Q3 2017 Blockchain Industry Observations/Predictions (Futurist Version)

My goal with this article is to convey the recent themes and essence of blockchain technology observations and some industry predictions (For industry professionals or advanced users skip to the “Futurist Prediction” header section below):

Legend: For the purpose of this article the following definitions generally apply:

- Blockchain Technologies may refer to either blockchain networks and/or digital assets “collectively”

- Blockchain Network(s) may be referred to in various ways including as blockchains, chains, crypto networks, digital asset networks, blockchain protocol(s), a cryptocurrency network, distributed (public) ledgers or distributed ledger technology (DLT) or decentralized peer-to-peer networks, as well as private centralized (non-public/permissioned) blockchains. Furthermore,

- Digital Assets are defined here as cryptocurrencies, cryptosecurities, cryptocommodities, crypto assets, tokens, utility tokens, among other verbiage or taxonomies crypto or digital asset related that may be used.

- Blockchain startups or mature blockchain companies, which may be in a transition phase of shifting their fiat capital (owned by their founders and underlying shareholders) to purchase and issue their own digital asset tokens, as part of a pre-sale to their seed-stage investors, before going to the public/private market with an initial coin offering (ICO) are potential cryptocurrencies.

- At the ICO stage, an organizational structure may shift to a decentralized open-source system where a portion of capital raised is put towards a non-profit foundation dedicated to the future benefit of enhancing/maintaining the specific protocol running the new public digital asset.

*This article is not a recommendation to invest in any particular cryptocurrency or ICO nor should be construed as investment advice, and probably contains several inaccuracies or subjective context/assumptions as we attempt to jump on the blockchain bandwagon.

As it seems everyone is jumping on the blockchain bandwagon, the question of “hold your horses,” or “off-to-the-races?” comes to mind for many…

Source: CBInsights

Recent ICO Mania

As seen in the excerpt above from CB Insights, many new digital assets have emerged and 2017 quickly became the year of the ICO, as creating digital assets in return for funding via cryptocurrencies such as bitcoin and ethereum fueled a new marketplace of startups accelerated by the crowd and their promise to deliver digital assets with utility and value.

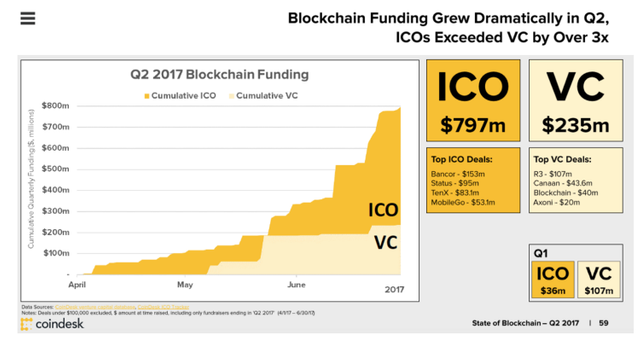

The State of Blockchain report for Q2 2017 from Coindesk highlights the ICO-fueled capital raised compared to traditional Venture Capital (VC) funding.

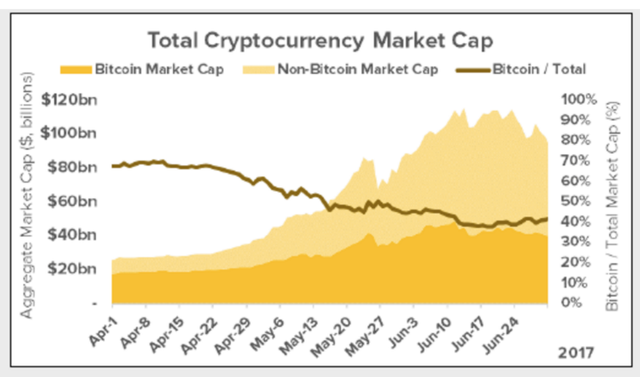

Over $1 trillion in cryptocurrency volume is expected to be traded in 2017 alone according to estimates from Juniper Research. And even putting aside the +$100 billion in market capitalizations for cryptocurrencies – even if partly inflated from speculators and investors, the business case for public blockchains appears to be proven already, despite unknown headwinds ahead as the frontier for blockchain research forges ahead by global stakeholders.

The Blockchain arms race has accelerated, driving the formation of digital capital markets as ecosystems are emerging to find the best protocols…

Welcome to the blockchain arms race

The power of the crowd in public blockchain networks (and their often direct effect on incentivizing protocol innovations and ongoing network use) will eventually continually produce the most useful solutions that will unlock additional market efficiencies in the new and existing global economy.As markets transform over the next decade and beyond, blockchain will converge with machine learning and artificial intelligence to help accelerate the exponential shift.The Blockchain arms race has accelerated, driving the formation of digital capital markets as ecosystems are emerging to find the best protocols, leading the evolution of a new and growing library of electronically-traded digital assets.

Cryptocurrencies are a natural extension of global currency (forex) markets as the key link in all digital assets that they are funded from base fiat currencies…

Jumping on the Blockchain bandwagon

I sometimes randomly ask people on the street in New York if they’ve ever heard of bitcoin or blockchain, and many say no, but many are starting to say yes and even already hold multiple digital assets.However, many others are not yet ready to trust trustless systems, as people are still accustomed to relying on 3rd parties although that is beginning to change as the prospects for blockchain become more evident.

Hold your horses or off to the races?

As it seems everyone is jumping on the blockchain bandwagon, the question of “hold your horses”, or “off-to-the-races?” comes to mind for many who hear about or are considering how to discern these new highly complex concepts and financial products, let alone dare invest in hyper-speculative cryptocurrencies.

Source: Steven Hatzakis Art ©

Putting aside technical, creative, or philosophical aspects that are still being subjectively put into context as industry thought leaders attempt to navigate this highly dynamic landscape, blockchain’s long-term prospects as an underlying infrastructure already has wide endorsement. Blockchain’s support is evidenced by global stakeholders (governments, central banks, commercial enterprises, startups, and individuals) that have backed numerous initiatives with more and more emerging each day including government grants.

