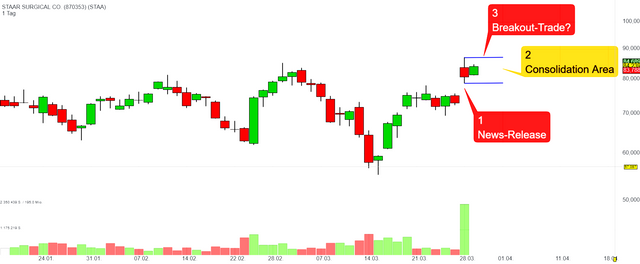

👓📈 STAAR SURGICAL ANALYSIS

1

Shares of STAAR Surgical were surging after the company announced that the U.S. Food and Drug Administration (FDA) approved the EVO/EVO+ Visian Implantable Collamer Lens for correcting myopia (nearsightedness) and myopia with astigmatism.

STAAR Surgical needed some good news. The healthcare stock had fallen more than 60% from its peak, set in September 2021, as of earlier this month. The FDA approval for EVO provided a well-deserved boost.

EVO has already won regulatory approvals outside of the U.S. Over 1 million EVO lenses have been implanted in other countries. STAAR's ex-U.S. momentum has been picking up, with EVO sales increasing 51% year over year in 2021.

The company should have a tremendous opportunity in the U.S. market. It's estimated that there are around 100 million U.S. adults between the ages of 21 and 45 who are potential candidates for EVO.

STAAR was already banking on FDA approval of EVO. Its full-year 2022 revenue guidance was for $295 million, a 28% year-over-year increase.

2

Since 28.03.2022 the stock is consolidating within an area ranging from $87.12 - $78.82.

WHAT DO I EXPECT NEXT?

3

I can imagine that the Staar Surgical stock will continue to consolidate within the range and might break out of its consolidation channel as soon as the entire market has strength. If the stock moves above $87.12 with higher than average volume, it might be beneficial to buy the stock. When the stock price closes below its temporary low at $78.82 the trading scenario is invalid.

What are your thoughts? Leave a comment down below 👇

🚫 No investment advice, I am just displaying my personal opinion which might be wrong!