5 Interviews about customer-funding models - For startups, the best way to survive!

In my country it is not quite easy to have a meeting with an Angel or VC unless your business has already generated some impressive revenue or has a huge number of active users. I am in China, Beijing, BTW.

So I did interview 4 entrepreneurs and 1 investor. First one, his ID name is “Tiandao chouqin”, who is IT doctor student and taught in college now. He said he came out an unquiet arithmetic which is knid of like blockchain tech and can share the data or CPU with nearby cell phone users. He said he got copyright last month and really want to build a startup based on his IP tech. In his thinking as long as he can build a team and come out a prototype of his arithmetic application, he can easily raised money from VCs. I told him this courser on Coursera. His answer is he is too busy to raise money , so that moght have no time to check it out. I asked him to consider the customer-funding business model. But for him this is smaller picture than what in his mind and he refused to even think of it. My opinion is he is far away from a successful entrepreneur, unless he failed a lot and become a humbler learner. I try to help him and offer advices but it doesn’t work. He need to grow up in his own way.

Second one is better. His name is Jun Yang. He is a programmer as well who is working for several startups as IT support. Now he is developing an APP for pets. He told me he is not family with how to promote and generate money in current team. That was not his job. But he is interested in learning this course on courser. And he feels the reason of failed lots time, is the knowledge his team have, which limited the ability they make a good decision. He has the same feelings about raising money from VC as the former one. They call believe as long as they can raise money from VC they can survive. So they totally ignore the possibility of customer-funding. Spent no time on customer side. I think for them who never has a second or optional plan they are doomed to fail.

Third one is a designer who owns a small graphic design company and hired 10. His name is Yan Zhang. He is survived for 5+ years based on his customer-funding model. He totally understand there is no opportunity to raise money from an outside investors. So at the beginning, he and his 2 co-partners, they focus on reach value customer one by one. And hire more designers based on their new customers’ needs. It is make sense for this type of small company to survive. But the downside is they don’t know how to expand their business using more capital. It seems no need for the outside investment. If the customer-funding works what the demand of outside money? I can not answer his question either. Looks like for some of business model, like CPA, law firm or architect’s office, they offer professional service which is not tech drive. It is easy for them to bootstrap but that is all.

Fourth interview is a successful blockchain trainer who just built his learning group 1 month and has already gathered 1875 people, and generate huge revenue. They build a small team from their early adapters. The service fee is from $50-500 based on the order you joined the group. Like, If you are the first 50 people who joined, the fee is $50, if you are the first 100, the fee is $100. And they early adapter who can share their learning on writing the articles in the group too. If he generate more than 20 accepted articles he can get refund of his service fee. In this customer-funding model, they successfully expand to more friends on WECHAT or FB. Also the users are glad to sharing their class review by article which can help them promoted more. I see a healthy circle in this business model. The name of this group is "JINMA teach you block-chain". I am a member in it too. I feel not only learn a lot of brand new dynamic top block-chain knowledge from here, but also meet a group of awesome people here. We inspired and courage each others. The core value of this service is not only save my time on researching valuable and high-tech new update block-chain knowledge, but also help me get one-to-one coach service. You can fells a group of real person who just live besides you and will help you on-line at anytime. Also i got great stimulated from their daily activities. Try to follow their steps is a great way to push me to learn more.

The fifth interview is a investor who we met each other for 5 years. His name is Xu wang who is a co-founder of small VC firm.He told me because of the low tide of investment industry, their firm changed more conservative on the startup. For them the high tech background is a crucial stander but besides that your company must have already generate the successful data on how to survive, and how to expand. For the VC what's the vision and how can your business changed the future customers' habits or lifestyle is another aspect influenced a lot.

