ITC is a good investment for yearly 5000 Rs per year dividend income?

Totally off the charts today with the election data. And all the drama. I thought it's worth going through the data and try to deduct what is possible.

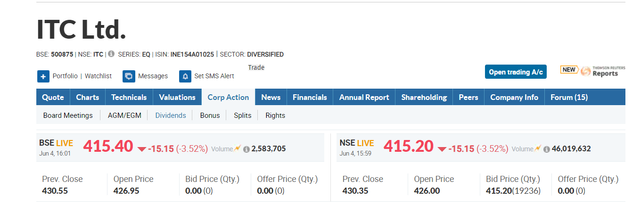

Based on the given dividend data and the current stock price of Rs. 415.40 for ITC Ltd., we can analyze whether it would be a good investment for generating a yearly dividend income of Rs. 5,000.

To generate a yearly dividend income of Rs. 5,000, we need to calculate the number of shares required. We can do this by dividing the desired yearly dividend income by the total dividend per share in the last year (sum of all dividends for a particular year).

For the year 2023-2024:

Total dividend per share = Rs. 7.50 (Final dividend) + Rs. 6.25 (Interim dividend) = Rs. 13.75

Number of shares required = Desired yearly dividend income / Total dividend per share

= Rs. 5,000 / Rs. 13.75

= 363.64 shares (rounded up to 364 shares)

At the current stock price of Rs. 415.40, the investment required to buy 364 shares would be:

364 shares × Rs. 415.40 = Rs. 151,205.60

So, an investment of around Rs. 151,206 would be required to generate a yearly dividend income of Rs. 5,000 from ITC Ltd.

Some additional factors to consider:

- Dividend payments are not guaranteed and can fluctuate based on the company's performance and dividend policies.

- The current dividend yield (total dividend per share / stock price) is around 3.31% (Rs. 13.75 / Rs. 415.40), which is relatively low compared to some other investment options.

- The stock price may appreciate or depreciate over time, affecting the overall return on investment.

- Diversification across different sectors and companies can reduce risk and provide a more stable dividend income stream.

Considering the above factors, ITC Ltd. may not be the most attractive investment option solely for generating a yearly dividend income of Rs. 5,000. However, it could be a part of a diversified portfolio, especially if you anticipate capital appreciation in addition to dividend income.