HOW TO FORECAST BITCOIN prices PART 2 (for beginners and intermediate) !

Two simple forecasting methods

In our previous post we discussed the different types of forecasting methods that exist. In this part we will focus on the two most simple forecasting methods. They are well known and often used by almost everyone. The two methods we are talking about are the Moving averages and the Exponential smoothing. Before we get into the mist difficult and advance forecasting methods we have to explain the simple methods. In order to master an art you have to master all levels of the art, the same counts for forecasting. Just like the cartoon "avatar ang", you will have to become master of all the elements of forecasting.

Moving averages

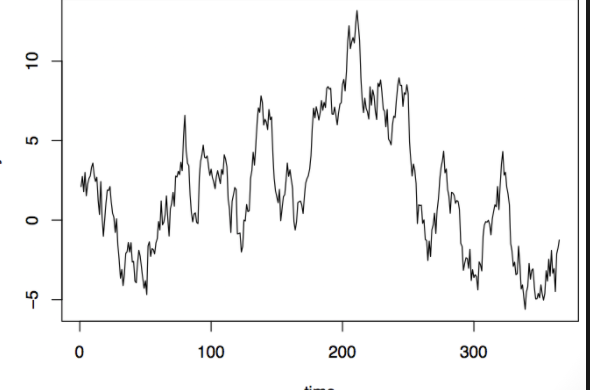

Moving averages are used to reduce the 'noise' in data to uncover the underlying pattern by smooting out random variations. To explain it in a more simple matter lets look at the two graphs below.

This graph is known as a time series. The reason it is called a time series, is because time is part of the series. When forecasting bitcoin prices you will have two components that are important. One is the bitcoin prices and the other one is "time". This graph above is a very basic time series. The bitcoin time series will not look like the one above. This graphs represents an easy pattern, and is we can see the variation, is changes in a multiplicative way. When we forecast this graph we want our forecast to contain the almost all the information possible in this time series. The more the forecast takes into account, the more accurate forecast will be.

So what's this smoothing?

The time series below is a good example why this smoothing can be useful. As you can see the variation changes drastically different over time. When we make a forecast of this time series, the forecast might not take every variation into account. What we want is that it does take into account most of the variation and therefore, we smooth out this variation, so that it can be taken into account when forecasting.

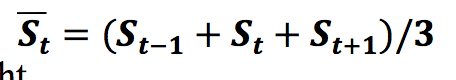

The moving average is really simple. The way it is calculated is by adding the previous three means and dividing it by 3. Apply this formula to your spread sheet in excel and you will be able to forecast the future price of bitcoin (highly un accurate method). One thing you have to take into account we do not know ST+1, so instead of St+1 we will now use ST-2. Let us know explain this formula, ST= the current price and ST-1= the previous price of previous period and St-2 is the previous price of two previous period.

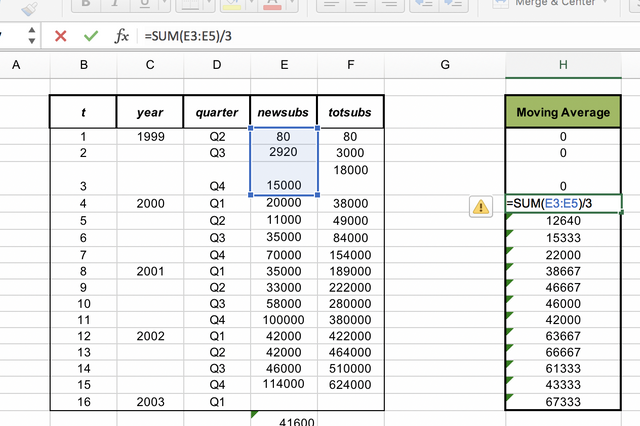

This all may sound a bit confusing, so let's give an example by using one of our spread sheets:

AS you can see, we basically take the average of the first three periods and divided it by 3 and the value we get it the price of the next period.

*** remember to define the period, in our example one period is equal to one quarter= 3 months.***

Exponential Smoothing

We just explained moving averages, now we will explain exponential smoothing. Exponential smoothing is a combination of the current period's price and the previous period times a factor. The formula you can use on your excel spread sheet is the following:

a is the factor that lies between 0 and 1. You can define a on however, you want to, but it has to be between 0 and 1. The closer to one the less variation you take into the forecast, the closer to 1 the more variation you take into account in the forecast. You sill see a lot of St, the St is just the price of the particular time give.

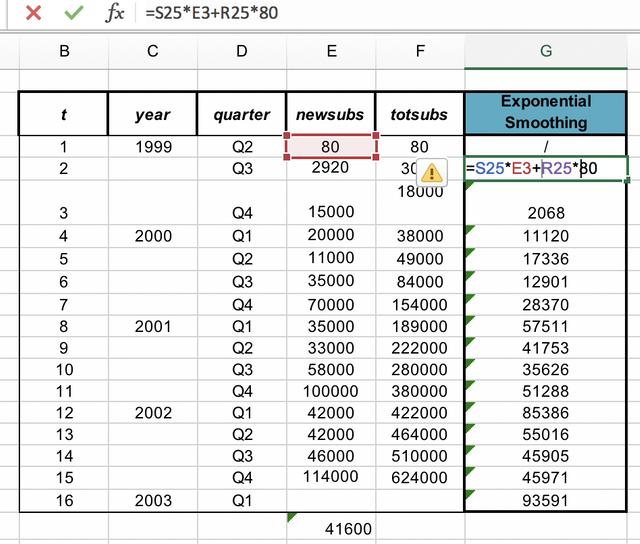

Once again it all may sound confusing so let's give another example by using our excel spread sheet:

S25 is the current period E3 is the factor we were talking about in our case we chose 0.3.

Now that you know the moving averages and the exponential smoothing, it is time for you to practice.

We will next talk about the method that is mostly used in practice and in professional companies. That method is the regression. Regression is really important for forecasting. Stay tune for the next part.

Hey everyone, If you got any questions regarding forecasting, or anything else just let us know ;) cheers.