What Fast Times at Ridgemont High Can Teach Us about Cryptocurrency Regulation

By Anne Szustek Talbot, Director of Content, BX3 Capital

.jpeg)

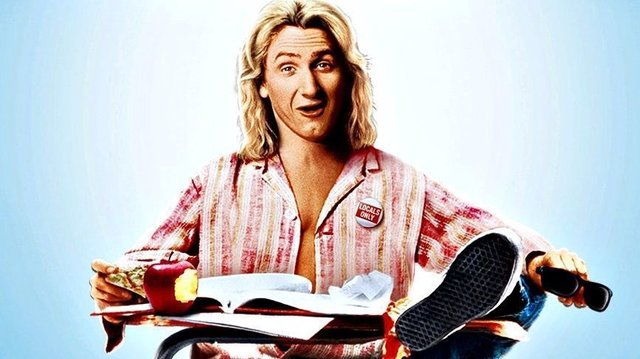

Fast Times At Ridgemont High / Universal Pictures Home Entertainment

Of all the things to cross one's mind when thinking of the phrase "Congressional testimony", the 1982 teen coming-of-age flick Fast Times at Ridgemont High most likely isn't near the top of the list. It boasts a killer New Wave soundtrack and a snapshot of Southern California life as portrayed by an ensemble cast that largely went on to become marquee celebrities in their own right. In one particularly memorable scene, Sean Penn, the actor behind slacker surfer-par-excellence Jeff Spicoli, engages in a lively discussion with his history teacher over the US Revolutionary War, namely the lack of a codified legal framework post-British rule. Spicoli muses on the Founding Fathers' thought process in drafting the Constitution: "If we don't get some cool rules ourselves - pronto - we'll just be bogus too!"

The "Movers And Shakers" Of Cryptocurrency

Fast-forward 30 years or so, and the sentiment remains just as relevant for modern times. A couple of my colleagues at BX3 Capital, a business advisory firm for companies looking to get established in the blockchain and cryptocurrency space, were among the 50-odd industry participants testifying before members of Congress last month at the "Legislating Certainty for Cryptocurrencies" roundtable, spearheaded by Ohio Rep. Warren Davidson.

The event drew from an array of high-profile stakeholders with an interest in making cryptocurrency work: asset management firms such as Fidelity and State Street; venture capital firms such as Andreesen Horowitz; and crypto exchanges such as Coinbase. Members of law firms' crypto practices and a representative from the US Chamber of Commerce weighed in with their perspectives. While different parties came to the event with different viewpoints, there was a common thread among their voiced concerns: "We as an industry need some US regulatory guidance, or the industry will head elsewhere." Or to echo the words of Fast Times' Jeff Spicoli, they will be "bogus too."

Fidelity Logo / Certified Financial Group, Inc.

Considering Cryptocurrency Regulations

Generally, calls for regulation isn't what one would expect from a business segment often associated with libertarians. But even the most vocal free-marketeer would agree that having the crypto industry leave US shores is too great an economic and security threat to bear. As a sector, technology, and burgeoning asset class - not unlike roses on a trellis - cryptocurrency needs a framework on which to grow and blossom. Roughly a decade old now, by this point, the sector is well-rooted.

Yet considering the boxes that need to be checked, ayes that need to be heard, and committees that need to convene before Washington can effect change, the federal government can only lay down workable regulation as it can.

The pace of development in cryptocurrency, however, is often the opposite: Innovation can happen so quickly that the rest of the industry is left scrambling to catch up. Government roundtables such as the one held last month are a step in the right direction. Congressional stakeholders have already drafted bills and called on the SEC to hand down clearer regulation.

For its part, the SEC this week invited industry players to weigh in on cryptocurrency issues on its new FinTech Hub. These moves on the part of the federal government are encouraging. Working in such a nascent industry ourselves, we know first-hand the importance of sustaining momentum. It is thus incumbent on us to not just be stakeholders - but standard bearers - in creating cryptocurrency frameworks.

Take the US Internal Revenue Code for example. Topping off north of 70,000 pages, the entirety of federal tax code makes for a weighty tome, if not the most plot-driven. Hidden in there among the various add-ons and deductions are but six pages devoted to cryptocurrency. And of the tax guidance that does exist, it's already of a dusty vintage. It dates back to 2013, when the ICO was a brand-spanking-new way to invest.

Dozens of new token offerings later, investors and issuers alike still want to comply by the rules. It's just that the rules in place are outdated. Rather than press forward with their plans, companies looking to make a cryptocurrency-backed security offering are either holding back or setting up shop elsewhere, lest they make an unwitting misstep and run afoul of regulators.

Early this year, the SEC issued subpoenas to an array of US-based coin issuers to ensure compliance with federal regulations on issuing securities. SEC director of corporation finance William Hinman noted in June that most ICOs are securities offerings and accordingly, either need to register with the SEC or meet two exemptions: sell only to investors based outside of the US, or to accredited investors.

Regulation By Enforcement

Now, the SEC is regulating by enforcement. This has left ICO issuers either rushing to comply, or refunding securities, if not both. Issuers are grasping for guidance, either from US regulatory bodies from the get-go; or by way of precedent from other firms. A clear initial framework would have left no ambiguity and given actors the confidence to proceed within guidelines. Beyond ex-post-facto enforcement, however, we need to revisit the idea of accredited investor with regards to cryptocurrency. A college student who spends hours after homework poring through exchanges and studying the price fluctuations of a token has a better grasp of the asset class than a decidedly analog financial adviser working out of a suburban office park on behalf of a wealthy couple nearing retirement. Yet according to SEC stipulations, the non-crypto-aficionado is better suited as an investor.

The exemption for non-US investors in ICOs has implications beyond the effective promotion of offshore investment. As Kiran Raj, chief strategy officer at Seattle-based cryptocurrency exchange Bittrex, pointed out at the Congressional roundtable, having a majority of non-US token holders can expose US companies to a 51 percent attack. Raj, a former deputy general counsel at the US Department of Homeland Security, elaborated a bare majority of actors could exact full control of a given blockchain, allowing them to shut down or freeze a blockchain network. (Side note: a 51 percent attack was a plot point in HBO series Silicon Valley.) While the blockchain itself is secure, promoting US investment on the network would only bolster network safety.

Stepping Up: Leaders are Creating a Brand New Framework

Regulatory ambiguity has left some ICOs bypassing the US entirely. Some recent international offerings have overshadowed US-based fundraises. Moreover, some jurisdictions have positioned themselves as cryptocurrency destinations. Malta is at the forefront of cryptocurrency trading, as are longtime offshore investment destinations such as Bermuda and the Cayman Islands. This article in Hong Kong paper South China Morning Post mentions US exchanges such as the Chicago Board of Trade setting rules and promoting cryptocurrency. For as many jurisdictions that beckon cryptocurrency investment, many more are feeling in the dark. That doesn't give US regulators the excuse not to have a playbook at the ready.

This is where we, as cryptocurrency leaders, can step in. The sketchier our framework, the more vulnerable the sector will be to sketchy behavior. As experts in such a new and ever-changing industry, we need to step up and come with a rulebook in hand. We at BX3 Capital provided a draft on cryptocurrency regulatory framework on these very topics: token categorization, the definition of "accredited investors," and capital formation. The SEC's FinTech Hub is a positive move, though we need to be proactive in giving the answers.

Sean Penn as Jeff Spicoli in Fast Times At Rigememont High / SouthFlorida

Too many observers think cryptocurrency is a bogus concept. Let's heed Jeff Spicoli's advice and not be bogus ourselves.

ABOUT ANNE SZUSTEK TALBOT