What Is Blockchain Technology?

A repost from my blog at bitcoinbuildify.com

I tried to make the general principles and nature of blockchain technology as clear as possible. Feel free to let me know how I did.

The granddaddy, so to speak, of cryptocurrencies is Bitcoin. And we cant talk about Bitcoin without talking about the "blockchain". Both terms have been tossed around increasingly with the rise in popularity and interest in cryptocurrencies in recent months. Ideas about "crypto" are varied and, generally speaking, public knowledge in this area is scant to say the least. And experts, even on the inside of the industry, are relatively few. Yes, it's strange but true. The movement Bitcoin has generated since its creation in January of 2009 is still very new. But the momentum behind it is steadily growing and many believe that it's really not a matter of if but when this new wave of technology completely revolutionizes how "data is done". You see, blockchain technology is applicable to a lot more than just digital currencies. Blockchain technology is actually about as applicable to the many different industries and technologies in our world today as is the internet.

However, just like in talking about the internet you could write volumes and volumes and still not really get anywhere near describing it in full I'm not going to go too much outside of the realm of Bitcoin/cryptocurrencies in this post. So, as I do my best to lay out a basic explanation of what blockchain technology is, keep in mind that it has implications way beyond what it is currently being used for. It is also a very new and constantly changing world. The changes and developments likely to come in the next 5 to 10 years will be amazing and the only limit seems to be the imagination of the teams working on this stuff.

If you really want to understand how the blockchain works and its significance, we recommend the Bitcoin whitepaper. The entire system is explained very clearly. It is a little bit on the tecnical side, though. And a decent understanding of math along with an appreciation for cryptography would help in getting through it. The general idea of blockchain technology and digital currency is quite simple but the details are, well, detailed.

Personally, I believe this is probably why it took Bitcoin so long to take hold: too few people could appreciate its implications in the early days. Bitcoin was seen as "one of those internet things" and remained in relative obscurity for years before finally taking hold on the public stage. As with a lot of revolutionary technolgies, very, very few people understood or appreciated the potential until it became totally obvious and mainstream.

Today, we are roughly at the same stage with cryptocurrencies as we were with computers in the early 90's. Where it goes from here is almost impossible to say. But most, including myself, believe that we will likely see a revolution in finance and the secured exchange of information via cryptocurrencies in the same way we saw a revolution in access to information via the internet.

BUT FIRST, SOME HISTORY

It's always a good idea to give a little background to how things started and why they are the way they are. Hey, if you don't like it, jump down to the section "what the blockchain is". But if you're even a little bit curous about how it all go started, keep reading. Sometimes it can be a good thing to know what the heck happened before everything else happened.

Probably the oldest reference to something approaching the idea of a blockchain can be found in a paper entitled "How To Time-Stamp A Digital Document" by Stuart Haber and W. Scott Stornetta which was written in 1991. In it, they mention the difficulty of proving a digital document is an original in a consistently repeatable way. The basic idea is broken down into three questions: 1) how can one demonstrate that a digital document is not a copy of something else and has not been altered since it was created 2) how can the details of the data (the specific content) be protected while its identity is maintained and 3) how can questions 1 and 2 be answered and done so via a service that doesn't rely on a 3rd party (because 3rd parties have always been the source of corruption and failure throughout history).

All very hard questions in a copy and paste world where just about anything digital can be copied with 100% accuracy and without leaving any provable connection to its source material. It turns out that a lot of what it takes to satisfy the first two questions rests on being able to prove when a digital document was created as well as finding a way to mark the data and not necessarily the content. The third question of doing it without relying on a 3rd party is where what would come to be known as the blockchain comes in. As the authors say themselves in the abstract on the title page for the paper:

“The prospect of a world in which all text, audio, picture, and video documents are in digital form on easily modi

able media raises the issue of how to certify when a document was created or last changed. The problem is to time-stamp the data, not the medium. We propose computationally practical procedures for digital time-stamping of such documents so that it is infeasible for a user either to back-date or to forward-date his document, even with the collusion of a time-stamping service. Our procedures maintain complete privacy of the documents themselves, and require no record-keeping by the time-stamping service.”

Click here to read the paper in full.

