3 Reasons why you should use a portfolio tracker not to lose money

First question: Are you a trader?

This post is talking to those who are already in crypto trading business or those who are spending time with a significant amount of money to become one...

second question: Are you a successfull trader?

definition of being successfull in trading business can be totally different whether you're trading in forex, stocks or cryptocurrencies. planning for long-term investments or short-term trading or even day-trading and grabbing swaps in volatile market of crypto, makes a huge difference in the percentage of profit you expect everyday, or the measurements you have to follow for managing your portfo more effienciently..

and the last question: Do you count on crypto trading as a primary job?

As a matter of fact, trading stocks is considered to be a profitable job. but in crypto investment and trading its a little bit different and it can be a double edge sword. But why?

in Forex or the market of other stocks, you're dealing with a highly controlable, stable, and reliable market in which you can count on your trading strategies, TAs and FAs. Also the indicators are working usually very well and there are always some bullish markets for a day or two in order to achieve profits as an even daily salary. but in cryptocurrencies, with its high volatility, and it's unsettled, sentimental and sometimes wild market trends you might experience days of waiting for opening another trade, or even tolerating sometimes high negative percentages of downtrend while investing on something you strongly believe in. indicators are not that readable sometimes and everything can act against your predictions and expectations.

but if you get professional in crypto trading and focus on its exceptional patterns, you can get limitless amount of profit every day. there are lots of coins that are having sometimes 5 swaps in a day with more than 15 percent profit. if you can use them, just calculate how much can it be:

it means you can have at least 100% profit per day. although with some strategies for risk management and diversifying your portfolio, it's logical to expect less. but imagine you can raise your budget about 50 percent a day. professionals understand what I mean.

after all, managing your portfolio in crypto market is getting more vital and understanding how you're performing and how much your do-nothing scenario space to the orders you open, is the very essential part of success plan.

I personally have checked, worked for a while and reviewed many (or better saying "ALL") crypto portfolio trackers available. I have worked with every one of them for a while, experienced their cons and pros and eventually decided to write this post to share the result.

the gist of my review is one thing:

Three most vital features a portfolio tracker should have includes:

1-It should be able to accept API from exchanges. and believe me its the most vital feature, otherwise you'll stop using it after a week or two. trading can be sometimes stressful and time-consuming so you can't mannually enter your assets in the app even if you use an android version.

2-It should prepare as many statistical reports as possible and all of them with meaningful charts and numbers. tracking portfolio is not just having a balance page and its equivalant to the national currency of yours. it should contian other stats like Tax-free efficieny, realized and unrealized gains, current,daily and monthly trend of your balance, and some other tax reports which are neglected in many trader's strategies for calculating their profits.

3-You should be able to eport your reports in a readable data sheet or any meaningful template. If you're a trader and you have accepted it as your primary job, you should be able to give proofs about your performance.

you can register in this website to get started tracking your portfolio using this link:

https://cointracking.info?ref=H587544

Here's a quick tutorial to know how you can import your API in this tracker:

First of all for any exchange you use, there is a Creat API part you have to find

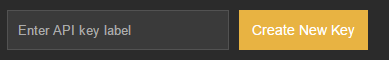

As you may need create several APIs for different purposes, for every use you have to create a new API. some websites are useful for using API to trade remotely without need to loging in to your actual account. it can be for safety purposes or using a wider range of indicators or even using binary trading programs to open trades automatically.

note that it's vital to uncheck enable trading for this website. make sure you have written the key and secret key somewhere safe and accessible too.

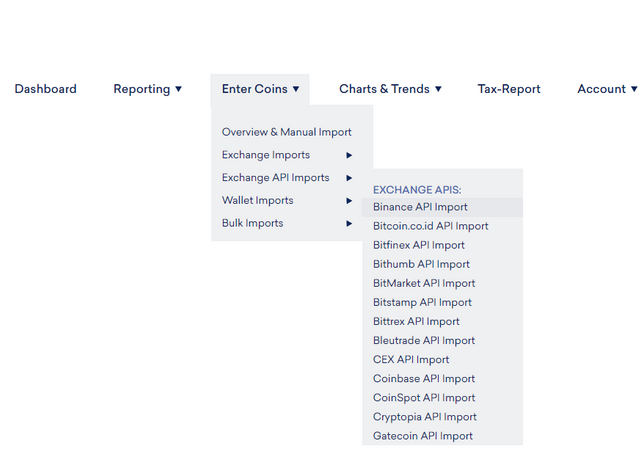

As you can see, cointracking has a wide list of all the exchanges you may possible be active at.

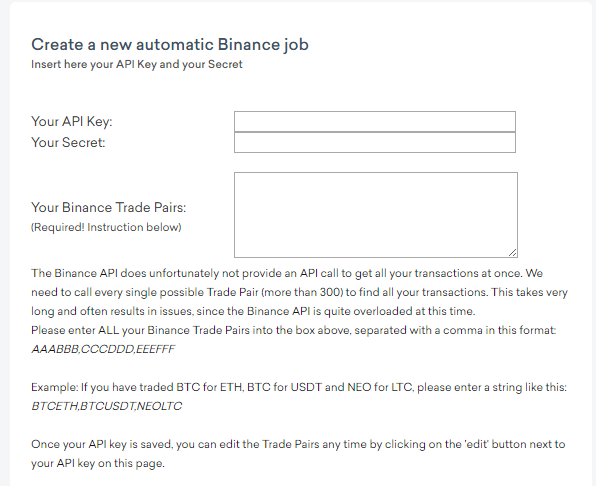

you then just need to fill in the API keys you got earlier in the exchange.

Share your trading experiences and every feedback will be appreciated. if you find this post useful, you can upvote and resteem and also say how it could get better.