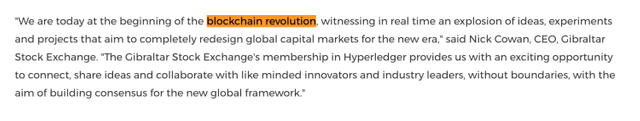

Source: Hyperledger

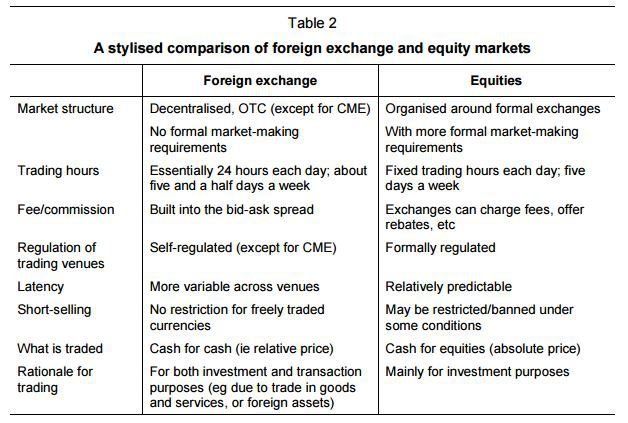

Natural extension of Foreign Exchange Markets

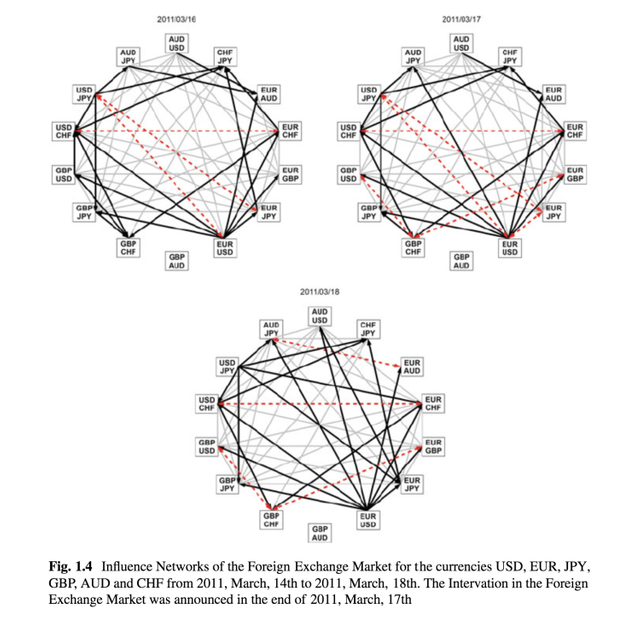

Cryptocurrencies are a natural extension of global currency (forex) markets as the key link in all digital assets that they are funded from base fiat currencies (or other digital assets), with foreign exchange markets being the only current link helping to bridge that gap between the world of fiat hard cash, central/commercial bank held electronic cash, and the new digital asset class.

Source: Yamashita Rios de Sousa, Arthur Matsuo & Takayasu, Hideki & Takayasu, Misako. (2015). Influence Networks in the Foreign Exchange Market. 3-13. 10.1007/978-3-319-20591-5_1.

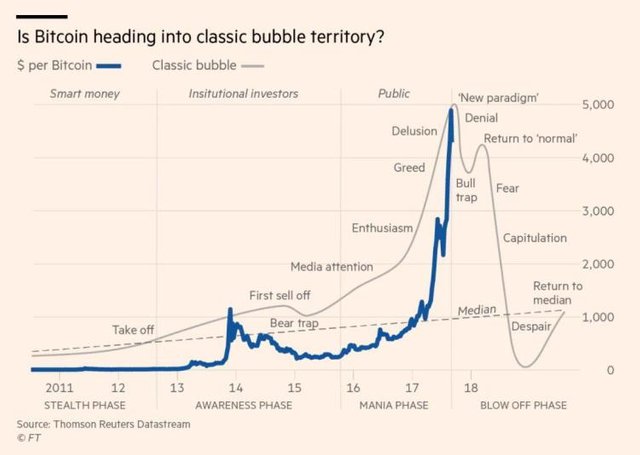

Central Bank Cryptocurrency (CBCC)

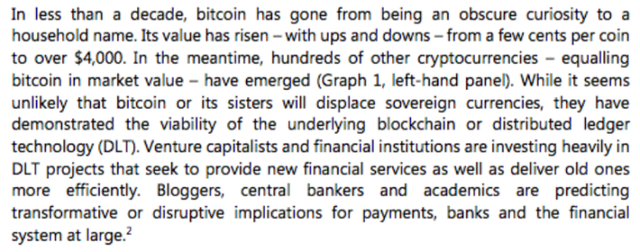

The Bank for International Settlements (BIS) is considered an authority on gauging foreign exchange market volumes and bringing together top stakeholders and policymakers across major and emerging jurisdiction to discuss key matters for commercial and government institutions in Forex and global derivative markets, among other asset classes that are electronically-traded.

…there are various emerging schools of thought in terms of blockchain’s potential, nearly all of them arrive at similar logical conclusions that reflect the state of transformation happening already…

Recently, BIS has been reporting on various blockchain developments as a growing number of central banks and commercial banks have pilot programs already underway or looking at ways to assess the prospects for a Central Bank Cryptocurrency (CBCC).

Source: BIS.org

Blockchain Potential

While there are various emerging schools of thought in terms of blockchain’s potential, nearly all of them arrive at similar logical conclusions that reflect the state of transformation happening already from a convergence of underlying market mechanics and infrastructure that are unlocking new possibilities. Basically, they all agree it sounds awesome but short/medium-term dynamics are less clear.

Source: BIS.org

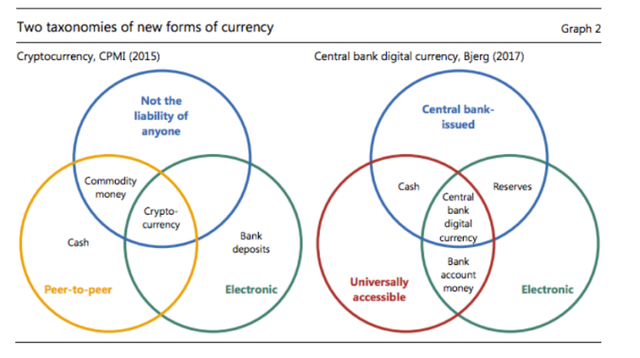

New Taxonomies and Libraries of Assets

The Venn diagram below shows the overlap of four types of money, with digital assets represented by the two on the right (central bank issued and peer-to-peer issued), and traditional paper money (fiat cash) and bank held deposits (electronic) on the left side.