To put it more simply, the issues raised were:

how can we prove that unique digital item “A” is really unique digital item “A”

how can we reliably identify or make identifiable unique digital item “A” without having to share its specific contents with others?

how can we do this without using a centralized service and thereby having to trust a 3rd party?

The more you think about them, the more you are likely to realize that these are deceptively difficult questions to answer in a way that would actually work. Which is probably why it took another 18 full years after this paper was written before anybody came up with a system that could successfully do so. That person was the semi-mythical Satoshi Nakamoto behind what would come to be known as Bitcoin. You can read his introduction to the technology here in the Bitcoin Whitepaper. Far more important than the introduction of Bitcoin, however, was the introduction of blockchain technology. That is what is proving to be the template for a whole new type of technology.

The paper’s main focus when talking about digital documents was on ” text, audio, picture, and video documents” i.e. intellectual property and, by extension, any data at all. One notable area where it the capacity of such a technology applies equally well is to digital currency or what some may call “internet money”. And this is exactly what the intention was behind the creation of Bitcoin.

Before Bitcoin’s creation, it remained quite difficult, almost impossible actually, for this technology to be implemented in a way that could allow it to be used in financial transactions i. e. as a digital currency. The main difficulty was what was then known as “the double spending problem”. That is, how can we create a reliable transaction from A to B using digital currency if A can simply duplicate the currency? Bitcoin, launched in January of 2009, was the first technology to successfully overcome this issue. But, even so, it took several years for it to begin attracting attention. And now, with Bitcoin’s growing popularity and, I should add, flawless performance more and more people are getting on board with just what this technology is.

Ok, to the main subject.

WHAT THE BLOCKCHAIN IS

The blockchain is essentially a database. That is an organized and searchable storage of a large amount of information. But beyond this rough definition, the similarities to the kind of database you’re used to thinking of abruptly disappear. This is because the blockchain has an extraordinary level of both security and accessibilty; much more than most databases we currently work with do. And certainly much more than the databases banks use. This part of what makes blockchain technology so accessible. It combines the private and the public. The secure and the accessible.

It sounds strange but, basically, anyone with access to the blockchain has access to all of the blockchain. However, and this is an important point, even though anyone can see any and all of the data stored on the blockchain, it is encrypted. Or, as the term is known, hashed. What this means is that each transaction on the blockchain is encoded into a series of letters and/or digits of a fixed length. But, only the end users with the correct access code can have any effect on it in any way. Which brings us to another important element of the blockchain discussed below.

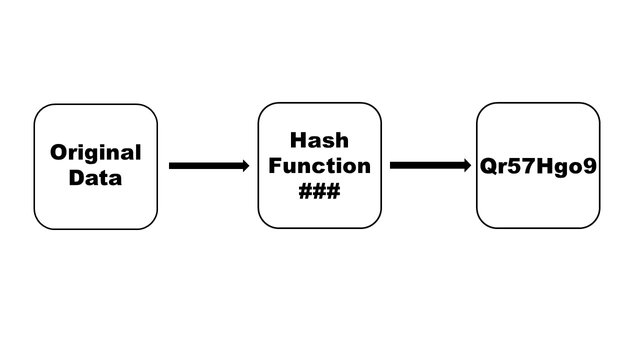

HASHING

You will hear the word “hash” tossed around a lot in regard to the blockchain. It is an abbreviation of the term “hash function” which comes from cryptography. It means “to map data of arbitrary size to data of fixed size”. Or, to put it less technically, to compress an undefined amount of data into a defined number of bits (letters or digits). When you “hash” something, a computer will take the data and encode it into a serial code of a certain number of digits. And you can hash just about any amount of data from someone’s name to the entire Library of Congress and more. With Bitcoin, the transaction is hashed to give it a unique identity that cannot be tampered with.

For example (and for example only) if you were to hash the word “banana” you might get something like “jdsFHtop”. You could then send this code through the blockchain to a public address. Once sent and received, only the person with access to the public address (the person with a private key) could actually receive the deposit. Everyone else accessing the blockchain would be able to see the transaction but would not be able to change it or redirect it. Further, the transaction would be “timestamped” (given an exact time of origin that is verified by the blockchain) on the blockchain making it all but impossible to duplicate. This transaction would also become a part of the blockchain. Or, more specifically, part of a block within the blockchain.

