Wagerr: Value Coupling and the Deflationary Economy

Wagerr is a revolutionary decentralized sportsbook, which brings trust-less sports betting to the entire world. Using a decentralized blockchain, Wagerr will elevate the sports betting industry, and usher in a new trust-less era of fairness, availability, and security. The Wagerr main and test networks will launch simultaneously on Jan 15th, 2018.

Be The House

You know how they say, “The House always wins?” That’s because bookkeepers bet on a sure thing: fees. Bettors win and lose, but steady fees provide a reliable income. As much as people may enjoy the thrill of betting, it sounds kind of nice to be the House, doesn’t it? Well, Wagerr allows everyone involved to win in two compounding ways.

The most straightforward way to “be the house” is by operating an Oracle Masternode, a network component (or consensus agent) which earns half of Wagerr’s service fees for performing bookkeeping services. Oracle operators collect fees and systematically win, just like traditional bookkeepers. Read more about Wagerr’s Oracle Masternodes here.

Additionally, there is a second protocol which allows any member of the Wagerr economy to win, by means of simply holding Wagerr tokens in their wallets. This system is accomplished through a mechanism we call “value coupling” and the deflationary mechanism built into the ecosystem.

Any solution to the problems of the sports betting industry must serve the interests of sports bettors and satisfy the needs of the contributors who maintain the security and functionality of the network. Such a solution must include mechanisms which stabalize the value of the network’s underlying token of exchange, whether adoption dramatically rises or falls.

Wagerr combines complex technical designs with a circular economic model, which creates a deflationary, and self-regulating economy. Structural mechanisms balance Wagerr’s token value by dynamically adjusting its supply based on the current exchange rate and betting volume. This built in functionality ensures the value of the token is tied to the usage of the system.

The mechanisms built into the Wagerr model will have a powerful and positive effect on its economy, as well as on the token’s long-term value. This results in an overwhelming value proposition available to all users.

Value Coupling

The term “value coupling” refers to a systematic linkage between the usage of the token, with the market value (price) of said token. In the case of Wagerr, value coupling refers specifically to the linkage between the betting volume over the network, and the price of the Wagerr token (WGR). The Wagerr blockchain achieves this linkage through the destruction of a portion of the betting fees. Simply put, the value of WGR token is systematically tied to the use of the sports betting blockchain.

Wagerr charges a modest fee for betting services, just like traditional bookkeepers. But unlike mainstream bookkeepers, the Wagerr blockchain systematically destroys almost half of every fee. Since this reduces the coin supply, increased adoption of Wagerr as the sports betting blockchain of choice, gradually drives up market value. What's good for bettors is great for investors; it's a simple matter of supply and demand, determined by the rate of burning versus the rate of minting.

The price of WGR dynamically affects the burn rate. High priced WGR means a declining burn rate and therefore, market stabilization. Meanwhile, low priced WGR means an accelerating burn rate, which mitigates inflation, and ensures price declines are temporary.

Nearly half of all fees are systematically destroyed — and destroying fees diminishes coin supply. Again, it’s a matter of supply and demand: Given steady demand, free markets tend to respond to a dwindling supply with rising asset price. Holders of the asset will only sell it for the highest price the market will bear. This is illustrated below:

The value coupling mechanism is extremely important in facilitating peerless direct chain betting. Peerless betting does not require a complimentary transaction to forge a bet contract. Any bettor can initiate a contract on chain, which the Wagerr network is programmed to pay out if the bettor wins. Peerless betting maximises flexibility for bettors. However, this risk must be balanced.

The blockchain pays out winning bets which are confirmed thanks to Oracle Masternodes, by minting coins for the pay-out. This means the blockchain does accrue some risk of coin supply expansion through forging such contracts, but such risk is balanced by several factors.

Losing bets systematically destroy coins, creating a balance over time. That’s because 48% of all betting fees are destroyed, tipping that balance in favor of net coin destruction from direct chain betting.

In fact, because losing bets destroy more coins than winning bets generate coins on the network, an intrinsic advantage is created for all WGR holders in terms of coin supply. Specifically, on a losing bet of 100 WGR, 96.88 WGR would be destroyed; by contrast, on a winning bet of 100 WGR, only 94 WGR would be generated. This imbalance constitutes the house edge of approximately 3%.

Through this value coupling mechanism, betting activity over the Wagerr network fuels supply destruction. This deflationary engine drives the value of WGR over time. Thanks to this powerful engine, anyone who holds WGR potentially benefits from Wagerr’s “house advantage” — meaning that the Wagerr token has great potential to rise in value.

As a result of value coupling, betting volume drives WGR token value. The enormity of the existing sports betting industry suggests that when Wagerr’s disruptive technology succeeds in securing only a fraction of the sports betting market share, the betting volume would be enough to drive a deflationary economy, one in which the rate of coin destruction exceeds the rate of coin generation.

Watch our small presentation about value coupling here.