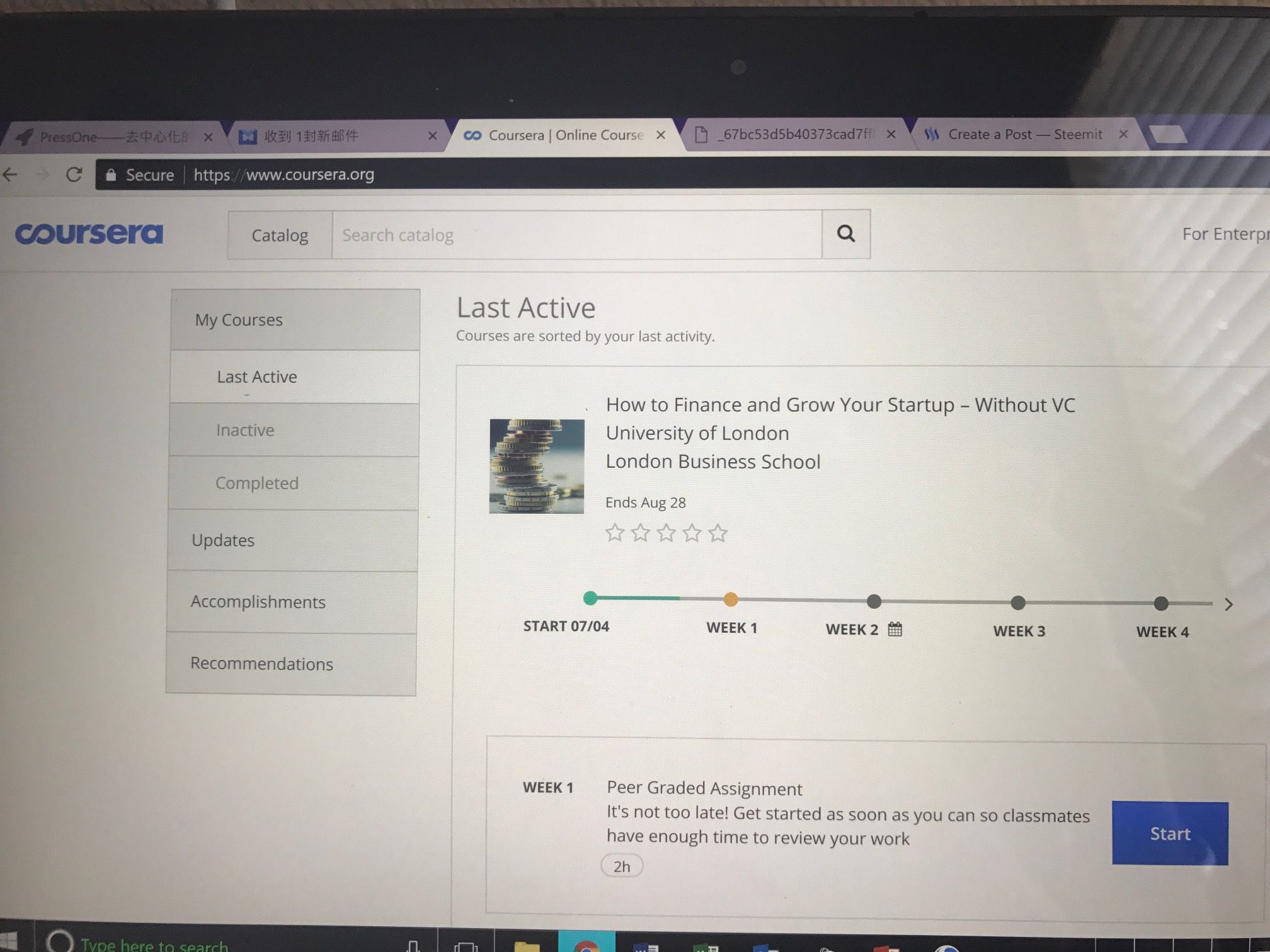

I took the course name is "How to finance or grow your startup with VC" on Coursera now. So will share my learning and some investigation with all of STEEMERS. Hopefully you will like it.!

Wow this is a great post!

I have a startup that is finally getting out of the incubation stage, we have meet with Investors and VC's .... the deals never felt right.

This early in the game I'm happy where we are and where we are headed.

Great post, thanks for the insight.

Thanks for ur reply~ feels encouraged now