Source: BIS.org

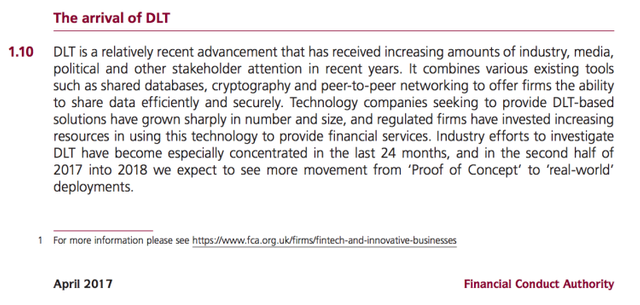

Public Blockchains are also referred to as Distributed Ledger Technology (while the distributed part may refer to public networks, private networks may also be referred to sometimes as DLT-powered, as central bank cryptocurrencies also use blockchain technology).

Semi-Unregulatable

Regulators have been actively trying to assess blockchains potential and ways it could be approached in terms of policy and regulatory frameworks to support innovation while protecting market participants. This has not been an easy task because of the many traits and decentralized characteristics of digital assets some of which no single entity or even government can control.

Source: FCA

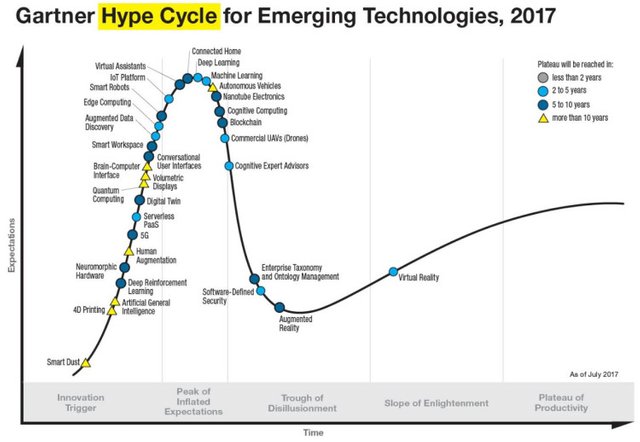

Beyond the current hype

Knowing that blockchain technologies are the future is not enough to know the various paths that these technologies will follow, and how the next-generation of blockchain technologies may replace existing digital assets in terms of utility, network users, and resulting valuations.In just a few years, some of the current digital assets could be obsolete and replaced by newer-generation innovation, challenging even the most passive investors to actively diversify or face concentration risks within their digital asset portfolio.

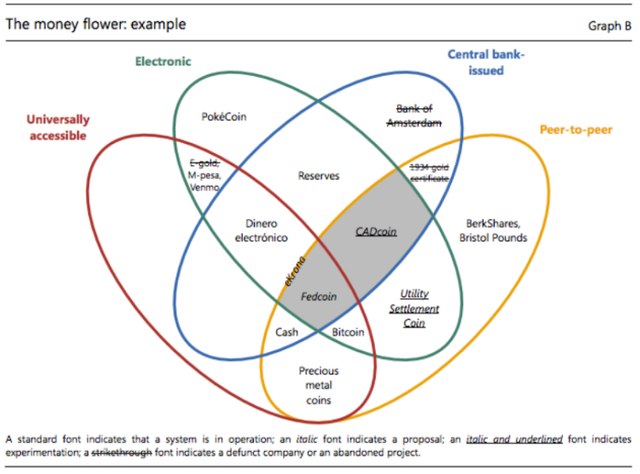

Bubbles: Bursts and Regenerative Cycles

Bitcoin has already experienced numerous bubbles since its inception, and while this article is not about Bitcoin per say, bitcoin is the original (first) blockchain network and relevant as all digital assets share variations of “blockchain” in terms of their protocol whether via fork or other unique specification.

Source: Financial Times

Blockchains are related but not all the same

Just as specific “Code” is used by all computer programs even though it may vary by syntax, application and/or operating systems). Let’s move past bubbles and look at the broader industry and longer-term themes.Moving past the basics of how a blockchain network works – on a high level – as seen below, we’ll also skip some differences about cryptography and move into emerging themes and trends.

For those who are new to blockchain or bitcoin, here’s a progressive educational video that starts out simple.

For a more advanced online course check out this Udemy link: https://www.udemy.com/bitcoin-or-how-i-learned-to-stop-worrying-and-love-crypto/

I’ve also written a guide on how to trade cryptocurrency, which covers three main ways across including trading the underlying, a derivative or security on cryptocurrencies.

Source: https://www.forexbrokers.com/guides/cryptocurrency-trading-bitcoin-ethereum

Without going into great technical details or specific consensus protocols, encryption methods, or smart contract code, the industry is invigorating and inspiring masses across the world as a new predictive future is being carved out, so here are my longer term predictions for the overall blockchain sector (if we can call it that).

…emerging blockchain technologies represent a growing irreparable crack…

Futurist Predictions

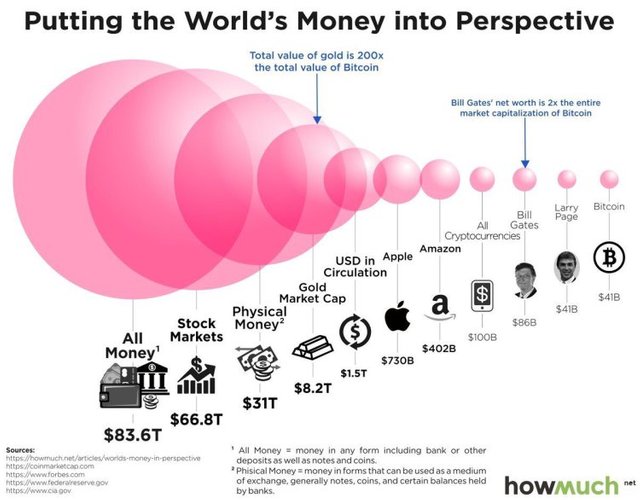

The world’s trillions of dollars that are tied up in traditional financial assets are like a huge sea of water behind a giant dam (current financial system that protects global interests), and emerging blockchain technologies represent a growing irreparable crack (where capital migrating to and from) will expand and contract and counterbalanced by global stakeholders as a new era drives an unstoppable blockchain revolution.