Deflationary Economy

In the Wagerr system, when price declines, deflation accelerates and corrects the price. Following is a brief break down:

Since bettors tend to bet consistent amounts in their local fiat currency (e.g., USD or Euros), when the price of WGR declines, the local currency buys more WGR. So, the user who usually bets $100 USD gets more WGR for $100, and the service fee — a percentage of the bet — is also a proportionally larger number of WGR coins. Since about half of that fee is burned, even more WGR are being destroyed when the price of WGR is depressed. This built-in adjustment is like a self-correcting mechanism for the economy, and it allows WGR to function as a consistent store of value, not merely a token of transient or speculative value.

The Wagerr network reduces the risk to value ratio and protects holders of the WGR tokens by linking betting volume to coin supply. This value coupling, between usage and supply, creates a built in deflationary mechanism which destroys 48% of the fee from every bet. With fees of 2%-6%, the net result is nearly 1%-3% of every bet permanently removed from the network.

For example, if price falls dramatically, significantly more outstanding supply is destroyed with every bet, because bets now require more WGR. Conversely, if the price rises drastically, significantly less supply is destroyed. Over time, this leads to less market volatility and an asset value which more accurately reflects both adoption and usage.

Wagerr’s systematic destruction of fees thus creates supply scarcity over time. As the average volume of betting activity over the Wagerr network rises, the value of WGR rises alongside it, enabling all investors to participate in its continuous growth potential by simply holding WGR tokens.

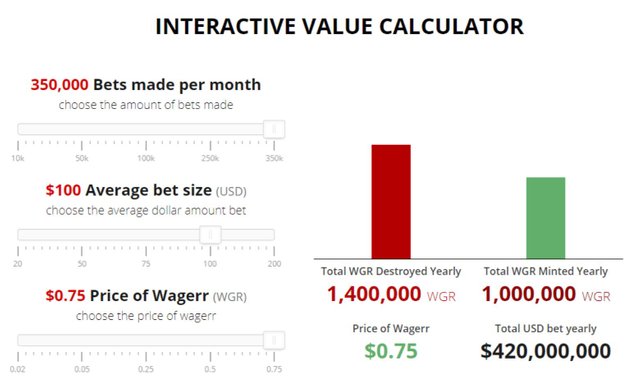

At any point in time, the price of WGR combined with the volume of bets, defines how much deflation takes place on the Wagerr blockchain. See for yourself how these three variables determine a specific output with the calculator here. One example is shown below:

Wager is designed to be more than a blockchain, it is designed to be a responsive and price linked economy. For users to feel safe holding the token, and to bet with it, they need to have confidence in the value backing the token. In Wagerr’s case, the method of ensuring that the value grows over time is by creating a deflationary economy.

This allows a bettor the potential to ‘win’ just by holding their bankroll, or a portion of it, in WGR. For recreational bettors who see a loss over time caused by the house edge, this has the potential to offset such loss and create an environment where a player can bet for fun, lose marginally over time, but have the loss counteracted.

You don’t have to be a bettor, an investor, a trader, or even an Oracle Masternode operator, for a high probability chance to win by obtaining and holding WGR. Wagerr is optimized for growth. The mechanisms for controlled scarcity of the token supply, mean that as Wagerr adoption rises, systematic destruction of fees puts upward pressure on the price of the token. Those who hold WGR, and operate a standard staking wallet, will accrue newly minted WGR in exchange of securing the network.

As a result, it is much safer to hold WGR over the long term, because even if the price goes down, there’s protection for the holder. The deflationary engine makes WGR a great store of value.

The Wagerr team didn’t set out to make a “currency”. Instead, we have engineered an economy. The key to the model’s design has been the structuring of incentives to reward and maintain behaviors which add value to the Wagerr network, and devising subsystems which translate the Wagerr network value to the WGR tokens value.

As long as a modest fraction of the trillion-dollar sports betting industry adopts the Wagerr network for betting, the value of the central token, WGR, will systematically be sustained in a relatively stable growth trajectory with dynamically moderated volatility.

Feel free to get in touch with us via any of our official social media outlets mentioned below.

- Website: https://www.wagerr.com/

- Twitter: https://twitter.com/wagerrx

- Facebook: http://www.facebook.com/Wagerr

- Discord: https://discord.gg/a9XRG43

- Telegram: https://t.me/wagerrcoin

- Medium: https://medium.com/@WagerrSports

- BitcoinTalk: https://bitcointalk.org/index.php?topic=1911583.0

- SteemIt: https://steemit.com/@wagerr

- Reddit: https://www.reddit.com/r/Wagerr/

- Whitepaper: https://wagerr.com/wagerr_whitepaper_v1.pdf

holdling

Long time supporter here.

Very curious to see how the platform will do! And I would love to know a bit more about MN setup.

You should check Fast Invest ICO http://bit.ly/2DiZlTt

Congratulations @wagerr! You received a personal award!

Click here to view your Board of Honor

Congratulations @wagerr! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!