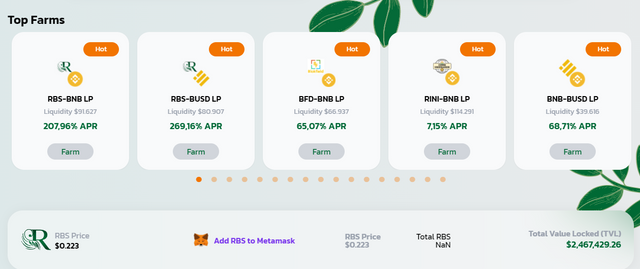

Just a few days before #RobiniaSwap starts executing transactions in November, there are still some doubts about its operation, so I wanted to dedicate these brief lines to explain some technical and financial considerations related to RobiniaSwap.

Before continuing, it is necessary to clarify that when a protocol works with a decentralized mechanism, there is no order book for traders, therefore to provide the necessary tokens for exchanges, liquidity is needed to provide financial functionality and #RobiniaSwap works on this parameter.

As mentioned in previous posts to this one, let's remember that #RobiniaSwap runs automated liquidity registers within its financial ecosystem.

This means that there are smart contract models that define a standard method for making liquidity pools and corresponding markets compatible with each other.

In practice, users who participate by adding liquidity to #RobiniaSwap are referred to as Liquidity Provider (LP), and the action itself is described as a procedure of adding fluidity.

Now, it should be noted that users who choose to add liquidity to #RobiniaSwap receive a portion of the fees generated by users who exchange their tokens, a highly attractive element for anyone wishing to earn passive income in the short and medium term.

Telegram: https://t.me/officialrobinia

Twitter: https://twitter.com/robiniaswap

OBSERVATION:

The cover image was designed by the author: @lupafilotaxia, incorporating image background: Source: Blokfield.Gitbook.io