…capital flows already in motion into digital assets helps build an irreversible momentum of decentralized networks that will lead to an inevitable outflow of capital from traditional markets.

source: Howmuch.net

The era of Blockchains

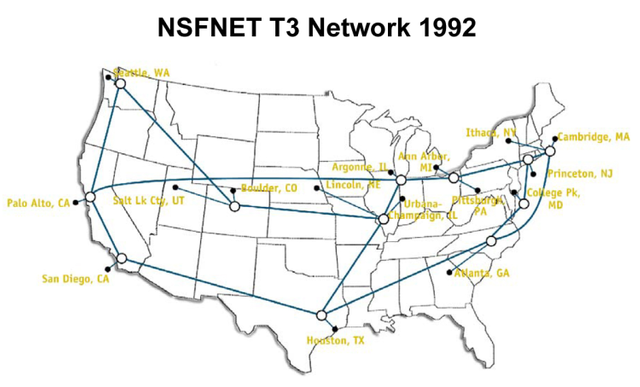

We’re living in the “digital” age of information, the internet era, after the dawn of computer operating systems and applications emerged, the next exponential paradigm shift – beyond a dot-com bubble – will be powered by blockchains which will accelerate and facilitate the convergence of other technologies (AI, VR, etc) and numerous other industries to radically transform markets and societies.Below is what the internet network looked like in 1992 in the U.S. as per wikipedia.

Source: Wikipedia

Here is a map of a portion of the internet network from Wikipedia (even if just a simulation) showing we’ve come a long way since 1992:

Source: Wikipedia

Similarly, and to a far greater extent, blockchains will eventually unlock many orders of magnitude of market efficiencies as new economic structures and eco-systems are created on top of blockchain powered-public and private networks attached to existing and new global trade networks and economic communities.

Inefficiencies still Abound

I wrote about cryptocurrency market inefficiencies in 2013, yet digital assets are still cranking out many inefficiencies as nascent markets are sprouting up daily, There is still a long way to go before the markets for digital assets will be highly efficient like forex markets are today.However, the momentum is firmly in place with market activity in Q2-Q3 2017 representing a key milestone with the emergence of a flood of Initial Coin Offerings (ICOs) and record high valuations.

Source: Coindesk, State of Blockchain report for Q2 2017

21 MarVitalik Buterin ✔@VitalikButerinhttp://www.truthcoin.info/blog/protocol-upgrade-terminology/ … Why can't these people understand that it's fundamentally okay, and unavoidable, to have defns that are subjective?

FollowVitalik Buterin ✔@VitalikButerinSpecifically, I think the *only* sane way to define bitcoin is roughly as I defined it here https://twitter.com/VitalikButerin/status/837151206233366528 …11:49 PM - Mar 21, 2017 88 Replies

1111 Retweets

4646 likes

Intra-terrestrial

I tend to think of blockchain technologies as a new form of alien technology bringing a higher form of intelligence that is an extension of our own capabilities, showing our connection to undiscovered thought within the cosmos.

Source: Steven Hatzakis Art ©

Legacy Financial Market Infrastructure

Dams are usually made (both by man and in the animal kingdom) to protect interest by keeping the flow of water in one place or out of another, and as the collective interest of global investors will shift towards new blockchain-powered digital asset classes, a convergence of market dynamics will re-contextualize the scope of how we define “transactions” and online commerce.

https://www.flickr.com/photos/alikgriffin/8151992934/

Source: Flickr/Alikgriffin

Unneeded Floodgates

The dam that holds the global financial systems together is not a necessity anymore if it is intentionally demolished at a rate equal to the growth of new emerging digital assets provided that the protection afforded by traditional capital markets systems are replaced or enhanced by the new technological approaches with blockchain and provided that the range of digital asset classes are a viable replacement or complement to current financial products.

Gradually Accelerated Adoption Rate

It may take many years to get there but the trajectory seems fixed, despite cyclical bubbles that will likely repeat many times over as we embark on a new blockchain-empowered future for markets.

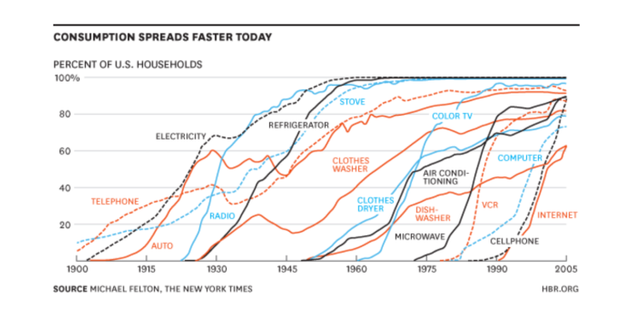

…the rate of adoption for next-generation technologies is accelerating.

That is why blockchain won’t change the world too fast (overnight), but fast enough (gradually) to continually and radically alter markets over the next decade, although the shape of the s-curve or j-curve it will follow is largely a guess and unknown.

Source: Gartner.com

In addition, the rate of adoption for next-generation technologies is accelerating:

source: Harvard Business Review

Irreversible and Unstoppable Trends

The change of capital flows already in motion into digital assets helps build an irreversible momentum of decentralized networks that will lead to an inevitable outflow of capital from traditional markets. These changes are a necessary driver to propagate the various paths of evolution that blockchain technologies will follow, driven by the most powerful form of capital, human-powered machine consensus.

