Bank of the future

2017 saw two major global and local trends come together making 2018 possibly the best year to start a banking revolution the likes of which the world has never seen.

First, people across the globe losing faith in financial institutions due to their socio-economic biases and instead turning to decentralised systems and cryptocurrencies at an unprecedented rate driven by blockchain technology. Second, India’s credit growth at its worst in decades primarily due to Indian PSBs accumulating huge NPAs over the years.

The Indian government has been trying to solve this financial puzzle in their own way. First they named and shamed the debtors with a well intentioned bankruptcy code (IBC) which enabled banks to liquidate assets and speed up loan recovery. Then as usual they called on the taxpayers by using their hard earned money to fund the incompetence of bankers with bank recapitalisation. The final nail in the coffin came with the proposed FRDI bill which attacks innocent deposit holders to bial-in banks which are neck deep in NPAs and are on the verge of a complete collapse.

After such mismanagement at banks and with bitcoin & crypto revolution knocking on our doors, a pertinent question has risen - Does India need a crypto banking revolution and if it does, what would it look like?

Do we need a crypto banking revolution?

The reason bitcoin was so successful wasn’t only because it was a new digital currency or that it successfully solved the complex double spending problem, it was because it created an incentivisation system to run the bitcoin network using blockchain in a completely decentralised and transparent way. In this context, blockchain isn’t just new age technology, its a whole new business model in itself. It enables us to create things which were never possible before. It’s a new paradigm.

In the entire NPA mess, central bank’s role came into question repeatedly and why it was slow to respond, letting NPAs rise to unprecedented levels. Some banks hid or are still hiding NPAs in their balance sheets with financial jugglery [1]. Would the same thing happened had our banks been decentralised and transparent? Should our central bank just be a consortium of de-central banks?

If our goal is to create a banking system which can last a century and propel us to become one of the top 3 economies while truly serving the people in a transparent way, we need a crypto banking revolution.

Crypto banking like most new technology trends can draw a lot of parallels from a 3 phased adoption of PCs and EVs (Electric Vehicles). Like car makers, banks would need to be shown a way to transition by threatening their very existence with a far superior banking experience till they reluctantly join it. You would need a trailblazing Tesla Roadster catering to the early crypto enthusiasts. A Model S catering to the middle class and finally a mass market product in Model 3 with a goal of financial inclusion. So to begin with you need a blueprint and a solid foundation to create a crypto bank for crypto enthusiasts.

What would it look like?

In order to answer this question, we need to better understand what is a bank and how is it structured.

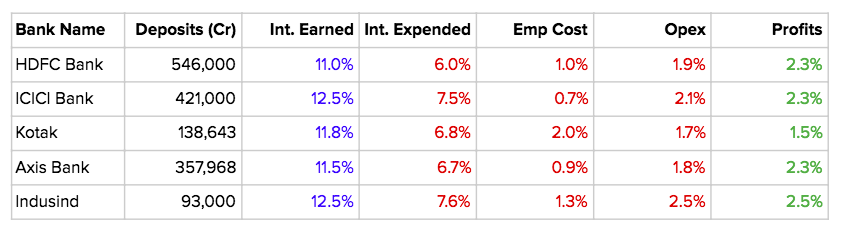

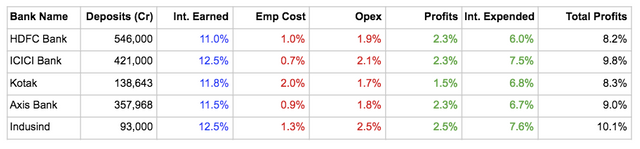

A bank is a financial institution that accepts deposits from the public and creates credit [2]. Yeah just that - takes deposits and lends them. Rest of it is all fluff. If you condense the financials of top 5 private sector banks in India, it looks something like this:

Source: Moneycontrol

So on an average a top private sector bank earns 12% by lending deposits, pays 7% to deposit holders in various forms (FD, savings interest etc), spends 1% on employees, 2% on operational expenses while generating 2% profits in the process.

I am sure some of our banker friends would be quick to point out that this is a very simplistic view of looking at a bank and that banks are deeply complex creatures. All organisations end up becoming complex as they venture into multiple business verticals but at its core they are driven by some key metrics. We need to identify these variables, analyse them, question them, churn them and only then can we re-imagine a new model.

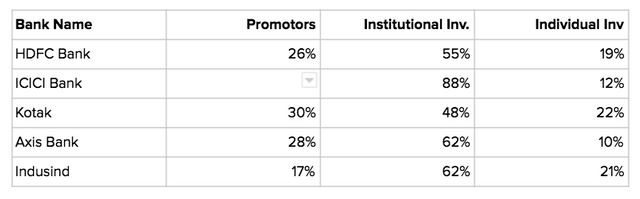

It’s also important to understand the shareholding pattern of a bank since that gives you a clearer picture of how profits or dividends are distributed and how investors are incentivised.