All transactions on the Bitcoin blockchain not only become part of the blockchain itself but are linked in a sequential way. This means that if you wanted to duplicate one transaction you would have to duplicate all transactions prior to it without a single mistake. This is part of what makes the system all but impossible to tamper with. At the time of writing, there were approximately 515,200 blocks on the Bitcoin blockchain each with a rough average of 2,000 transactions. This is equal to over 1 billion separate encoded transactions.

To put this in perspective, even if someone had enough computer processing power to decode and duplicate one transaction per second (which is currently impossible), it would take almost 33 years to catch up to a point where a false transaction could be safely inserted or a legit transaction safely altered. On top of this, there are further elements built into the system which make fraud too expensive, too time consuming or both to be worth pursuing. Realistically duplicating or manufacturing a false transaction on the Bitcoin blockchain would be the rough equivalent of inviting a total stranger to a family dinner and expecting everyone to act as if they’d known this strange guest their whole life. Essentially, it’s not going to happen.

With Bitcoin transactions, the transaction is hashed into 64 bits or digits. These digits will be viewable on the blockchain and miners and visitors alike can see how much Bitcoin is being moved and when. However, what they cannot see is who is sending or receiving the Bitcoin or where in the world they are. The identity of the end users and their location being kept private is part of what makes the blockchain such a potentially powerful and truly peer-to-peer system.

WHAT ARE THE BLOCKS?

If we were to imagine the blockchain as a book or ledger of transactions, each block could be imagined to be a page in the ledger. This analogy of a ledger is quite accurate, actually, and so the information contained in the blocks shares a lot of similarity to the structure and content of ledgers you might find in real estate, accounting or even the stock market.

However, what is totally unique about the “ledger” that is the blockchain is its highly private yet highly accessible nature. Literally anyone in the world with an internet connection can log on to a “blockchain browser” (a website displaying the blockchain its activity in real time) and see what is going on. Our personal preference is the website blockchain.info. To see actual blocks on the blockchain displayed in a way that human beings can read, click here.

Also, this “ledger” is not stored in any one place. It is distributed across all computers running as Bitcoin clients or involved with the network. This is what people are talking about when they say the Bitcoin network is “decentralized”. It is not housed on one single central server like you would find in a bank or other financial institution. It is distributed almost in the same way as a hologram in that each part contains a map of the whole thing and the whole thing may be found in each part.

The blocks on the Bitcoin blockchain are made of the following 5 elements

1 A “Magic Number”: This is a system in computer science used to make the file type or protocol immediately recognizable to other computers. It is basically a fixed number used to make Bitcoin blocks identifiable as a bitcoin block. It is basically a code that says “I’m a Bitcoin block”.

2 Blocksize: a figure showing the “number of bytes following up to the end of the block”. This is just like how any other file, from an MP3 to an MS Word Document, will display its size in bytes.

3 Blockheader: criteria which label the block as a unique and verified part of the blockchain of which it is a part. It is a kind of stamp of authenticity for the particular block in question. Among other things, the header will include: 1) a reference to the block immediately before it in the form of a 256-bit Hash, 2) a compressed reference to its place in the entire Blockchain (Merkle Root) in another 256-bit Hash, and 3) the time it was created. There is more to it, but the above three elements should suffice in giving a basic understanding of how the blocks are connected and verified as relating to each other in a chain like structure.

4 Transaction Counter: the number of transactions recorded in the block. Again, just as other file types will display their contents via a “properties” function, so too do blocks on the blockchain.

5 Transactions: a list of the transactions themselves as processed by the network. This is where individual transactions can be seen, frozen forever as it were, on the Bitcoin blockchain. This is also the main body of the content when we talk about the blockchain functioning as a distributed ledger free for all to view.

All you have to do to view a transaction is to enter the address it was sent to by entering it into the search bar at blockchain.info. You will then be able to see a list of all transactions to that address, when they occurred (down to the second), and how much Bitcoin was sent. Again, however, the physical location of the address recipient and/or who/they are will not be viewable.

WHAT’S SPECIAL ABOUT IT?

In terms of record keeping, whether financial or otherwise, blockchain technology introduces what can essentially be called “triple entry bookkeeping”. And this is a vast improvement over the older (much older) method of double entry bookkeeping wherein a simple list of two columns, one for deposits one for withdrawals/expenditures, is kept.