Infrastructure for Artificial Intelligence

Blockchains will be an infrastructure for machine learning and A.I to operate as applications, similar to how apps function within an operating system, digital assets are applications within blockchain networks.View image on Twitter

FollowSteven Hatzakis @shatzakis#US #Congress approves defense bill to asses #blockchainpotential + the prospects/risks for government's use of it: https://bit.ly/2hgXrrY 9:30 PM - Sep 19, 2017 Replies

Retweets

11 like

Twitter Ads info and privacyThe accompanying wave of evolving cybersecurity standards will challenge the number of startups and mature companies many of which will undoubtedly fail, get hacked or otherwise evolve/devolve and regardless of the various restrictions or permissions from regulators and governments and stakeholders.

FollowSteven Hatzakis @shatzakisChairman and CEO of Equifax quits http://bit.ly/2yqry7k via @ForexLive9:17 AM - Sep 26, 2017Chairman and CEO of Equifax quits

When the times get tough, the CEO retires Equifax Chairman CEO Richard Smith announced that he's retiring. He's been CEO since 2005 and owns 285K shares, valued at about $30 million. He's 57 years...forexlive.com Replies

Retweets

likes

Quantum Challenges

Blockchain systems that run distributed (public) ledger transactions where public/private-key password security is used – should last against quantum computer cracking for some time giving innovators and investors a head start on tackling that future challenge.

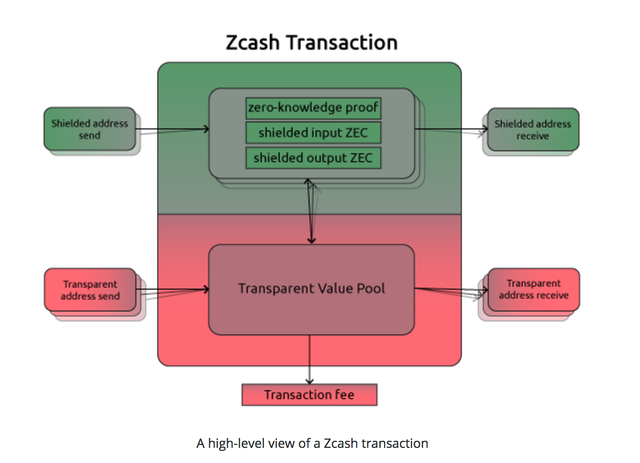

source: PWC/Microsoft

In addition, new approaches such as Zero-knowledge proofs are introducing a new dimension of interoperability and functionality within and between blockchains, which may help with privacy and deter the chance of a quantum computer guessing (cracking) a private key code.

Source: Z.cash

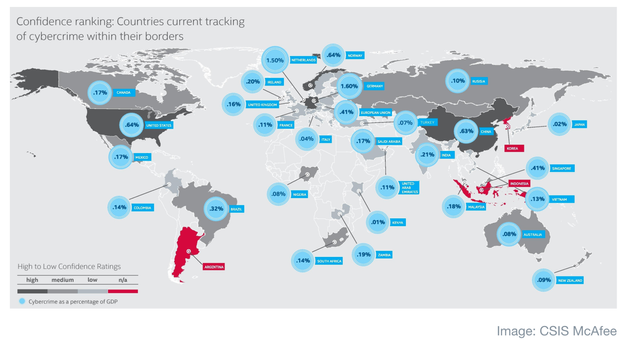

Cyber Hacks, Cracks, and Leaks

Around the time of this writing, Equifax and the SEC revealed they were hacked, following by Deloitte & Touche which suffered an email database leak due to cybertheft. Shortly thereafter, the SEC announced the launch of a cyber division to help protect retail investors in digital asset investments including ICOs.And days later, the SEC took action against scammers trying to dupe investors with fake tokens that didn’t exist. This news follows around the time that the US Senate and House passed the 2018 defense budget which included amendments for Blockchain research and federal grants as the Government explores the potential benefits of blockchain for public/private use.

Cybertheft

And days later, the SEC took action against scammers trying to dupe investors with fake tokens that didn’t exist. This news follows around the time that the US Senate and House passed the 2018 defense budget which included amendments for Blockchain research and grants as the Government explores the potential benefits of blockchain for public/private use.

Digital assets are probably the most hyper-speculative investment in the world right now…

FollowSteven Hatzakis @shatzakisWhy 'Cybersecurity is like a black elephant.' Via @whartonknows: http://knlg.net/1FPYPaW 12:49 PM - Sep 26, 2017We Don't Need a Crisis to Act Unitedly Against Cyber Threats

Cybersecurity is a multi-dimensional problem, but efforts to deal with attacks are largely uncoordinated. A focal point is needed for a collective response.knowledge.wharton.upenn.edu Replies

Retweets

likes

Two Galaxies Converging

Traditional Markets that support real assets, financial assets and electronic transactions and payments, have a newly arrived galaxy of digital assets (securities, derivatives, payments, and other internet-based commerce) and have attached themselves as a natural extension and are starting to sprout up in nearly all industries.

Source: Wikipedia/ScitechDaily

Digital assets are probably the most hyper-speculative investment in the world right now, although that may change after trillions of dollars shift away from traditional financial markets into cryptocurrencies. While a shift of the world’s trillions in wealth into digital assets may take many years, it eventually may cause traditional assets to become more speculative/volatile as digital assets stabilize and are sought as safe havens.I foresee the hyper-speculative nature of digital assets moderating at a rate that is inversely correlated to “traditional” financial assets becoming more short-term speculative/inflationary, as capital shifts sides. That shift should take many years, yet appears to the eventual outcome/direction.

Highly Dynamic Industry and Landscape ahead

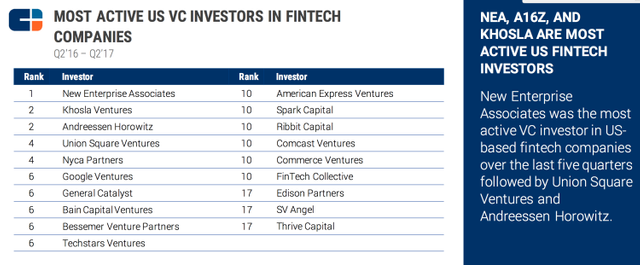

The blockchain industry is evolving so rapidly across a multitude of dynamics that even top players in the industry are navigating unchartered territory and hoping that promising ideas get widely adopted for the digital asset to succeed and increase in value, as open-source protocols are driving the democratization of power by small startups that have a chance to compete with incumbent banks and megaliths.