Source: Moneycontrol

On an average, 20% is held by promoters, 60% by institutional investors and 20% is owned by individual public shareholders. Here we have only taken into consideration top 5 private sector banks in India which represent the gold standard for ‘banking done right’.

We now have a good understanding of some key metrics which helps us create the blueprint for a crypto bank of the future.

- A whole new banking structure

Ever wondered, why is a bad loan treated as a non performing 'asset' while your deposits which fuel the banking system treated as a liability?

Why are banks, which aren’t making a dime and losing money instead, made liable to pay same interest rate to deposit holders as HDFC which is the most profitable bank? This makes almost 200+ banks virtually indistinguishable to the average person and prevents true capitalism from kicking-in.

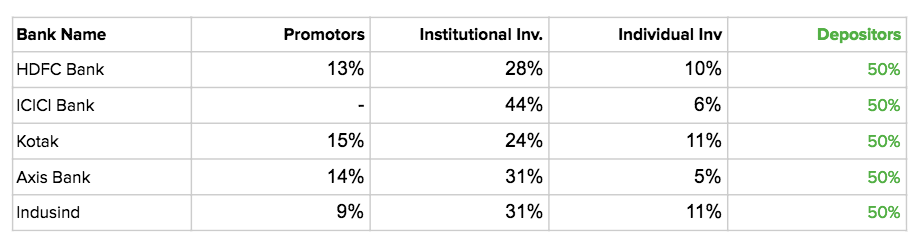

A crypto bank needs to reinvent this paradigm by changing the balance sheet structure with a new age incentivisation model unlike any other. For long term sustainability of a decentralised banking model, deposit holders can't be incentivised based on socio-economic policy of the central bank, it should be based on how the bank is performing and its plans going forward. A crypto bank would treat deposit holders as token holders not liabilities.

With blockchain based smart contracts, a crypto bank can issue smart tokens proportional to the deposits you hold. The function of a token is similar to a share. It receives dividends and appreciates in value based on how the bank is performing. Depositors earn more tokens based on their deposits, financial transactions, loan repayments, etc. as predefined in the smart contract. No surprises.

With these structural changes the new balance sheet and shareholding pattern would look something like this:

- Fully Digital & Global Bank

A crypto bank in 2018 would be completely digital and mobile. That's a huge advantage than most people realise. Most of the technology used at current banks is decades old and primitive. A new bank born in 2018, has some of the best tools of AI, ML, cloud computing at its disposal to personalise banking experience and create new financial products. Most importantly a fully digital bank would result in massive increased efficiency and productivity thereby reducing its employee, Capex and Opex overhead (almost 90%) which maximises shareholder and deposit holder returns.

A digital bank catering to the Indian market cannot afford to be restricted by geography. India has one of the richest and diverse diasporas around the world. We rank #1 in inward foreign remittances receiving an estimated $80 Billion every year. In the process, we lose billion of dollars in exchange rates and transaction fees. A crypto bank which uses blockchain needs to think global from day zero in order to solve this for the long term ensuring near zero transaction costs over blockchain for international transfers. Ripple has been able to execute this quite successfully making near instant international transactions possible.

- Core Banking, Payments & API Marketplace

Core banking system (CBS) is a store house which enables all banking transactions - holding deposits, lending, payments etc. A new age crypto bank needs a robust core. A crypto bank would be built on cloud and micro services architecture compared to most banks today which use mainframe technology and have monolithic architecture. This enables a crypto bank to deploy financial products and react to changes in days rather than weeks or months. The backend systems can primarily be composed of micro services communicating over modern data-pipelines, using blockchain based primary data store.

A crypto bank would need to recreate its very own payment rails to reduce cost and time per transaction. Today, the biggest problem with blockchain or bitcoin based payments is that transactions take a lot of time since they need to confirmed by multiple nodes in the network and cost a bomb. In case of bitcoin, sometimes even 5%. Segwit hard fork tried to solve this partially for bitcoin by doubling the block size but the answer seems to be forming payment channels across a network and making off chain transactions similar to Lightening or Raiden Network and then broadcasting it to the main blockchain later.

Finally, a crypto bank would be driven by APIs. It would act as a financial control centre for its users providing all financial services at one place. It would make financial identity portable on the lines of PSD2, the way facebook made personal identity portable. You would be able to take your financial identity to avail various financial services not necessarily provided by the bank, the way you use facebook login on Spotify or Tinder. It would have deep integration with global and local fintechs using Open APIs creating a global banking marketplace. The fintech revolution saw an unbundling of banking and financial services, crypto banking revolution will oversee a rebundling of financial services with crypto bank at the centre of it all.

Congratulations @varundeshpande14! You received a personal award!

Click here to view your Board

Congratulations @varundeshpande14! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!