Turning Income Into Collateralized Crypto Loans - Hodl!

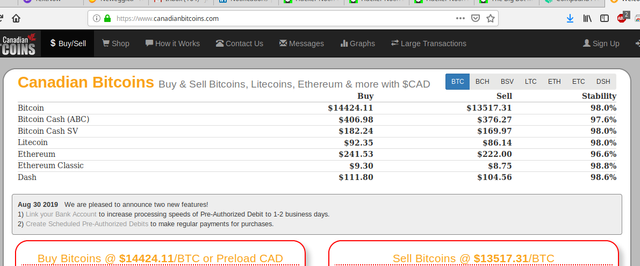

Tomorrow, I'm getting $1313 CAD refund as a present from Newegg for their defunctional laptop they'd sent me. I'm going to etransfer it to canadianbitcoins.com in exchange for ETH at around 5% loss on the dollar.

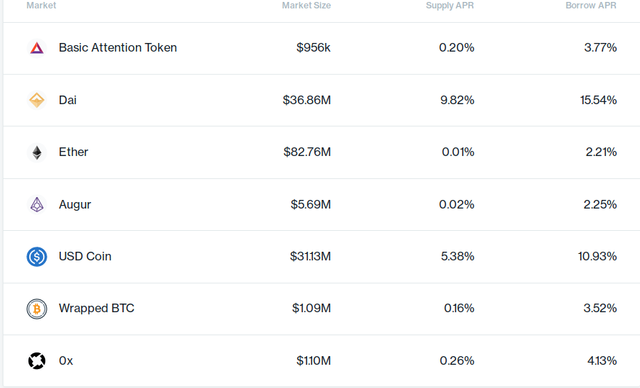

I'm going to send it to a wallet that I connect to compound.finance and then borrow what I need back in DAI or USDC - about $134 CAD for cigarettes and $325 CAD to pay back a laptop debt.

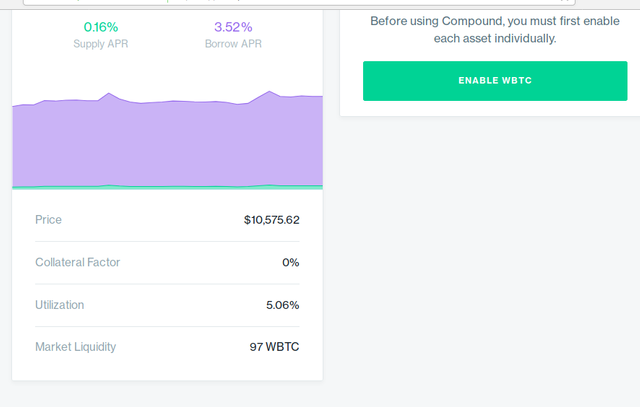

I'll be exposed to 11-15.5% APR from borrowing stablecoins, but since I'm long ETH I believe it will grow more than that in a given year - year over year - allowing me to borrow more, should I wish. Also, since my loan will be over-collateralized - as I'm not borrowing the full 75% I'm allotted when borrowing ETH - ETHUSD can go down a significant amount before I'm risking liquidation, which I can fix by collaterlizing more crypto in the future.Their collateralization factor for wrapped BTC at present, however, is 0% - but in a near update to the protocol this will reflect WBTC liquidity, and be some value between 0 and 75% - which I plan on capitalizing on by holding WBTC and then borrowing against it.

Voila! I'm now long BTC and long ETH.As I'm in the process of negotiating my first multi-client exchange volume faking bot subscriptions, which will not only produce enough income for me to comfortably be labor-free but also make a fortune out of my favorite passtime and hobby, it's critical to find a way to both hodl crypto for the long haul while still paying for the necessities of life. Given that I can borrow up to 75% of my hodlings at a given point in time, I can now accumulate crypto wealth - even being able to borrow again should incomes drop against it so long as BTC/ETH grow more than the %APR it costs to borrow - and I won't be left in situations like in the past.When I was first switching my $USD payroll to bitwage.com in 2013/2014/2015 I was earning 3-5 Bitcoin - @$200, $300, $500 apiece - each and every week for consecutive months. Opportunity cost of spending all that at current values - even while truly believing in BTC's value proposition, just having expensive habits like rent and tobacco in Canada - pales in comparison to having 850 Ether I cloud-mined and sold @ $5, $6 apiece maybe 9-11 months before ETH's ATH.People have been known to lose their minds or lives over far, far less.What the remaining people can do is learn from this experience - be long crypto or at least long BTC and ETH while still being able to spend most of your income on the necessities of life.Long live #DeFi!Ps I wonder if the folks at Compound saw this:

Congratulations @hodlorbust! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!