…incumbents and new market entrants are on a far more level playing field than before.

This has also attracted plenty of venture capital and interest from individual and institutional investors.

Source: CBinsights

Level playing field but unknown battlefront

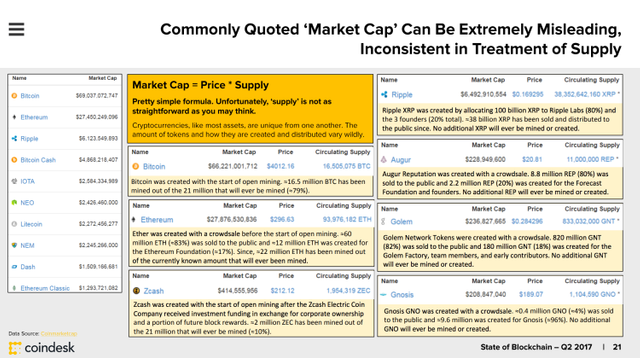

Nonetheless, incumbents and new market entrants are on a far more level playing field than before. Meanwhile, even long-term investors face the challenge of knowing how to rebalance and diversify across digital assets due to limited historical data and difficulty in fundamental analysis and forecasts beyond technical analysis.Coindesk’s recent state of blockchain Q2 2017 report highlighted the problem of determining market cap based on the available supply of a particular digital asset since there are conditional variables for supply and it is not standardized on purpose in some cases, whereas, in other cases, it may be permanently fixed.

Source: Coindesk

Eventually, digital assets could become the longer term safe haven bets as cryptocurrencies are used in conjunction with fiat currencies to intermediate the liquidity needs of the markets ebbs and flows that will result from a new market trajectory path that has been introduced into the global economy via blockchains.

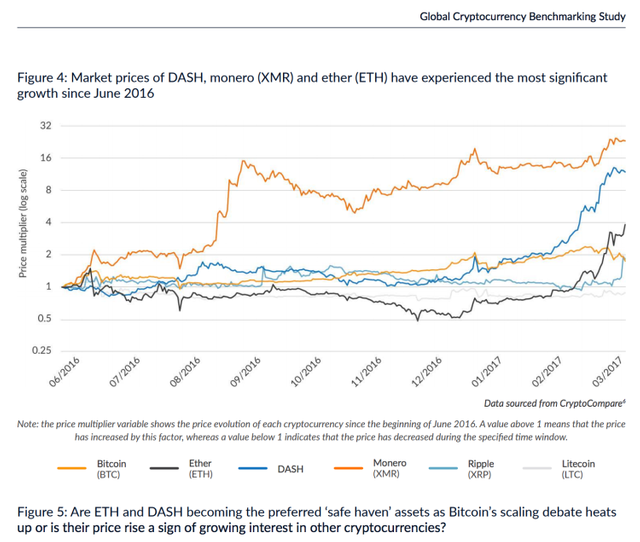

Looking beyond just Bitcoin

In a recent Washington Post article titled: Is bitcoin another tulip craze or a legitimate investment?, Former U.S. SEC Commissioner Arthur Levitt said bitcoin is quite speculative and ‘“I would consider investing in companies that use bitcoin, or trade in bitcoin. I’m not sure I would invest in bitcoin itself. It fluctuates for reasons that are hard to understand,” and added, “I don’t know whether it will be bitcoin or ethereum, to name just two. But it’s here to stay because of the disparity between countries where a monetary system is robust and countries where there is virtually no monetary system. This comes up as an alternative currency.”

Fintech, Payments, and Forex

Blockchain is now a central part of Fintech, and the financial services industry is first in line to help drive the narrative of this paradigm shift, supported by a wave of innovators from across industries and other global stakeholders including governments, companies and individuals.I predict that the financial technology (Fintech), payments, and forex/multi-asset online brokerage industry including stock exchanges that are already regulated, are well poised to acquire market share by facilitating access to digital assets.This need is arising to support the flow of capital across digital asset classes, coupled with growing need for increased cybersecurity standards as public/private identities are the main actors within digital asset networks.

Wallet providers

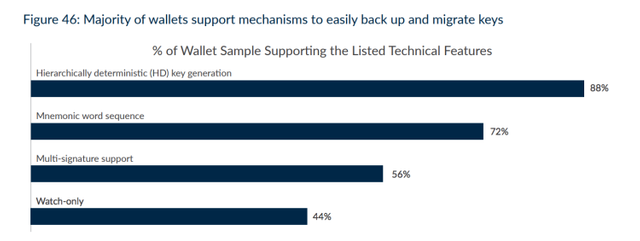

More wallet companies are emerging to provide exchange-related conversion using free open-source, closed-source, or mixed-source tools and helping to facilitate user interactions with web interfaces that connect to either their own blockchain network or to external networks, catering to users via the web.

Source: 2017 University of Cambridge Global Cryptocurrency Benchmarking Study

Data compiled by the 2017 University of Cambridge Global Cryptocurrency Benchmarking Study showed that all custodial wallets surveyed used closed-source code and even 11% of non-custodial wallets (where only users have access to funds/private keys) use closed-source code, leaving potential vulnerabilities.

Source: 2017 University of Cambridge Global Cryptocurrency Benchmarking Study

Web developers and programmers who can learn to apply their skills to blockchain are already in short supply and helping to design the idea that entrepreneurs and innovators are thinking of for use with blockchain technologies.

Source: 2017 University of Cambridge Global Cryptocurrency Benchmarking Study

Fintech & Blockchain Advisors

Industry researchers, advisors, consultants, or other subject matter experts from a wide range of industries where blockchain technologies are being applied are helping firms navigate and are providing related services across a number of operational fronts including business planning, product design, marketing, and other business development efforts that are common to startups pursuing or using blockchain technologies.