The triple entry bookkeeping method introduces a third element: communal access and verification. Well, these are actually two elements but the principle that holds them together is singular.

With this third element of distributed, communal access and verification an entirely new level of security and efficiency is introduced. And this has implications across almost all of the industries and endeavors humanity is currently involved in.

But for a more thorough presentation on this, you’ll have to wait till our next post “Uses and Implications for Blockchain Technology“.

DECENTRALIZATION

“Decentralization” is another term you will often here in regard to the blockchain. And it is usually mentioned as a postive thing; especially in regard to its counterpart: centralization. For a deeper presentation of what the big differences in these two types of systems are, see my post “Crypto Currency VS Fiat Currency: What’s the big difference?”. I recommend reading this post because decentralization is one of the most powerful features of cryptocurrencies like Bitcoin while centralization is one of the weakest features of our current mainstream economic system based on fiat currency.

But it’s also worth mentioning that applications of blockchain technology are not limited purely to finance. Not even remotely. Blockchain technology can be applied in basically any industry that has a need for record keeping or tracking of information whatsoever at all. So let me break down the strengths of a decentralized system in and of itself regardless of what it is actually being used for.

So, to do that, let me begin with this: a system with a central point of control and access is a system with a central point of failure. Think “putting all of one’s eggs in on basket”. In a decentralized system, the opposite is true. A decentralized system has no one point of ultimate access and control so it has no single point of failure. So while it may be relatively easy to corrupt or destroy a centralized system through one access point, with a decentralized system you would have to have access to the entire system at once in order to corrupt or destroy it. Think “all of one’s eggs appearing simultaneously in many different baskets”.

Take a look at the images below:

The central blue sphere is connected to each green node. However, the nodes are not interconnected and rely 100% on the central blue sphere. All influence moves back and forth between the center and each node only. Any damage or corruption will also do so.

There is no central control. Each node is part of an interconnected network and has equal influence/responsiveness to the rest of the network. Any force seeking to damage or control the network would need access to the entire network simultaneously.

The diagrams above are a simplification of the general idea behind a decentralized system. Both systems, in the real world, would likely be a lot more complex. However, you should be able to gain a basic understanding of what people mean when they refer to a system as “centralized” or “decentralized”.

Essentially, a centralized system is one with a central hub that sends commands to its satellite nodes and receives feedback from them individually. The hub is like the “brain” of the system; highly concentrated but also highly vulnerable. If anything destructive, whether human corruption or some kind of technological failure, happens to the hub the entire system will fail. It is therefore always at risk and exceedingly difficult to guarantee 100% security. Centralized systems also tend to be notoriously limited and inefficient.

A decentralized system is more like a hologram. That is, it has an interdependent/responsive nature that is represented equally across the entire system yet responds in a linear way based on chronology (when something happens) and encryption (a series of unique codes for each transaction).

A decentrlazied system has no central hub or “brain”, so to speak. It has instead a network of nodes that are all interlinked and share identical content which is updated and maintained in real time. With this type of system, unlike centralized systems, it is exceedingly difficult to compromise the security or integrity in any effective way. This is because, instead of having only to corrupt of destroy one central hub, you would have to corrupt or destroy the entire system.

FINAL WORDS

A little reflection on the benefits of decentralization combined with blockchain technology should be helpful in understanding not only the current craze toward this type of technology but also its implications in terms of what it can do for the flow of data around the globe.

Thank you for reading. The original post is available here: http://bitcoinbuildify.com/index.php/2018/03/28/what-is-blockchain-technology/

@technoguy,

A brilliant piece of work. We need more posts that punch at this level on Steemit.

I am resteeming it for the benefit others (you really have done some stellar work).

Kudos!

@shenobie

Wow, man. Thank you! So happy to have an appreciative reader. :-)

This post has been rewarded with 30% upvote from @indiaunited-bot account. We are happy to have you as one of the valuable member of the community.

If you would like to delegate to @IndiaUnited you can do so by clicking on the following links: 5SP, 10SP, 15SP, 20SP 25SP, 50SP, 100SP, 250SP. Be sure to leave at least 50SP undelegated on your account.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by shenobie from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Thx for another informative post. Easy to read.

Please continue up with creating interesting content - it may be hard at the beginning to build reach and solid followers base.

Steemits needs solid content builders so just dont ever give up! :)