Blockchain is now a central part of fintech…

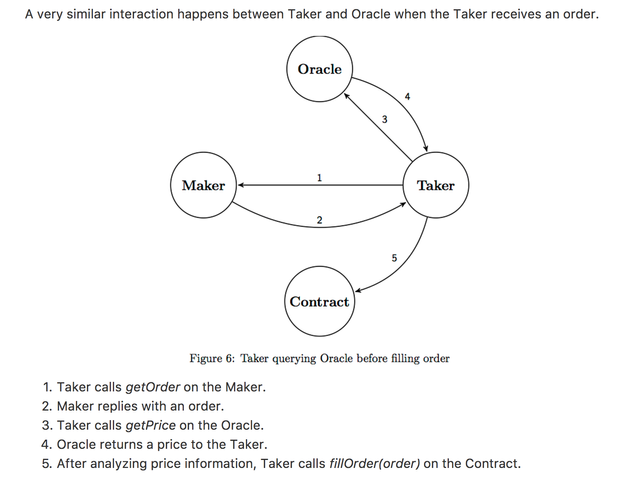

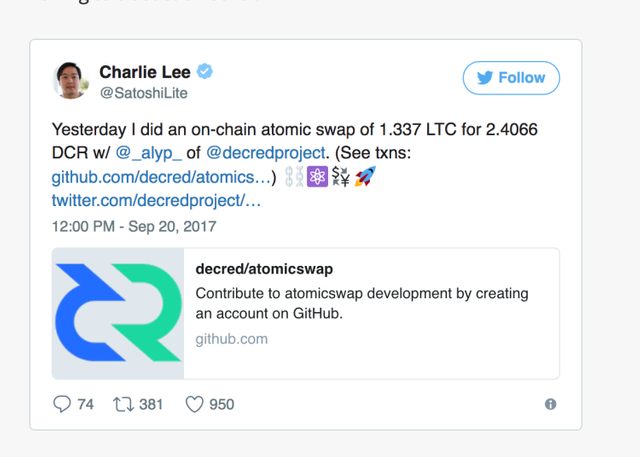

Whether working closely with legal teams and venture capital or institutional investors who are backing new ideas early on, competition fiercely escalates as new market entrants aim for a piece of a pie that appears to be growing. Next-generation blockchain protocols, including the ability for atomic-swaps to be conducted will help existing blockchain companies build out their products further and integrate them into other blockchain networks. Excerpt below from swap.tech’s AirSwap model.

Source: Swap.Tech, airtoken

The Paradox of Accelerating and Waiting

Startups face a challenging paradox of meeting an urgent need to scale their product to gain wide adoption at a fast enough rate, versus taking enough time for enough R&D to be completed to help ensure their business plan and roadmap is viable so their chances increase of reaching their ultimate vision.

“Win the crowd, and you’ll win your freedom” [Gladiator, 2000]

Knowing when to accelerate and when to wait, and communicating with users is key as consensus is attempted to be achieved or disagreements arise that can lead to forks and variations in the protocol for decentralized cryptocurrencies, or alienate existing users who may abandon (sell) the digital asset in exchange for another one or for fiat currency.

Source: Twitter

Research tools largely absent

For investors, actively diversifying as the market continues to shift dynamically should become easier as newer research and trading tools emerging including curated news headlines that effect crypto market prices, and other sentiment data and analysis tools.

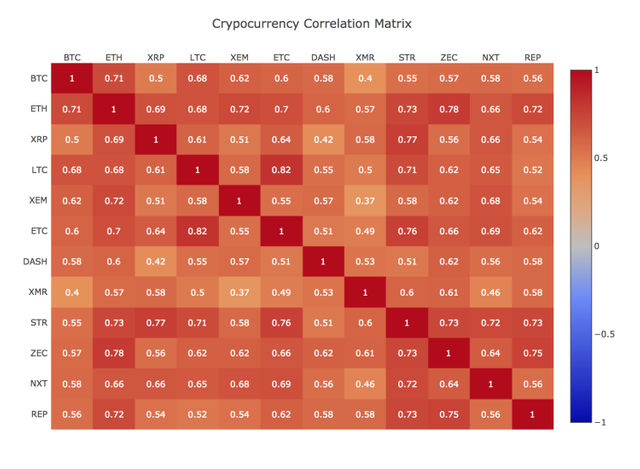

Source: SifrData using Poloniex price data for last 90 days

Beyond analysing technical price action from historical and current market rates, the ability to curate news for fundamental analysis will be an important component for crypto traders and investors.While many investors focus on Bitcoin, Ethereum and other top cryptos by market capitizalation and volume, other cryptocurrencies are coming into the scene with more and more nearly each day.

Source: 2017 University of Cambridge Global Cryptocurrency Benchmarking Study

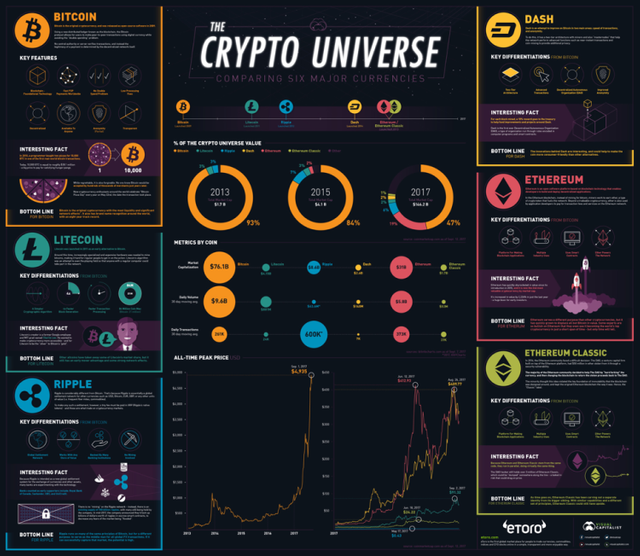

Just using some of the six top cryptocurrencies, we can see the variety of functions and utility shows significant diversity, making it hard to group coins as each one may fall into one or more group depending on its range of functions.

Source: Visual Capitalist

Crypto liquidity

These early pre-sale stages which require momentum are highly relevant as liquidity of a cryptocurrency is being established on markets where it attempts to be tradeable such as by being offered (listed) at an exchange or compatible wallet where price discovery can be established by market makers and takers (buyers and sellers).

Source: BIS.org

Fund managers and exchange operators are also faced with the challenge of handling large crypto flow, as market inefficiencies create challenges for large order execution to happen orderly without negatively affecting fill rates.Building models for valuation projections based on the economic indicators of each crytocurrency’s economy will also be highly challenging with so many contigent and unknown variables, and due to limited historical data sets.

Brokers Are Morphing

The role of brokers or any transaction-based facilitators that provide technology may morph as they pivot or enhance their business models to build refined user experience across new products that handle access to control digital assets.Nearly half of the brokers I’ve reviewed this year on ForexBrokers.com have already launched cryptocurrency trading.

source: ForexBrokers.com/reviews

As users delegate their digital power across online products/services they access via the web for cryptos, this is comparable to how consumers authorize apps using their existing account credentials authenticated by Google for example to login to a non-google service.Accordingly, the standards for the web are also starting to evolve towards greater use of open-source solutions that are compatible with new cybersecurity best practices being piloted by market participants.

Utility token versus Security/Derivative

The question of whether tokens are securities/derivatives or solely serving as a utility is another concern for market participants that are looking at raising crypto financing from crowd-sourced token sales via ICOs.

Regulatory Arbitrage

Jurisdictions will be relevant in the next phase of emerging regulatory frameworks for digital assets, as there are key areas that should not be stifled, whereas, other areas have a need for government regulation alongside self-regulatory efforts from market participants.

I expect these trends to be cyclical as regulators will be reactive to market development…

South Korea just banned shortly before this ICOs was published, while Australia had just provided a more friendly framework to support innovation. Clearly, each country may be at its own stage with regard to the tapering or increasing the growth of blockchain from within its economy. I expect these trends to be cyclical as regulators will be reactive to market development and traditionally lag behind new market innovation.

Next phase of emerging regulatory frameworks

Therefore, now – more than ever, a self-regulatory effort is needed to help create best practices and minimum industry standards to help drive the industry forward, and we await guidance from regulators.

…minimum industry standards for ICO issuers is one such example of an emerging need…

There are already numerous efforts underway across a wide range of either non-profit or commercial self-regulatory organizations (SROs) and trade associations, and the highest priority is identifying the areas of greatest concern where stakeholders can discuss solutions that are in the best interest of the collective blockchain industry.Developing minimum industry standards for ICO issuers is one such example of an emerging need, and guidance from regulators should help improve such efforts, along with best standards issued by technology developed such as for smart contracts.

Trade Associations

The Chamber of Digital Commerce supports several industry bodies in across the blockchain ecosystem including the blockchain intellectual property council and smart contract alliance, among other working groups helping to guide policymakers including at the state level.

Source: Digital Chamber of Commerce

Recent enforcement action

Numerous announcements have been made by global regulators ranging from whether a cryptocurrency can be deemed a security or utility token, as well as banning exchanges and restriction ICOs and other token sales of digital assets to retail and institutional investors.For the scammers that are trying to catch a free ride on the ICO wave and dupe investors, the SEC has already taken action with its first case just announced following the creation of a new cyber division to protect retail investors: https://www.sec.gov/news/press-release/2017-185-0

Recent Thoughts from Industry Leaders

Here’s a great talk with Coinbase’s founder Fred Ehrsam and Chris Dixon from Andreessen Horowitz: https://soundcloud.com/a16z/cryptocurrencies-networks-tokens

FollowSteven Hatzakis @shatzakisGreat talk re #cryptocurrency #icos #tokens w/ @coinbase' s @FEhrsam + @a16z's @cdixon w/ shout-outs to @cburniskehttps://bit.ly/2hC9fJh 8:55 PM - Sep 30, 2017 Replies

Retweets

likes

Creativeness and Blockchain mix well

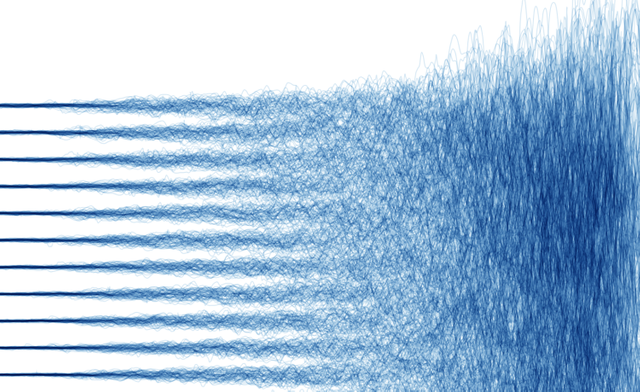

While checking out some cool open-source CSS code made by Daniel Eden, called animate.css on github, I came across one of his code-driven artworks (see excerpt below)which resembles a Monte Carlo simulation or Random Walk, and analogous to the likely path of emerging digital assets on a timeline where somewhere towards the left side of the picture below is the present, and the right side is the future.

Source: Daniel Eden

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Just as much of the subject matter in this article is hyper-speculative, so are many of my opinions, although the essence of what blockchain means to the masses who are inspired by it resonates as profoundly true.

Additional references: https://www.coindesk.com/us-government-awards-750k-new-blockchain-startup-grant/https://info.forbes.com/rs/790-SNV-353/images/crypto.pdfhttps://futurism.com/scientists-may-have-found-a-way-to-combat-quantum-computer-blockchain-hacking/https://bitcoinmagazine.com/articles/bitcoin-is-not-quantum-safe-and-how-we-can-fix-1375242150/https://investor.equifax.com/news-and-events/news/2017/09-15-2017-224018832https://www.sec.gov/news/public-statement/statement-clayton-2017-09-20https://www.wsj.com/articles/accounting-firm-deloitte-says-it-suffered-cyberattack-1506354393https://coincenter.org/entry/does-18-u-s-c-1960-create-felony-liability-for-bitcoin-businesseshttps://www.sec.gov/news/press-release/2017-185-0

Share this:

Tagged Blockchain, blockchain networks, blockchain startups, blockchain technologies, crowdfunding, crypto, crypto networks, cryptocommodities, cryptocurrency, cryptosecurities, digital assets, distributed ledger technology, ICO, ICOs, initial coin offering, peer-2-peer, smart contracts, tokens, venture capital

Congratulations @steemitplease! You have received a personal award!

Click on the badge to view your Board of Honor.